The Nifty ended the March series on a weak note, down 2.6 percent on the last trading day on the week. The index closed below its crucial 200-days exponential moving average (DEMA) and formed a small bearish candle on the daily candlestick charts.

The Nifty future closed the March series with the loss of 2.6 percent. It closed lower by 200 points from its VWAP. The Nifty Future has seen rollover of around 66% on provisional basis compare to 62.34 percent rollover seen in the last series.

In terms of technicals, the index formed a bearish candle after a Doji pattern which does not auger good news for the bulls in April series. For the bulls to gain upper hand, Nifty has to surpass its crucial resistance level placed at 10,200, followed by 10,400 and 10,500.

On the downside, strong support is placed near 10,000 levels. As long as index trades below 200-DEMA, and 10,000 levels the trend is likely to favour bears, suggest experts.

The index which opened at 10,143.60 rose to an intraday high of 10,158.35. It slipped below 10,100 levels to hit an intraday low of 10,096 to close the day at 10,113 down 70 points on Wednesday.

“It is a weak close on the Indian bourses as Nifty50 registered a small bearish candle formation, as a follow up to Tuesday’s Doji, as if it is confirming the short term weakness going forward. However, if this fall is just for expiry related reasons then bulls should come back on the first day of the new series,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“But, if in next couple of trading sessions Nifty50 breaches the level of 10002 then recent lows of 9,951 will be challenged which may then open up new targets towards 9700 levels. Last two sessions price behaviour has clearly reviewed the chances of bears once again,” he said.

Mohammad further added that as long as Nifty50 sustains below 10227 levels the near term trend shall continue to favour bears. Hence, traders are advised to avoid long positions for time being.

We have collated the top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,113.7 on Wednesday. According to Pivot charts, the key support level is placed at 10,087.63, followed by 10,061.57. If the index starts moving upwards, key resistance levels to watch out are 10,149.03 and 10,184.37.

Nifty Bank

The Nifty Bank index closed at 24,263.3 on Wednesday. The important Pivot level, which will act as crucial support for the index, is placed at 24,190.8, followed by 24,118.3. On the upside, key resistance levels are placed at 24,348.4, followed by 24,433.5.

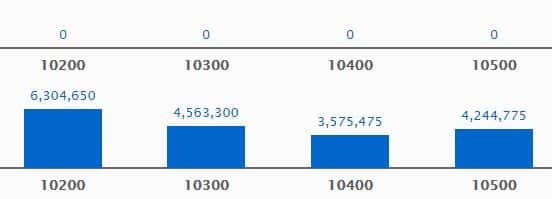

Call Options data

In terms of open interest, the 10,200 call option has seen the most call writing so far at 63.04 lakh contracts.

The second-highest buildup has taken place in the 10,300 Call option, which has seen 45.63 lakh contracts getting written so far. The 10,500 Call option has accumulated 42.44 lakh contracts.

Call writing was seen at the strike price of 10,200, which added 21.92 lakh contracts, followed by 10,300, which added 12.30 lakh contracts.

Call unwinding seen was seen at the strike price of 10,000, which shed 12.50 lakh contracts, followed by 10,100, which shed 9.78 lakh contracts and 10,400, which shed 2.58 lakh contracts.

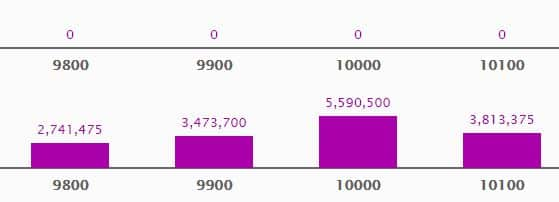

Put Options data

Maximum open interest in put options was seen at a strike price of 10,000, in which 55.90 lakh contracts been added till date.

The 10,100 put option comes next, having added 38.13 lakh contracts so far, and the 9,900 put option, which has now accumulated 34.73 lakh contracts.

During the session, put writing was seen the most at a strike price of 10,000, with 8.61 lakh contracts being added.

Put unwinding was seen at a strike price of 10,200, in which 19.79 lakh contracts were shed, followed by 10,400, in which 6.15 lakh contracts were shed. The 10,300 put option saw 3.96 lakh contracts getting shed.

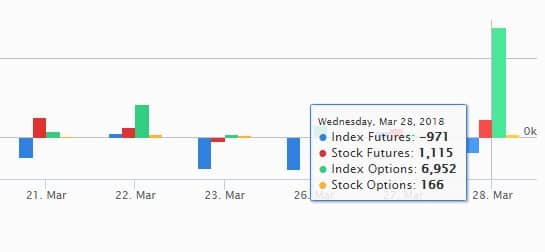

FII & DII data:

Foreign institutional investors (FIIs) sold shares worth Rs 1,190.55 crore, while domestic institutional investors bought shares worth Rs 1,960.67 crore in the Indian equity market, as per provisional data available on the NSE.

Fund flow picture:

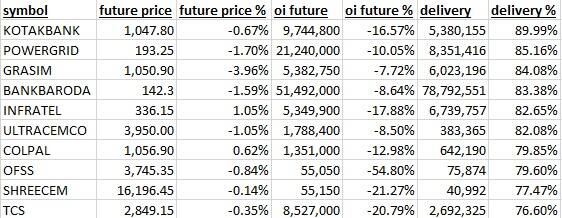

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

High rollover:

32 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

6 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates build-up of short positions.

174 stocks saw long unwinding

Bulk Deals:

Balrampur Chini: Nirshilp Commodities and Trading bought 13.68 lakh shares at Rs 76.64.

Bombay Dyeing: Rajkumar Patni bought 16.96 lakh shares at Rs 243.1.

Fortis Healthcare: BNP Paribas Arbitrage sold 39 lakh shares at Rs 123.30.

East Bridge Capital Master Fund bought 1.6 crore shares at Rs 128.71.

Shaastra Securities traded 35.81 lakh shares at Rs 127 apiece.

Gitanjali Gems: BP Fintrade bought 20 lakh shares at Rs 8.30

Jain Irrigation: Societe Generale sold 26.28 lakh shares at Rs 106.44.

Suzlon: Share India Securities trading over 2 crore shares at Rs 10.94-10.95 apiece.

(For more bulk deals click here)

Analyst or Board Meet/Briefings:

Indian Hotels: American Century and Quantum Asset Management met the management on March 29, while the latter will meet them on April 2, 2018.

Thyrocare: ASK Wealth Management will meet the firm on April 3, 2018

Bank of India: MK Ventures and LIC Mutual Fund met the company on March 28, 2018.

Eris Lifesciences: Franklin Templeton AMC met the management on March 30, 2018.

Dixon Tech: Officials from the company met Emkay Global on March 28, 2018.

Stocks in news:

Ashoka Buildcon: Its arm has won an award from NHAI for a stretch on Vadodara-Mumbai Expressway.

UltraTech: It has received CCI Nod w.r.t its bid for Binani Cement.

Cadila Health: US FDA issues zero observations for its Changodar unit in Ahmedabad.

PNB: The bank said it will Honour LoUs Worth Rs 6,500 crore on basis of undertaking by claimant bank.

ICICI Bank: RBI Imposes Monetary Penalty Of Rs 58.9 crore.

Karnataka Bank: Reported Fraud Worth Rs 86.5 crore To RBI

Tata Power to sell defence business to Tata Advanced Systems for Rs2,230 crore

Videocon has approached NCLT against SBI move to change bankruptcy plea, according to a Mint report.

Tata Motors: The company has tied up with BCCI for upcoming IPL

Dr Reddy’s: It has appointed Erez Israeli as COO, according to a report on Hindu Business Line.

Nitin Fire: IFCI invokes pledge on 6.76 lakh shares held by the firm's promoter

McNally Bharat: Promoter Acquires Additional 40 Lakh Shares

LT Foods: The Board has approved increasing stake in its arm, Raghunath Agro Industries

Adani Ports: Promoters Create Pledge On 2.14 Cr Shares From March 23-28

Adani Trans: Promoters Create Pledge On 76.5 Lakh Shares From March 23-28

Fiem Ind: The company has entered into JV with Japanese firm Aisan Ind For manufacturing Of 2 & 3-wheeler Parts

Maruti Suzuki March sales up 15% at 1.60 lakh units

Sandhar Technologies, Karda Construction to debut today

Vedanta wins bid to acquire Electrosteel Steels

Allahabad Bank cuts lending rates by 45 bps

IOC to invest Rs 1.4 lakh cr to double refining capacity

Canara Bank calls off move to divest stake in Can Fin Homes

No stocks under ban period on NSE

Security in ban period for the next day's trade under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

But for April 2, 2018 there are no stocks present in this list.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!