The Nifty, which started on a muted note, gained momentum in the second half of the trading session on Monday, fuelled by short covering in banks and financials. The index made a ‘Long White Day’ kind of pattern on the daily charts.

A 'Long White Day' signifies the market witnessed sustained buying interest from the bulls for most part of the trading day, which is a bullish sign. The index managed to reclaim 10,000 levels as well as 200-days exponential moving average (DEMA) placed at 10,092.

Such volatility was expected ahead of the early expiry and hence such strong price action would force bears to run for cover. As long as global cues remain stable, chances are the bias could remain tilted in favour of bulls.

The 50-share index opened at 9989 and slipped to an intraday low of 9,958 before bulls stormed D-Street and took the index back above 10,000. The index recorded an intraday high of 10,143 before closing the day 132 points higher at 10,130.

“The Nifty registered a Long White Day kind of formation as it witnessed a powerful short covering rally which has erased the losses of last Friday’s session and went on to close above the critical moving averages on short-term charts suggesting a near-term bottom to be in place around 9950 levels,” Mazhar Mohammad, Chief Strategist – Technical Research & Trading Advisory, Chartviewindia.in told Moneycontrol.

“A confirmation of a possible bottom will only come on a close above 10227 levels. However, this kind of strong momentum ahead of expiry session shall create enough panic among bears forcing them to run for cover in next few trading sessions,” he said.

Mohammad further added that in the absence of any overnight negative global cues and technically sustaining above 10227 levels this rally shall get extended initially up to 10390 levels. “At this juncture, it can be difficult to project a trend reversal but certainly for time being the ball is in the court of bulls,” he said.

We have collated the top 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

The Nifty closed at 10,130.7 on Monday. According to Pivot charts, the key support level is placed at 10,011.67, followed by 9,892.63. If the index starts moving upwards, key resistance levels to watch out are 10,196.62 and 10,262.53.

Nifty Bank

The Nifty Bank index closed at 24,244.3 on Monday. The important Pivot level, which will act as crucial support for the index, is placed at 23,837.36, followed by 23,430.43. On the upside, key resistance levels are placed at 24,470.96, followed by 24,697.63.

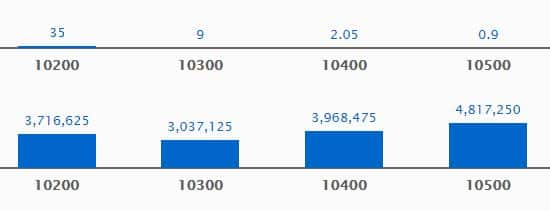

Call Options data

In terms of open interest, the 10,500 call option has seen the most call writing so far at 48.17 lakh contracts. This could act as a crucial resistance level for the index in the March series.

The second-highest buildup has taken place in the 10,400 Call option, which has seen 39.68 lakh contracts getting written so far. The 10,200 Call option has accumulated 37.16 lakh contracts.

There was hardly any Call writing seen.

Call unwinding seen was seen at the strike price of 10,000, which shed 13.64 lakh contracts, followed by 10,100, which shed 8.10 lakh contracts and 10,500, which shed 6.45 lakh contracts.

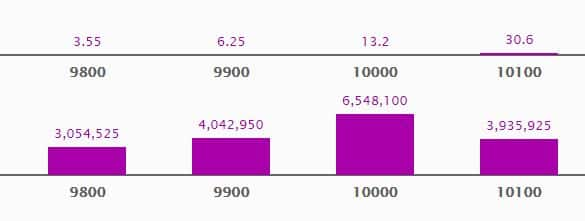

Put Options data

Maximum open interest in put options was seen at a strike price of 10,000, in which 65.48 lakh contracts been added till date. This will act as a crucial base for the index in the March series.

The 9,900 put option comes next, having added 40.42 lakh contracts so far, and the 10,100 put option, which has now accumulated 39.35 lakh contracts.

During the session, put writing was seen the most at a strike price of 10,000, with 13.61 lakh contracts being added, followed by 10,100, which added 11.12 lakh contracts, and 9,900, which added 1.79 lakh contracts.

Put unwinding was seen at a strike price of 9,700, in which 3.58 lakh contracts were shed, followed by 10,300, in which 1.98 lakh contracts were shed. The 10,500 put option saw 1.54 lakh contracts getting shed.

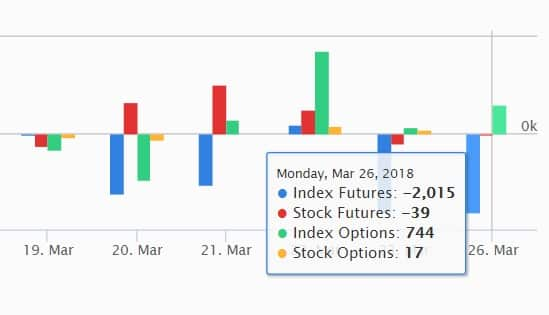

FII & DII data:

Foreign institutional investors (FIIs) sold shares worth Rs 741.19 crore, while domestic institutional investors bought shares worth Rs 2,017.95 crore in the Indian equity market, as per provisional data available on the NSE.

Fund flow picture:

Stocks with high delivery percentage:

High delivery percentage suggests that investors are accepting delivery of the stock, which means that investors are bullish on it.

101 stocks saw long build-up:

78 stocks saw short covering:

A decrease in open interest along with an increase in price mostly indicates short covering.

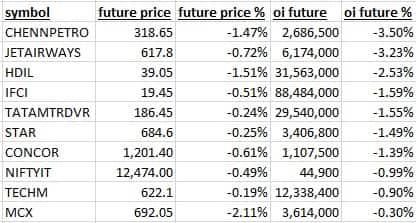

21 stocks saw short build-up:

An increase in open interest along with a decrease in price mostly indicates build-up of short positions.

11 stocks saw long unwinding:

Long unwinding happens when there is a decrease in OI as well as in price.

Bulk Deals:

D P Wires Limited: Prem Cables Pvt Ltd bought 4,20,800 shares at Rs 75 per share.

Inventure Gro & Sec Ltd: Ashok Commercial Enterprises bought 8,50,000 shares at Rs 16.58 per share

Jindal Saw Limited: JSL Limited bought 20,71,000 shares at Rs 116 per share

Jindal Drilling And Indus: Jindal Pipes Limited bought 13,30,000 shares at Rs 149.40 per share while Sudha Apparels Limited sold 13,30,000 shares at Rs 149.40 per share

Manaksia Limited: Subham Capital Private Limited bought 6,90,000 shares at Rs 49.60 per share

Milton Industries Limited: Beeline Broking Ltd bought 8,56,000 sharesat Rs 25.16 per share

TD Power Systems Ltd.: MSD India Fund Ltd bought 8,56,679 shares at Rs 185.06 per share

(For more bulk deals click here)

Analyst or Board Meet/Briefings:

TVS Motor: Goldman Sachs Securities will be meeting the management of the firm on March 28, 2018.

General Insurance Corporation of India: Sameeksha Capital Private Limited met the management of this firm on March 26, 2018.

Astral Poly: ICICI Prudential Mutual Fund and Emkay Global Financial Services will be meeting the management on March 27, 2018.

VRL Logistics: ICICI Prudential MF will be meeting the company on March 27, 2018.

Rallis India: Franklin Templeton Mutual Fund will be meeting the management on March 27, 2018.

AIA Engineering: The company will be meeting representatives of Edelweiss Securities on March 27, 2018.

LIC Housing Finance: Balyasny Asset Management met the company on March 26, 2018.

Pidilite: Axis Capital will be meeting with the firm on March 28, 2018.

Puravankara: Fidelity Management and Research will be meeting the company’s representatives on March 27, 2018.

M&M Financial Services: Elara Securities met with the management of the firm on March 26, 2018.

Wockhardt arm Wockhardt Bio AG gets USFDA nod for Oxacillin sodium injectable

Aurobindo Pharma gets tentative USFDA nod for Emtricitabine (20 mg) Capsules

IDFC Bank got prior approval of NSE to proposed amalgamation of Capital first with co

Stocks in news:

ICICI Bank: The bank has allotted 1,07,215 shares of face value Rs 2 on March 26 under the ESOP scheme.

Capital First: Merger with IDFC Bank has received the nod of National Stock Exchange (NSE).

MCX: MCX brass futures contract debuts with volume of Rs 14.71 crore.

Tata Metaliks: Operations at Kharagpur plant to be hit due to planned shutdown at its blast furnaces, sinter plant and captive power plants between March 26 and April 6, 2018.

Power stocks: Power minister RK Sinha has said that he has proposed NTPC, PFC, REC To Make SPV to operate stressed assets.

Punj Lloyd: The company has received a contract worth Rs 505 crore in Odisha On EPC Basis By NHAI.

Wipro: The company and Adobe have expanded partnership to offer enhanced digital services & solution.

Dilip Buildcon: The company has been declared lowest bidder for 4 hybrid annuity projects valued at Rs 4,115 crore by NHAI in Karnataka & Maharashtra.

Tata Power: To sell Tata Communications’ shares to parent for Rs 2,150 crore.

JSW Steel to set up facility in Texas with $500 million investment, reports Reuters.

Mangalore Refinery and Petrochemicals Ltd: The company will come out with BS6 standard diesel by March 2019 and BS6 petrol by December that year, reports Hindu Business Line.

Hero Cycles: It has launched 9 new models under Sprint Pro range.

Adani Enterprises: It has signed coal mining pact with NLC India

KEC International: The company has won contracts worth Rs 2,419 crore.

Four stocks under ban period on NSE

Security in ban period for the next day's trade under the F&O segment includes companies in which the security has crossed 95 percent of the market-wide position limit.

Securities which are banned for trading include names such as IFCI, Jet Airways, JP Associates and Oriental Bank of Commerce.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!