Indian benchmark indices slumped over 1.5 percent on Friday, thereby ending the week on a negative note while the US markets also registered a weekly loss.

Nifty patterns on multiple time frames show; it successfully closed below the 30 weekly EMA placed around 10,290 and is approaching towards 200 daily EMA placed around 10,100. Further, Nifty broader trading range for the coming week is expected to be 10,110-10,340, according to a report by Stewart & Mackertich Wealth Management Ltd.

Indian Markets: Nifty, Sensex end 0.3% lower

The Indian benchmark indices including the Sensex and the Nifty ended the last day of the week in control of the bears as the indices plunged over 1.5 percent each.

The Sensex lost more than 500 points as investors turned cautious amid global trade war concerns, and political uncertainties after the Telugu Desam Party formally pulled out of NDA government.

All sectoral indices closed in the red as Nifty Bank, Auto, FMCG, Metal, Pharma and Realty indices were down between 1 percent and 2 percent while technology stocks saw buying interest towards the end that helped the IT index to minimise loss to half a percent.

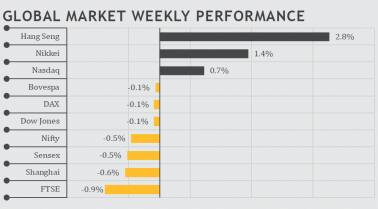

For the week, Sensex was down 0.5 percent and Nifty shed 0.4 percent. Nifty Bank lost 0.8 percent during the week.

The volatility index (VIX) for the week closed at 14.33 percent and is expected to volatile, said a report by SMC Global. The consumer price inflation (CPI) came lower than expected at 4.4 percent in February and Industrial production for January came in at 7.5 percent. India’s trade deficit narrowed to a 5-month low of USD 12 billion in February after widening to a 56-month high a month ago.

The Sensex as well as the Nifty opened the week on a positive note as the trade-war concerns cooled off. The indices strengthened but couldn’t hold the momentum for long enough after the outcome of better than expected IIP and CPI data.

The World Bank has projected that the economic growth is likely to accelerate to 7.3 percent in 2018-19 and 7.5 percent in 2019-20.

US Markets: Indices fall for the week; S&P shed 1.2%

US stocks fell for the week after Friday's rally broke a 4-day losing streak for S&P500. Small- and mid-caps outperformed larger shares. Within the S&P 500, utilities and real estate shares fared best, helped by a decline in longer-term Treasury yields, which make their healthy dividend payments more attractive in comparison.

Earlier in the week, the Commerce Department reported decline in retail sales by 0.1 percent in February, well below the 0.3 percent rise as many expected.

The S&P 500 notched a 1.2 percent loss for the week, despite a 0.2 percent gain on Friday. The Dow Jones industrial average also fell 1.5 percent on the

week as shares of Boeing dropped 6.8 percent on the trade tensions. The Dow closed 72.85 points higher on Friday at 24,946.51, a CNBC report said.

The Nasdaq composite closed flat at 7,481.99 amid a 1.4 percent decline in Google-parent Alphabet and a 0.7 percent fall in Amazon shares. The index also fell 1 percent for the week.

European Markets: Indices end on mixed note

European equities ended the week mixed amid relatively low trading volumes and disappointing inflation numbers for the eurozone. The political uncertainty about the prospects of a trade war and other geopolitical tensions also dampened the sentiments.

At the beginning of the week, the pan-European benchmark STOXX 600 gained ground following the strong US jobs report the week before. On the week, the STOXX 600 finished slightly under pressure, closing down

0.14 percent.

Germany’s DAX 30 and France’s CAC 40 all trended higher in what T. Rowe Price traders coined a “Goldilocks” environment in which trade concerns had calmed, oil prices were steady, and volatile bond yields and interest rate uncertainty were no longer forefront topics.

But by midweek, investor sentiment turned more negative as optimism began to flag following US President Donald Trump’s staffing reshuffles, UK Prime Minister Theresa May’s assertion that Russia was connected to the chemical poisoning of a former spy on British soil, and news of softer-than-expected economic data.

By the end of the week, trade volumes were subdued and somewhat stuck in a holding pattern as investors worked through the geopolitical uncertainty.

Meanwhile, the Eurozone industrial production fell 1 percent in January compared with the month before.

Asian Markets: Nikkei registers 1% gain

For the week the Japanese stock market benchmarks rose with Nikkei 225 ending the week at 21,676.51, a modest 0.97 percent gain over the prior week. The large-cap TOPIX Index rose 1.23 percent for the week but ended down on Friday by 4.45 percent for the year to date. The Kospi finished Friday on a higher note by 0.06 percent at 2,493.97 as Samsung Electronics pared steeper losses seen earlier to close lower by 0.78 percent.

Earlier in the week, riding on strong US jobs data, Asian stocks got off to a strong start with regional markets closing higher on Monday. The Nikkei closed up 1.65 percent, or 354.83 points, to close at 21,824.03 after recording a more than 400-point gain earlier in the session.

The broader Topix rose 1.51 percent, with gains seen across all of the index's 33 sectors despite developments related to a possible cronyism scandal.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!