CBEC has prescribed the procedures to be followed by operators of the duty-free shops for accounting of receipt, storage, operations and removal of goods at their boned warehouses and shops.

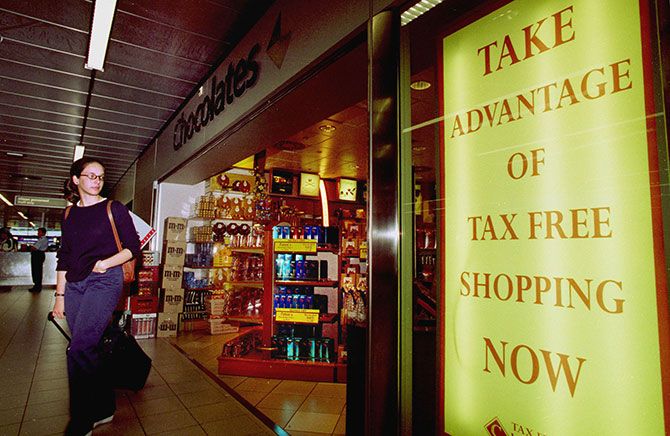

The Central Board of Excise and Customs has permitted duty-free shops in Customs areas to accept payment in rupees till a ceiling of Rs 25,000 from those going out of or coming into the country.

They will also be required to display the prices in rupees alongside those in foreign currency and the exchange rate adopted.

The decision follows the Reserve Bank’s notification which revised the limit for export from and import into this country of Indian currency, from Rs 5,000 to Rs 25,000 per person.

CBEC has prescribed the procedures to be followed by operators of the duty-free shops for accounting of receipt, storage, operations and removal of goods at their boned warehouses and shops.

The Customs Act was amended on May 14, introducing a provision for licensing special warehouses that will be subject to physical control by the Customs.

CBEC issued the notification for supply to duty-free shops in a Customs area in the class of goods which shall be deposited in a licensed special warehouse.

The Board also notified the Special Warehouse Licensing Regulations and the Special Warehouse (Custody and Handling of Goods) Regulations.

These do not permit retail sales from such a warehouse.

CBEC has said a duty-free shop in a Customs area should not be treated as a warehouse.

It is a point of sale for the goods, which are to be ex-bonded and removed from a special warehouse for being brought to such shops for sale to those eligible -- passengers arriving or departing from India.

Operators of these shops store goods in large warehouses in the city and/or in smaller warehouses in and around the precinct of the airport, as a staging area for replenishing of stocks.

Such warehouses qualify to be licensed as bonded ones, as they are capable of being under the lock of Customs.

CBEC now says the maintenance of records of goods deposited in a special warehouses should be only in digital form.

The software for maintenance of electronic records must incorporate the feature of audit trail.

Meaning a secure, computer-generated and time-stamped electronic record.

It must allow for reconstruction of the course of events on the creation, modification or deletion of an e-record. The monthly returns may be filed as a paper copy or in digital form, as preferred by the licensee (digital form means a pen drive or CD).

The monthly returns need not include details of sales to individual passengers.

The procedures prescribed for receipt of goods in the warehouses and their removal from these must be followed.

Under Customs escort, goods can be removed from a special warehouse to duty-free shops or loaded on a scheduled commercial airline for sale to passengers going abroad, as in flight duty-free shop sales.

The Board has also issued guidelines for recovery of the costs of Customs supervision. Overall, CBEC’s latest instructions appear reasonable and easy to comply with.