We have compiled a list of key factors which led to Warren Buffett’s coveted success.

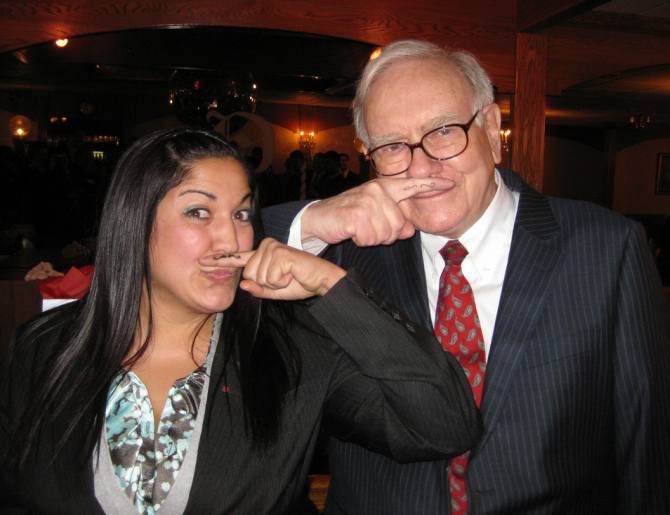

Photograph: Aaron Friedman/Creative Commons

Warren Buffett is undeniably the most successful investor in history. His success is attributed by some to his sharp business acumen, understanding of businesses while others call it luck. Numerous books have been written in an attempt to analyse the factors which led to his extraordinary success. However, replicating similar results is no cake walk.

Success at Buffett’s rate is not a result of following a set formula. It was a continuous process which was followed. Almost like a way of thinking. Discipline, perseverance and effective execution play a pivotal role in his success story.

1. Chalk up a plan

While making an investment, it is important to set a goal. Invest in value and then be patient. Quoting Buffett’s famous words, “the stock market is a device for transferring money from the impatient to the patient.” So once your homework is done and a choice is made, stick to the plan.

2. Invest in value

“Price is what you pay, value is what you get”, said Mr Buffett. Whether it is going in for an investment or making any other purchase, these words ring true. Looking for value is the underlying principal to be followed.

3. Plough back to reap benefits

Retain the earnings and invest it back in the business. The idea is to make the business grow and sustain. If earnings are taken home as dividends from a flourishing business, it does not help the very business which helps your earn, to grow. Dividends are popular but they shouldn’t be the only thing one must have an eye on. It is important to track the utilisation of funds back into the business to continue growing.

4. Strategise and execute

When it comes to investments, figure out the cash in hand and the fixed income sources one may invest in. The returns must be enough to sustain your current lifestyle. After this is sorted, money can be invested in other options which have a possibility of high returns against high risk. The strategy adopted must ensure that investment options are balanced.

As Buffett said, do not put all your eggs in the same basket.

5. Time is money and has to be managed accordingly

Warren Buffett said, the rich invest in time and the poor invest in money. Indeed time is one commodity which is equally distributed to everybody. Tasks which are not related to his investment process were either delegated or eliminated. Time and energy spent on trivial tasks can be channelised on the ones topping the priority list.

6. Develop managerial skills

A manager sets goals for the team and drives them to achieve those. Keeping the team motivated, providing appropriate financial incentives and addressing any other concerns to the team’s satisfaction are where managerial skills are tested. Not everybody is born as a good manager but these skills can definitely be developed.

7. Learn. Read. Think

Warren Buffett said that investing in yourself is the best thing you can do. Nobody can take away talent from a person. Irrespective of the economic conditions, talent will always fetch proportionate returns. The value does not deteriorate. Hence, it is important to invest in developing one’s skills. Staying updated helps in making intelligent decisions. Buffett’s wise words: You can’t reach success in investment if you do not think independently.

8. Everyday advice

Create more than one source of income. Do not depend on your job alone. Make investments to create a second source of income. Think twice before buying anything. Retail therapy does not really help in the long run. If one continues to buy things which are not needed, there will be a stretch situation someday for making necessary purchases.

9. Investment advice

Diversify the portfolio. It is important to balance investments on basis of fixed income, returns and risks. Also, while taking risks, tread cautiously. Like Buffett said, never test the depth of water with both feet. Only invest in businesses which you understand completely. Remember, it is your hard earned money invested there and you need to be absolutely sure about how it will be utilised to fetch returns.

10. Be your own advisor

Many people make investment decisions based on other people’s opinions. This kind of an investment is the most risky investment and we are not even considering the inherent risk of the option chosen here. The investment option chosen by a friend may be best suited for their lifestyle and future plans. But that does not necessarily make that option a good fit for you. So think for yourself, seek clarity on your goals and then make a wise investment choice. Like Buffett said, a public opinion poll is no substitute for thought.

While we hope that these rules inspired by Warren Buffett will help you in making choices, we leave you with the two golden rules quotes by Buffett.

#1 Never lose money.

#2 Never forget rule number 1.

The author is a credit expert with 10 years of experience in personal finance and consumer banking industry and another 7 years in credit bureau sector. Rajiv was instrumental in setting up India's first credit bureau, Credit Information Bureau (India) Limited (CIBIL). He has also worked with Citibank, Canara Bank, HDFC Bank, IDBI Bank and Experian in various capacities.