CESC bounced back sharply on Friday after falling as much as 15 percent in the previous trading session after the R P Sanjiv Goenka Group announced a restructuring of its flagship company by splitting it into four entities.

Group chairman Sanjiv Goenka said CESC is being split into four companies by way of the demerger scheme of existing businesses for value unlocking and focused management into each of the verticals, subject to regulatory approvals.

On Friday, CESC was trading 5 percent higher at Rs 870.80. The unwarranted fall was led by confusion on a number of shares. A perfect restructuring exercise to bring in the desired benefit for investors, suggest experts.

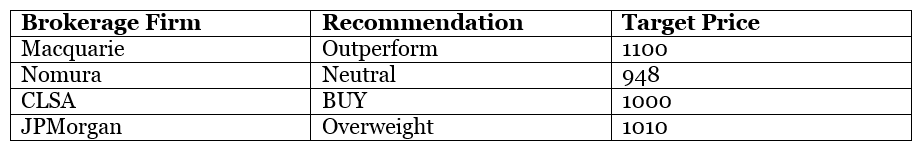

Most brokerage firms maintain their rating post-CESC Q4 results while some raised target price to Rs 1100, which translates into an upside of 32 percent from current levels.

CESC Q4 ending March 2017 saw the net profit go up marginally to Rs 295 crore from Rs 293 crore registered during the corresponding period last year.

We have collated a list of views from different brokerage firms on CESC:

Macquarie which maintains most aggressive 12-month target price of Rs 1100 on CESC sees sharp re-rating in the stock price due to restructuring exercise. It raised its target price from Rs 658 to Rs 1,100.

CESC announced a massive restructuring of its business by splitting its existing company into four different companies focused on a particular business segment. It is a clean mirror shareholding demerger with no loss of value for minorities.

“We believe this move substantially removes the overhang of unrelated diversification by CESC and could drive a sharp re-rating,” said the Macquarie note.

“We raise our price target meaningfully to Rs 1,100 (from Rs 658) as the holding company discount disappears and we roll forward to FY19,” it said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!