Juzer Gabajiwala

Nowadays we see a lot of experts and investors debating on whether it is more beneficial to invest in active or passive funds. Before getting into the debate, here is some information, which will help us come to a conclusion:

What are active funds and passive funds?

Active Funds:

Active funds are managed with the main objective of generating a return which is higher than the market/benchmark index. This excess return is called Alpha. The fund manager has complete freedom or leeway while constructing or managing the portfolio, except for regulatory restrictions and the fund house’s internal policy framework. So effectively, a fund manager, managing an active fund, can decide on stocks selection (which stocks to buy and in how much proportion), market timing (when to buy or sell), etc.

Passive Funds:

Passive funds, on the other hand, are managed with the main objective of generating a return that is in line with the benchmark. It is a “no-brainer” for the fund manager managing the fund as he or she just needs to merely mimic the benchmark portfolio. The fund house and the fund manager do not enjoy any discretion while selecting stocks or taking buy or sell decisions. When funds are received from investors, they are invested in the same proportion as the composition of the benchmark and when there are redemptions, the sale of stocks is in proportion too. For example, a fund tracking the Nifty index will buy exactly the same stocks present in the Nifty and in the same proportion as they comprise the index. Also, in case there are any changes in the composition of the Nifty index, like perhaps the removal of ABC stock and addition of XYZ stock, the same changes need to be replicated in the fund as well. Thus, these funds are usually less volatile compared to active funds and they ideally move in tandem with the index to which they are aligned. Since passive funds do not require active research and stock picking, the expense ratios are much lower than that of active funds.

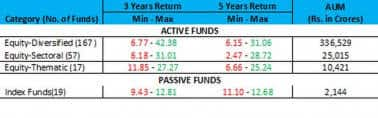

Features / Performance: Below is a comparison of active and passive funds in terms of number of schemes available for investment, Assets Under Management (AUM) and performance across different time periods.

For the active funds category, we have considered all equity-diversified funds (Large Cap/ Multi Cap/ Mid and Small Cap funds, except ELSS funds), Sectoral (Banking/ Pharma/ Infra, etc.) and Thematic funds. Under Passive funds, all the funds tracking the Nifty and Sensex, except one fund tracking mid cap index, have been included.

Thus, investors investing in passive funds are missing out on the whole mid and small cap rally due to very limited choice of funds tracking mid and small cap index. Also, there are currently a total of 47 indices comprising of Nifty 50, Nifty Bank, Nifty FMCG, Nifty IT, Nifty Media, Nifty Infra, etc.

Data as on Mar 31, 2017

As seen from the above table, the equity diversified category’s best fund return on a five year basis is more than 2.4 times that of the index funds’ best fund return. Almost 97 percent of equity diversified funds returned more than 11% p.a. on a five years basis.

The index fund universe comprises of 19 funds only whereas there are 167 funds in the equity-diversified fund universe. Also, the AUM managed by index funds is only Rs 2,144 crores.

Should I opt for passive or active funds?

Having understood the differences between active and passive funds, the bigger question now is what option should you choose? We will restrict our understanding only to the Indian markets and Indian mutual funds space.

The average expense ratio (fees charged by mutual fund houses for managing your money) for passive funds and active funds is 0.90% p.a. and 2.40% p.a., respectively. Thus, there is an impact cost of 1.5% for investors investing in active funds and hence, these funds need to generate 1.5% higher returns than passive funds in order to even the odds. However, as seen from the table of comparison, the differential return between equity diversified and index funds is positive 2.4 times on maximum return basis.

India is still a developing economy and there are many companies or sectors with a lot of opportunities and scope for growth. This is due to the fact that in our markets, the potential of some sectors and companies has not been discovered, unlike the case of global markets, where most sectors have been well and fully researched. We do not see this situation in India at-least for the foreseeable future as the guidance provided by Indian companies is not very accurate and also, the Indian economy is expected to do well compared to other emerging economies. Further, we are still a nascent economy compared to the US. The company with the highest market cap in India is TCS, whichis valued at USD 73.15 bn; this is only 10% of the market cap of Apple Inc. (one of the top companies in the US), whose market cap is USD 752.51 bn. Thus, TCS, which is a large cap company in India, is equivalent to a mid or even small cap company in the US.

Conclusion: India presents a lot of investment opportunities and active funds should continue to outperform passive funds, at least until passive funds manage a relatively small corpus of funds and track a limited number of indices. Also, most importantly, active funds should do well when the variance between the minimum and maximum return is wider. Passive funds should do well once this variance narrows down in future.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!