The S&P BSE Sensex rose to a record high of 32,686.48 on August 2nd but since then bears took control of D-Street as the index saw a decline of over 1,400 points. It broke below crucial support levels hinting further weakness in coming days.

Although the Sensex saw buying at lower levels this week, the decline may not be over yet, according to experts who see a fall of 2-5 percent for the rest of 2017, according to a poll conducted by Moneycontrol last week.

The market is not likely to fall in one straight line because there are a lot of investors who were waiting for the dip but it will fall over a period of time. Reasons could be many but one reason which can’t be discounted is fall in global markets.

If global markets start to underperform, and earnings fail to catch up back at home brace for correction in markets, suggest experts.

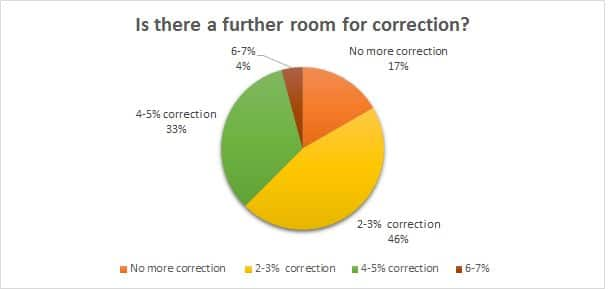

The Nifty could correct by at least 2-3 percent by December, said a majority in a Moneycontrol poll of 25 leading CIO, fund managers as well research heads and brokers conducted over this week.

The poll showed 46 percent of the participants see 2-3 percent correction in rest of 2017, while 33 percent of them see a decline of up to 4-5 percent. The rest 17 percent feel there will be no correction while 4 percent of the respondents feel that the correction could be as severe as 6-7 percent.

“Currently, there is a lot of optimism and consensus on the street, the market had a one-way climb from December 2016 without a significant correction, which we believe, now makes a strong case for a correction,” Jimeet Modi, CEO, SAMCO Securities told Moneycontrol.

He expects 4-5 percent correction in markets in the rest of 2017. “Some pockets in the market have already started to correct, but we believe a more widespread correction will follow soon, which would then throw open a compelling opportunity to invest for the next leg of the rally,” he said.

Earnings could be a dampener:

The June quarter earnings have not been exciting but analysts polled by Moneycontrol are of the view that earnings revival could happen by December quarter.

Almost 61 percent of the poll respondents see Nifty earnings revival by December quarter while 26 percent feel that it could happen by March quarter while 9 percent of the respondent see it happening as early as September.

"Markets are ruthless and any disappointment in earnings delivery versus investor expectation in a sufficiently owned stock can lead to significant value destruction," Shashank Khade, Director, and Co-founder, Entrust Family Office Investment Advisors told Moneycontrol.

Free float Nifty50 earnings for Q1FY18 contracted by 4.7 percent on a YoY basis, largely driven by pharmaceuticals (-53%), energy (-13.9%) and auto (-22%). The major contributors to earnings upside were metals (142%), retail lenders (23%) and FMCG (7.7%).

“The Net Profits for the Nifty 50 have been dismal. There are no adjustments that can be made, or mitigating factors. Only 20 companies have delivered what we consider above par results, i.e., above 10% profit growth,” Sunil Sharma, Chief Investment Officer, Sanctum Wealth Management told Moneycontrol.

“The other noteworthy fact is that the profit distribution curve is barbell in nature, suggesting a bifurcating market, a market of haves and have nots,” he said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!