The benchmark index might not offer much of an exciting trade on Thursday, but as much as 155 stocks on the BSE across groups hit a fresh 52-week high, data from BSE showed.

The S&P BSE Sensex pared early morning gains, but was still trading with a positive bias. The Nifty was trading comfortably above its crucial resistance level of 9,100.

The stocks which rose to fresh 52-week highs on the BSE include names like Venky’s, Grasim, APL Apollo, Sun TV, Jay Bharat Maruti, TVS Motor Company, Petronet LNG, Muthoot Finance, GAIL India, GSPL, Fortis Healthcare, Kwality, MRPL, etc. among others.

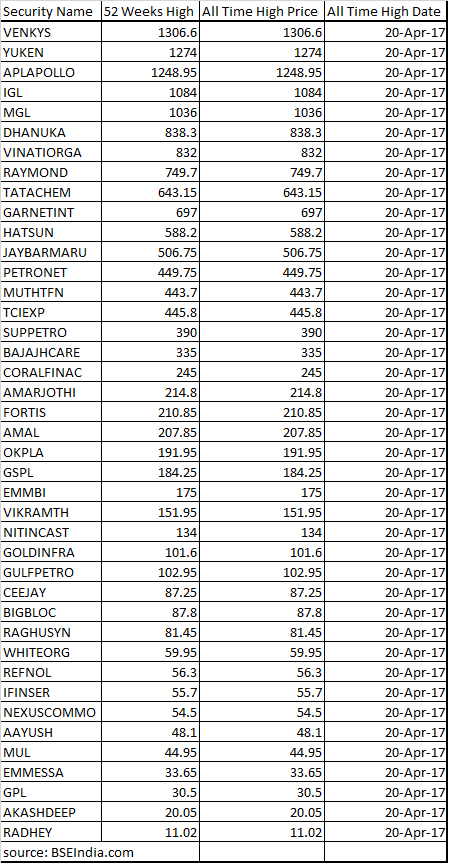

More than 40 stocks hit fresh all-time highs on Thursday which suggests strength in the market. Stocks which rose to record highs include names like Venkys, Raymond, Tata Chemicals, Bajaj Healthcare, Hatsun, OK Play India among others.

The Nifty was trading comfortably over its crucial support level of 9100 and nearly 100 stocks rose to their fresh 52-week high on the NSE.

Stocks which hit fresh 52-week high include names like MRF, Sundaram Clayton, Container Corp, Savita Oil, Sun TV, Vinati Organics, Mahanagar Gas, Raymond, M M Forging, Gujarat Alkalies, Muthoot Capital, TCI Express, India Nippon etc. among others.

The market awaits some positive trigger for a breakout to happen and till that time benchmark indices are likely to move in a narrow range. The Nifty is facing strong resistance around 9,200 which signify traders need to be cautious at this time.

It is still buy on dips market as the long-term structure story still remains intact, but in the short term, some more consolidation cannot be ruled out. Options data also suggests strong resistance at higher levels.

On the option front, maximum Put OI was seen at strike prices 9,100 followed by 9,000 while maximum Call OI was seen at strike prices 9,200 followed by 9,300 strike.

Fresh put writing was seen at strike prices 9,100, 9,150 and 9,000, while Call writing was seen at strike prices, 9000-9400 strikes.

“Overall data indicate that on downside 9000PE having highest open interest suggesting strong support and the upside 9200CE having highest open interest showing strong resistance,” Rohit Singre, Senior Research Analyst, Bonanza Portfolio Ltd told

Moneycontrol.com.

“Overall, we expect Nifty to trade in a range of 9000-9275 zone and we recommend buy on dip and sell on rise strategy to be used for the ongoing week,” he said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!