The S&P BSE Sensex might have retreated after hitting mount 30K in the previous trading session but the stocks specific action continue on D-Street on Thursday where more than 200 stocks hit a fresh 52-week high on the BSE.

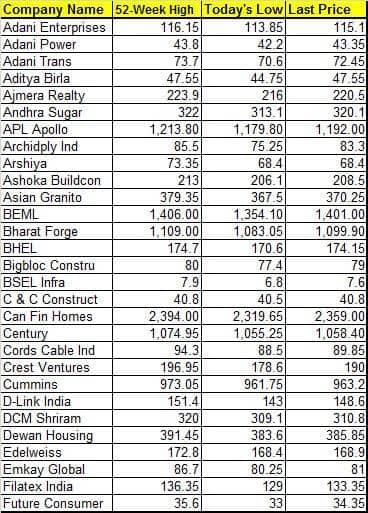

Stocks which rose to fresh 52-week high on the BSE include names like Adani Enterprises, Adani Power, Can Fin Homes, L&T, Yes Bank, RIL, BEML, Century Textiles, Jubilant Lifescience, Tata Chemicals, Sobha Ltd, Dewan Housing, Inox Leisure, ICICI Pru. etc.

On the NSE nearly 100 stocks rose to fresh 52-week high which includes names like Honeywell Auto, Navin Fluorine, L&T, Yes Bank, RIL, Bharat Forge, Venky’s, Cummins India, IFB Industries, Tata Metaliks, IIFL Holdings, Sobha, Shakti Pumps, etc.

The S&P BSE Sensex came under pressure after the minutes released from Federal Reserve overnight indicated that it could change its bond investment policy this year.

The meeting of the March FOMC meeting showed that the Fed plans to begin unwinding its $4.5 trillion balance sheet later this year. The implications of this could be hugely negative for the global markets, suggest experts.

“We believe that the Fed’s talk of a balance sheet contraction, even before all the planned hikes have gone through this year, is to bring the markets down to terra firma, rather than any genuine desire to do so at this juncture,” V K Sharma, Head - Private Client Group, HDFC Securities told Moneycontrol.com.

Liquidity driven rally along with stable macros and political climate has already pushed benchmark indices to record highs but there is no further headroom if earnings don’t pick up.

The foreign institutional investors which were net sellers in the October-December quarter pumped over Rs 50,000 crore in FY17 against a net outflow of Rs 14,172 crore during FY16. But, there is a risk which investors should understand as the tide could reverse anytime.

The US Federal Reserve meeting has already dropped a hint that US Fed could well start sucking back all the stimulus that it has given to the markets all these years.

“You never know what liquidity is. Everything will look good and suddenly it could change. Therefore, keep in mind the fact that what is driving liquidity is the events which are unfolding in the US, so you are seeing weakness in the US stocks and on the back of that very strong inflows into emerging market and India is also getting its fair share of money,” Sanjeev Prasad, Senior Executive Director & Co-Head at Kotak Institutional Equities said in an interview with CNBC-TV18.

“If you look at India alone, it has got about USD 9 billion in the month of March. So, we have to be careful about what is driving this market. However, some of the factors could change if there is a change in the narrative in the US,” he said.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!