Indian indices seen a consolidation for the week ended February 23 amid no major cues from domestic as well as international markets.

Equity benchmarks have been oscillating within last two weeks’ broad range of 10600-10300, indicating consolidation after the recent sharp decline of 8%.

The index rebounded from the oversold territory and is under the process of forming base near the lower band of broader consolidation range around 10300.

Going forward, we expect the market to consolidate and form a good base in the range of 10300–10600. However, we believe this consolidation will make markets healthier and offer an incremental buying opportunity, said Dharmesh Shah of ICICIDirect.com Research.

On the F&O expiry day, both the indices closed with a marginal loss. However, on Friday the indices closed with 1 percent gain.

In the last week, Nifty50 gained 38.75 points, closed at 10,491.05 and Sensex was up 131 points, closed at 34,142.10.

The foreign investors sold equities worth Rs 5781.98 crore. However, domestic institutions bought Rs 5972.69 crore worth of equities in last week.

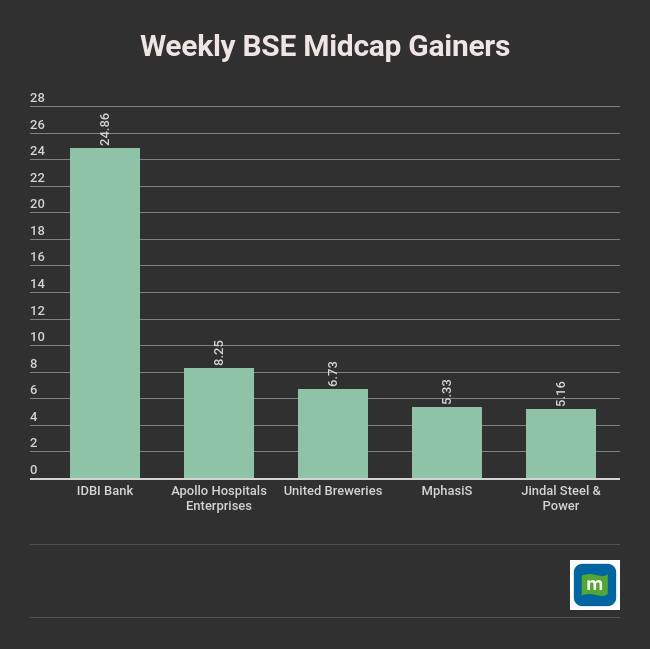

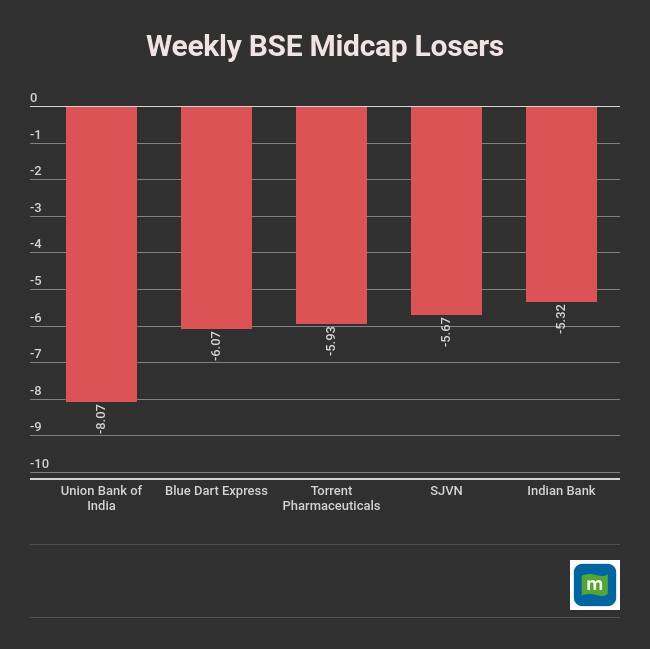

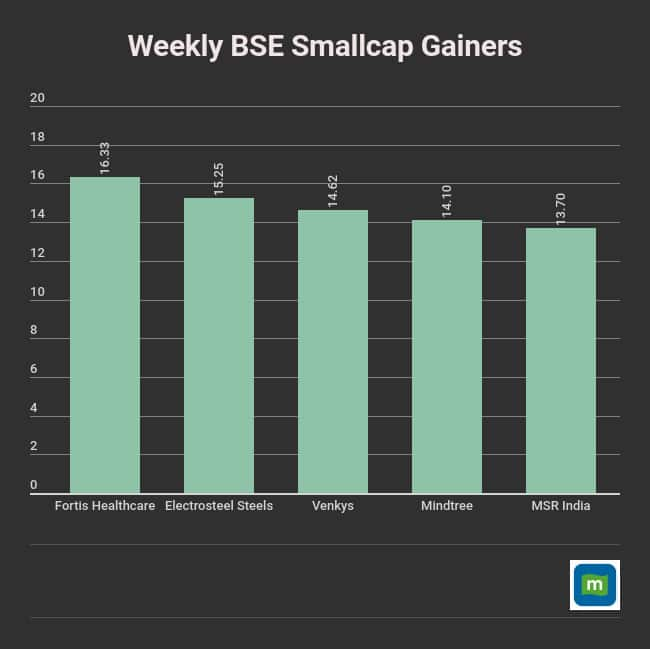

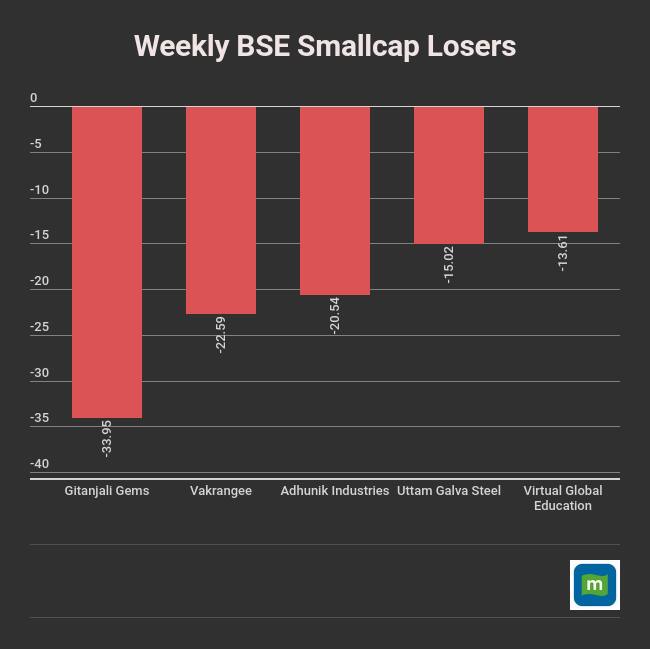

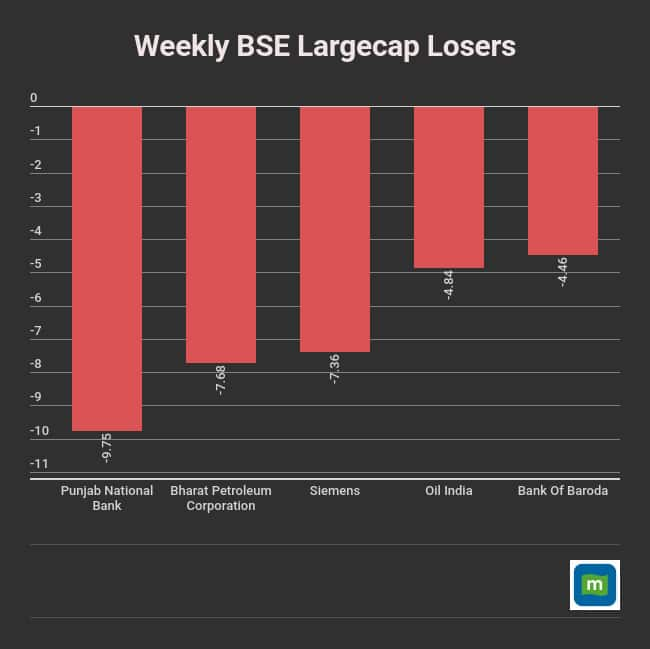

India's volatility index (India VIX) shed 13.3 percent last week. S&P BSE Midcap index was down 0.24 percent, S&P BSE Smallcap index was down 0.22 percent, while S&P BSE largecap index was up 0.29 percent.

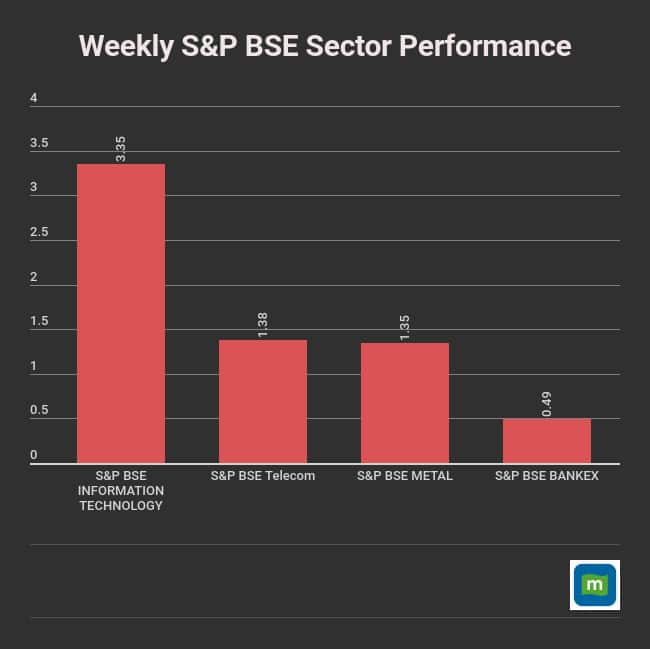

IT index outperformed the other sectorial indices with 3.3 percent gain during the week.

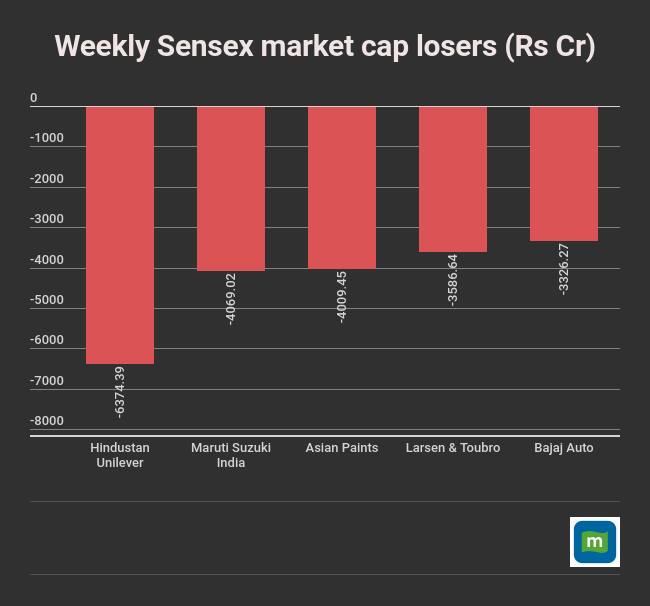

TCS added most of its market value on the Sensex, followed by Reliance Industries, Infosys and Kotak Mahindra Bank.

177 stocks has touched the 52-week high including Mindtree, Ipca Laboratories and Cholamandalam Investment, while 293 stocks touched 52-week low including UCO Bank, Syndicate Bank, SML Isuzu, Rural Electrification Corporation, Punjab National Bank, Orchid Pharma, Max India, Jagran Prakashan, Force Motors, Wim Plast, UPL, in the week ended February 23, 2018.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!