Dalal Street caught in bear grip on Wednesday as the market posted biggest one day fall in percentage terms in two months. The Sensex lost more than 300 points, weighed by global weakness amid rising uncertainty over US President Donald Trump's economic policies, and Missile test in North Korea, which reports said failed. Recent government's proposal to reduce cash transactions limit to Rs 2 lakh from Rs 3 lakh also caused selling pressure.

The market fell for third consecutive session, with the 30-share BSE Sensex down 317.77 points or 1.08 percent at 29,167.68 and the 50-share NSE Nifty falling 91.05 points or 1 percent to 9,030.45, dragged by heavyweights ITC and ICICI Bank.

After three-day consolidation, finally the market got direction on downside but that is unlikely to continue, feel experts who say the Nifty has support at 9,000.

"Nifty has almost reached closer to 9000 mark and downside now seems capped from the current level. However, stocks may continue to trade volatile after the recent slide," Jayant Manglik, President of Religare Securities says.

He advises traders to limit leveraged positions and keep them hedged. Consolidation is more likely in near future, he feels.

Inderjeet Singh Bhatia of Macquarie Research says valuations definitely are on the higher side. "Somehow the market continues to ignore the short-term earnings pain in expectation on long-term improvement both in earnings and in reforms coming through from the government side," he adds.

Asian and European markets were down following a negative lead from Wall Street. France's CAC, Germany's DAX and Britain's FTSE fell more than 0.6 percent, at the time of closing of Indian equities. Japan's Nikkei lost 2 percent on missile test in North Korea and stronger yen.

Back home, the broader markets fell nearly a percent on weak breadth. About two shares declined for every share rising on the BSE.

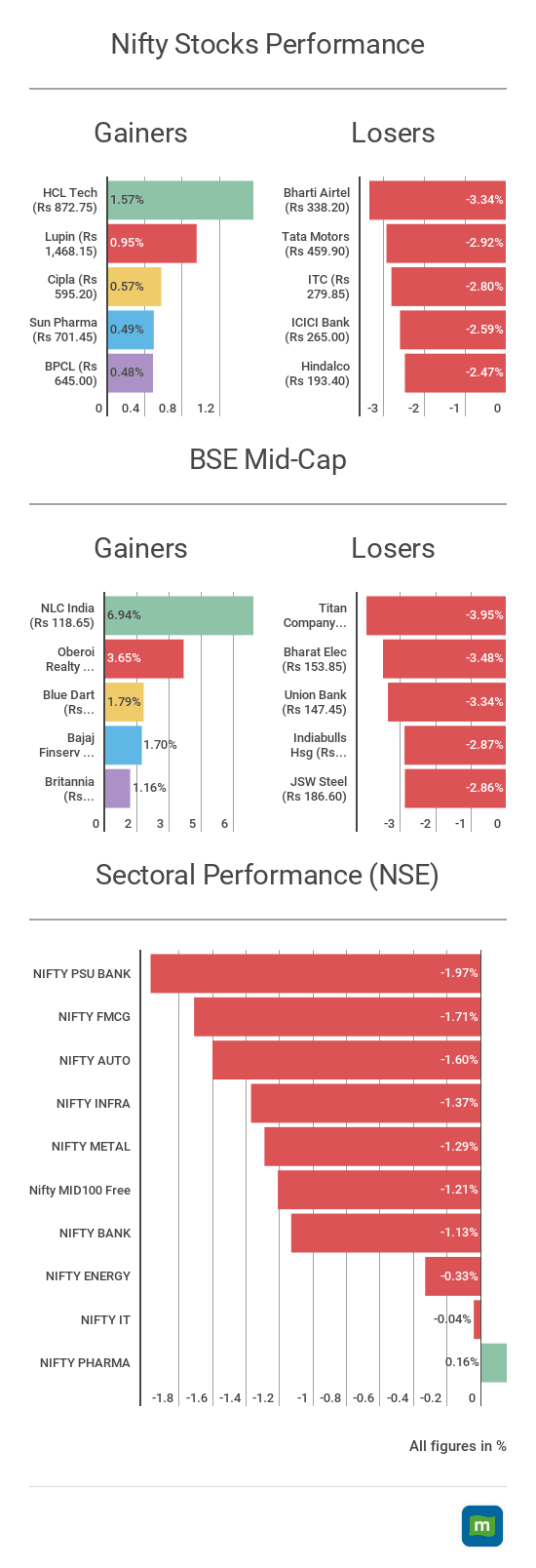

All sectoral indices barring Pharma (up 0.2 percent) and Realty (up 0.6 percent) closed in red. Nifty Bank, Auto, FMCG and Metal indices were down 1-1.7 percent.

ITC was the biggest contributor to Sensex' fall, down 2.75 percent followed by L&T (down 1.3 percent) and Axis Bank (down 0.7 percent). These stocks were under pressure, especially after agencies told CNBC-TV18 that the Government of India may sell its stake in Axis Bank and L&T through exchange traded funds (ETF).

Among others, Bharti Airtel, ICICI Bank and Tata Motors were top losers, down 2.5-3 percent followed by HDFC, HDFC Bank, SBI and Maruti Suzuki.

In broader space, jewellery stocks like PC Jeweller, Gitanjali Gems and Titan Company dropped 2-4 percent after the government's fresh proposal to cap cash transaction limit at Rs 2 lakh from Rs 3 lakh currently.

NLC India shares gained 7 percent on management's positive commentary for Q4 and FY18. However, ABG Shipyard was locked at 5 percent lower circuit on doubt over recovery of various advances.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!