Tension across the Line of Control (LoC), following ‘punitive fire assaults’ by the Indian Army dragged the already weak market further in the final minutes of the session, with the Sensex losing over 200 points, while the Nifty settled below 9400.

After opening flat, the market saw a sharp fall in the first hour of trade, losing over 0.50 percent on both indices. The day was rather sluggish till the last half hour of trade, which is when the news of the attack on Pakistan posts surfaced. Indices tracking pharma and PSU banks, along with oil and gas, weighed down on the Street on Tuesday.

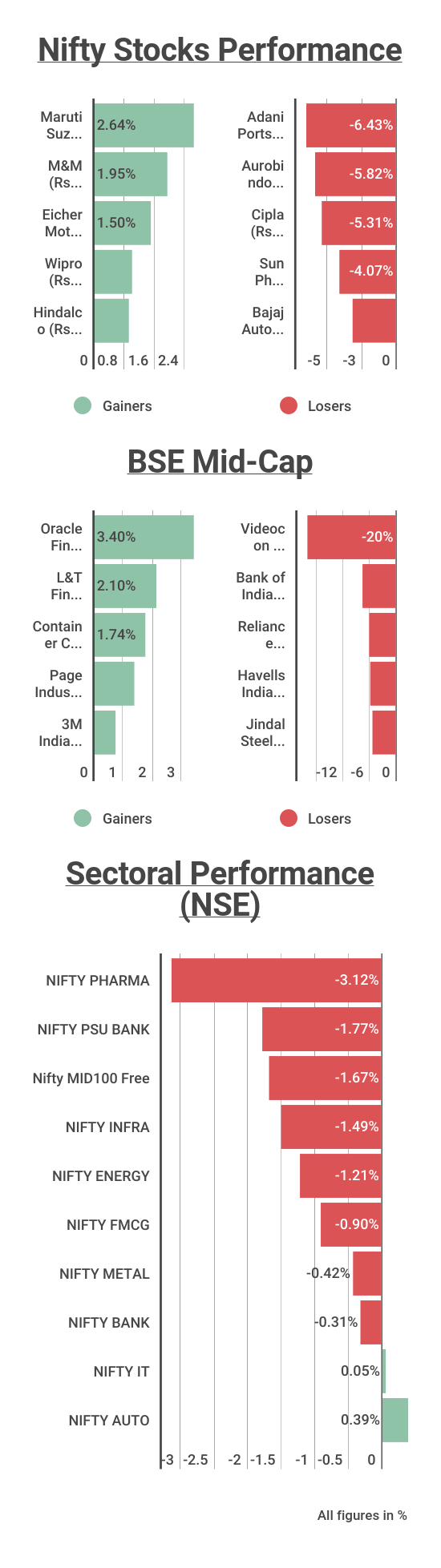

Midcaps continued their corrective phase, extending the intensity in the current session as they fell over 2.5 percent. PSU banks, pharma, energy, and banks, among others, were trading in the red zone as well. The saving grace for the market were IT and auto stocks, which prevented the market from falling further.

The 30-share Sensex closed 205.72 points lower at 30365.25, while the Nifty was down 52.10 points at 9386.15. The market breadth was negative as 610 shares advanced against a decline in 2,113 shares, while 159 shares were unchanged.

Gold prices plunged Rs 235 to Rs 28,915 per 10 grams at the bullion market today amid a weak trend overseas and fall in demand from local jewellers. However, silver remained in demand and advanced by Rs 315 to Rs 39,815 per kg.

Traders said apart from a weak trend overseas, fading demand from local jewellers mainly pulled down gold prices. Globally, gold fell 0.02 percent to USD 1,260.10 an ounce in Singapore.

"PSBs cut losses ahead of F&O expiry, giving brief sense of recovery, market breadth remained suppressed by earnings shocks as long liquidation pressure. Market would now wait for monsoon updates and further news on NPA resolution for making the next decisive move,” Anand James, Chief Market Strategist, Geojit Financial Services said in a statement.

Auto stocks Maruti Suzuki and Mahindra & Mahindra gained the most on both the indices, while pharma stocks Cipla, Aurobindo Pharma as well as Adani Ports were the top losers.

Adani Enterprises tanked Tuesday as investors turned wary of the company’s decision to defer investment decision in its Australian project.

The company, on Monday, deferred a final investment decision on its long-delayed Australian Carmichael coal project as Queensland state government is yet to sign off a royalty deal for the mine.

The company had been planning to make a final investment decision (FID) on the 25-million tonne a year coal mine and rail project by the end of May.

Aurobindo Pharma was weak on Tuesday after investors reacted to the developments around the insider trading case with the SEBI.

The market regulator Securities and Exchange Board of India (SEBI) on Monday disposed a case relating to violation of insider trading norms against Sumanth Kumar Reddy Mettu, promoter of Aurobindo Pharma. The case was disposed as the pharma company had already imposed a fine on him and also cautioned him against future defiance. Investors, however, could have reacted negatively just to the case in general rather than reading the fine print of the judgement.

A probe conducted by Sebi found that Mettu had traded for 40,000 share option contract in derivatives of Aurobindo Pharma on May 30, 2013 during trading window closure period just before announcement of quarterly results in violation of insider trading regulations.

So, what is next for the market going forward?

“It's early sign of weakness and we feel a decisive break below 9350 in Nifty will further deteriorate the condition. Stocks were badly hammered today and midcaps & smallcaps are still at risk. Keeping all in mind, we suggest maintaining a cautious view and keeping leveraged positions hedged till market stabilize," Jayant Manglik, President, Retail Distribution, said in a statement.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!