Driven by intense buying, a comeback rally in midcaps, and steady earnings from index majors, the market Friday hit fresh all-time highs. It settled at record closing highs as well. The Sensex clocked 31,000-mark and ended above it for the first time ever, while the Nifty ended a tad lower than the 9600-mark scaled intraday.

The Street had a flat opening with a positive bias. It soon extended the gains to hit a fresh record high of 31,000 on the Sensex. The Nifty clocked the key milestone in the afternoon.

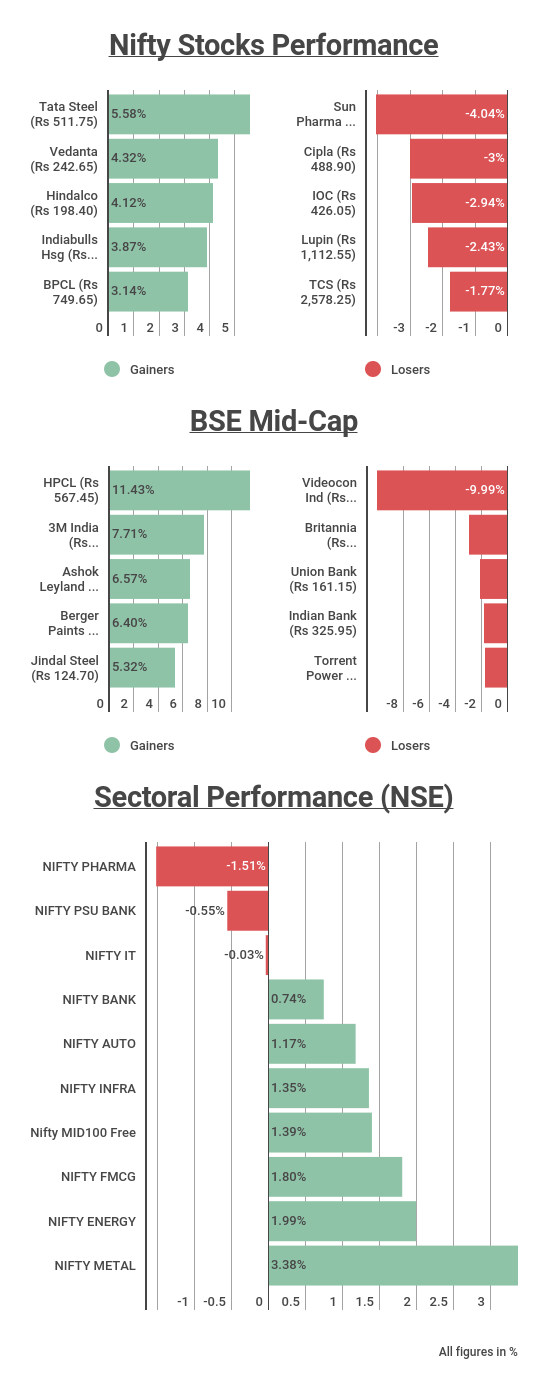

Midcaps continued their positive momentum from Thursday when they returned to action after a corrective phase. The midcap index on the Nifty ended with gains of 1.3 percent. Among other sectors, metals saw a stellar rally on the Nifty index, followed by energy, FMCG as well as auto stocks. However, pharma stocks continued to sulk on the back of poor results as well as weak sectoral outlook given the pricing pressure in the US.

The Sensex ended 278.18 points higher at 31028.21, while the Nifty closed up 85.35 points at 9595.10. The market breadth was healthy as 1,810 shares advanced against a decline of 854 shares, while 182 shares were unchanged.

Marching on for the third straight day, news agency PTI reported that gold prices rose by another Rs 100 to Rs 29,250 per 10 grams at the bullion market in line with a firming trend overseas amid increased buying by local jewellers.

Silver followed suit and recaptured the Rs 40,000-mark by rising Rs 150 to Rs 40,100 per kg following increased offtake by industrial units and coin makers.

"The market touched another milestone supported by continued buying interest on index heavy weights post expiry. Expectation on good monsoon & a slow pace in interest rate hike by FED continue to weigh the sentiment. Mid & small caps outperformed as recent correction scaled down the valuation gap with large caps, this gave an entry point for those who missed the opportunity," Vinod Nair, Head of Research, Geojit Financial Services said in a statement.

Among stocks, the final hours of trading saw a huge upsurge on Hindustan Petroleum Corporation as well as ITC post their Q4 numbers. The companies reported steady set of financials for the March quarter.

Weakening crude prices sent aviation stocks as well as paint stocks soaring as investors cheered the likely cut in input costs and higher profitability potential. Jet Airways, SpiceJet and InterGlobe Aviation, the operator of low cost carrier IndiGo ended between 1 and 3 percent lower. The fall in crude also boosted paint stocks, thereby pushing the like of Asian Paints, Kansai Nerolac, Berger Paints and Shalimar Paints higher by 1-8 percent.

Dish TV saw some buying interest after witnessing a beating down of the stock on Thursday, as the stock ended 7 percent higher. Mastek was locked in upper circuit with gains of 10 percent.

Metals rally boosted relative stocks such as Tata Steel, Hindalco, and BHEL, which were among the top gainers of the session with 4-6 percent increase in prices of stocks.

Reliance Industries too rose around 3 percent during the day’s trade, thereby contributing to the index’s gain on Friday.

Meanwhile, pharmaceutical stocks were the biggest losers of the day, continuing its bearish momentum on the indices. The likes of Cipla, Sun Pharma and Lupin fell the most on indices on the back of earnings trajectory along with poor outlook for US business on the back of pricing pressure. The Nifty pharma index lost over 1.5 percent.

Among other results-oriented stocks included Manappuram Finance and Swelect Energy Systems. The latter was locked in upper circuit for brief period on Friday morning, following good results for the March quarter. The stock soared 20 percent intraday. It resumed trading after a few minutes, only to be locked in the upper circuit again at 9:50 am. The former ended over 2 percent higher following its 50 percent rise in Q4 net profit.

Going forward, the Street would watch out for cues form earnings of index majors such as Sun Pharma, among others. On Monday, the Street would also watch out for the listing of new entrant into the market, PSP Projects.

“To start with, surge in select index heavyweights triggered a firm opening, in continuation to yesterday's rebound, which later gained momentum with buying interest in cash segment. The week ended on a strong note and we feel it'll continue next week as well. Any dip in between should be considered as buying opportunity in index majors,” Jayant Manglik, President, Retail Distribution, Religare Securities said in a statement.

“However, midcap and smallcap counters should be dealt with caution as they may consolidate further prior to any significant rebound,” he added.

( Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!