M SaraswathyMoneycontrol

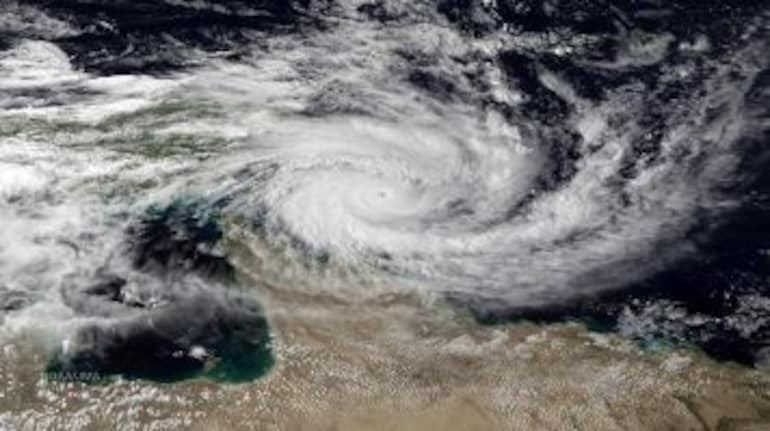

Insurance companies’ books are unlikely to be impacted by the damage caused by Cyclone Vardah that hit Chennai recently. Company officials said that unlike last year’s flash floods that hit Chennai, parts of Tamil Nadu and Puducherry which led to insurance claims touching Rs 5000 crore, this time the claims have not been high. The claims are expected to be under Rs 1000 crore according to initial estimates.The companies that would have financial implications include public sector insurers like New India Assurance, Oriental Insurance, Unitd India Insurance and National Insurance. Private sector insurers like ICICI Lombard would face a small hit.

Sanjay Datta, chief (underwriting and claims), ICICI Lombard General Insurance said that the claims have not been high, both for the public sector as well as the private sector. He added that even they have received only about 400 claims and are processing them.

Public sector general insurers are expected to take a bigger hit than private insurers, as their exposure is higher. However, the claim losses will be much higher. A senior public sector insurance official explained that both motor losses and corporate losses have been significantly lower since the extent of the damage was not high.

Industry officials said that at a time when the ministry is ironing out plans to list the public sector general insurers on the stock exchanges in a year or two, higher incurred claims and underwriting losses increasing could be a hurdle for them to move ahead.

In 2015, the Chennai floods led to claims of Rs 5000 crore with public sector general insurers taking a direct hit on their books in the third quarter, impacting underwriting positions. The incurred claims ratio of public sector non-life insurers rose to 89.02 percent in 2015-16 from 82.09 in 2014-15, according to the Insurance Regulatory and Development Authority of India (IRDAI) Annual Report. This meant that of every Rs 100 premium collected, Rs 89 was paid as claims.

Overall, insurance claims from natural catastrophes have seen a big jump. In the past three years, cyclones including HudHud and Phailin as well as the floods in Uttarakhand have led to insured losses touching almost Rs 15,000 crore.

According to the sigma report by global reinsurer Swiss Re, the total economic losses from natural and man-made disasters in 2016 were at least USD 158 billion (Rs 10.7 lakh crore) all over the world. This is significantly higher than the USD 94 billion (Rs 6.4 lakh crore) losses in 2015 and was caused by large natural catastrophes, such as earthquakes and floods, according to preliminary sigma estimates. Insured losses were also higher in 2016 at around USD 49 billion (Rs 3.3 lakh crore), compared to USD 37 billion (Rs 2.5 lakh crore) in the previous year.

India does not have a natural catastrophe pool to cover losses arising from such incidents. While a proposal was presented to the National Disaster Management Agency (NDMA) a few years, there are differences with respect to the pricing and structure of the pool.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!