Indian Oil Corporation shares surged 8 percent to close at Rs 417.80 on Friday after analysts retained their positive stance, citing better-than-expected refining margin performance.

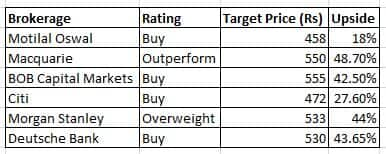

"The earnings should raise investor confidence not only in IOC's delivery but also in the outlook for retail fuel margins, with upside from the global oil glut. This remains our top refinery pick in Asia," Morgan Stanley said while maintaining overweight rating with a price target of Rs 533.

Core EBITDA (earnings before interest, tax, depreciation and amortisation) beat Morgan Stanley's bullish estimate and reported earnings were around 7 percent above its estimate and consensus. Core earnings (ex one-offs) grew 40 percent YoY and 32 percent QoQ as volumes grew and refining and marketing margins expanded.

Marketing margin started to normalise to pre-demonetisation levels as volume growth picked up and competitive intensity in fuel retail eased. Core refining margin in Q1 at USD 7.5 a barrel was around 15 percent above Morgan Stanley's estimate (up 9 percent QoQ), one of the best expansions among emerging market peers.

As IOC ramps up its product mix upgrades and raises flexibility in crude sourcing (via the ramp-up of the Paradip refinery), the research house sees around 10 percent upside to consensus.

It expects an 18 percent earnings CAGR (FY17-FY20). A steady rise in retail marketing margins amid strong demand will be a tailwind for the upside from a golden age of refining, it said.

Deutsche Bank also reiterated its buy rating on the stock premised on increase in refining segment contribution driven by ramp-up at Paradip refinery and improvement in marketing segment contribution led by higher margin and volumes.

Citi, too, maintained buy call on all three oil marketing companies (IOC, HPCL, BPCL).

"The daily pricing of fuels, which started in mid-June, has been progressing well, with QTD (quarter-to-date) margins trending up QoQ (around Rs 0.7-1 per litre; could help offset GST impact). Daily pricing should also help smoothen out inventory movements going forward. In addition, QTD refining trends should also support Q2 performance," it reasoned.

With Singagore gross refining margins trending higher QoQ (USD 7.4 QTD) and higher crude prices, Q2 refining performance should be a lot better, according to the research house.

BOB Capital Markets said IOC remained its best pick among oil marketing companies, valuing it at Rs 555 per share. "We recommended buy as improvement in GRMs and marketing margins are structurally positive," it said.

Motilal Oswal feels IOC is expected to benefit from free cash flow generation over the next 2-3 years. Paradip refinery should help the company in a declining benchmark refining margin scenario, it said.

"Despite its recent run-up, the stock price still is down around 12 percent since the last quarterly result. We value IOC at 5x for refining and 7.5x for marketing to arrive at a fair value of Rs 458 (including investment value of Rs 49 post 20 percent discount), implying 18 percent upside, which appears attractive at current price level of Rs 387," it said while upgrading the stock to buy, purely on the basis of attractive valuation.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!