Nitin AgrawalMoneycontrol Research

The entry of a formidable player like Reliance Jio has turned the Indian telecommunication industry upside down. Jio’s freebies have intensified the price war leading to a steady decline in average revenue per user (ARPU) -- an important metric for telecommunication players.

The intensity of the competition is being felt by the debt-laden incumbents, evident from their latest results compared to last year's. Industry dynamics will change drastically.

What does the latest TRAI data suggest?Recently, TRAI (Telecom Regulatory Authority of India) published financial data pertaining to gross revenues, adjusted gross revenues (AGR) and other parameters for the quarter ended June 2017. The data did not surprise us as it reflected the pain that incumbents have been highlighting.

For the understanding of our readers, AGR is calculated from gross revenues after adjusting for charges paid to other service providers, roaming revenues actually paid to other service providers, and service and sales tax paid to the government. Adjusted gross revenue ARPU is calculated by dividing AGR by the number of users and this is a measure of spending on telecom services per customer.

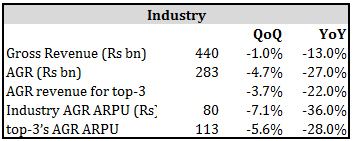

Competition shrinking the overall pieTelecommunication industry witnessed a significant decline of 13 percent (YoY) in gross revenues and 27 percent decline in AGR. The fall indicates that the customers are paying less for the services, primarily led by steep discounts offered by Jio and the response of the incumbents to these offers.

ARPUs decline continuesIndustry AGR ARPU also fell by 36 percent (YoY) and 7 percent (QoQ). It currently stands at Rs 80. A sequential fall in AGR ARPU indicates that the price war is far from over. In fact, we believe that the launch of the JioPhone might hurt incumbents further.

AGR for the top 3 players (Bharti Airtel, Idea and Vodafone) fell by 22 percent (YoY) in the quarter gone by and their ARPU fell by 28 percent (YoY) to Rs113.

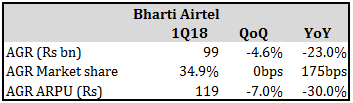

Bharti – performance indicators not lending comfortBharti Airtel’s AGR fell 23 percent (YoY) to Rs 99 billion. However, it could gain 175 bps (YoY) in AGR market share on the back of 300bps market share gains in 900MHz circles. Airtel also witnessed a 30 percent (YoY) fall in its ARPU.

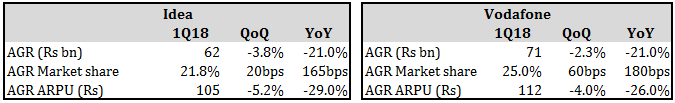

Idea and Vodafone – gaining market share at the cost of profitabilityIdea also witnessed a 21 percent (YoY) fall in its AGR. The fall was lower than Airtel on the back of higher conversion of AGR from gross revenue, perhaps with more calls landing in their own network. Idea’s AGR market share witnessed an uptick of 165bps (YoY). However, ARPU for Idea continued the downward trend with 29 percent (YoY) fall and stood at Rs 105.

Vodafone also posted a similar set of numbers. It witnessed a steep fall of 21 percent (YoY) in its AGR and 26 percent in ARPU. However, Vodafone’s gain of AGR market share was higher than Airtel and Idea. It rose by 180bps (YoY) and 60bps (QoQ) on the back of improved market share in the established circles.

Vodafone and Idea together have close to 46.8 percent AGR market share, much higher than the current leader, Airtel.

Jio- still in redJio’s AGR stood at a negative Rs 10 billion led by payment of Rs 21.5 billion access and other charges. Any decision to lower IUC (Interconnection Usage Charges) – the charges paid to the other networks to complete calls -- would be a big boost to its business. Jio’s AGR market share is also negative and currently stands at a negative 3.7 percent.

Will Jio’s monetisation efforts help the industry?The good news for the industry is that after intensifying the price war by providing freebies, Jio is now moving towards monetising its customer base, which stands at 123 million at the end of June-2017 (up from 108.9 million in March 2017). It is likely to adopt a balanced approach between revenue growth and subscriber additions.

The company has recently outlined new plans wherein it has reduced the validity indicating an uptick in ARPU (average revenue per user). The most prominent plan of Rs399 for 84 days validity translates into an ARPU of close to Rs 124, up from Rs 94 based on the earlier plan (Rs 309 for 84 days).

The price war has already eliminated the marginal players. With the stronger entities left in the fray, the industry can look forward to a relatively more rational competition, although not before a couple of more years of turbulence.

(Disclosure : Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd)

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!