Krishna KarwaMoneycontrol Research

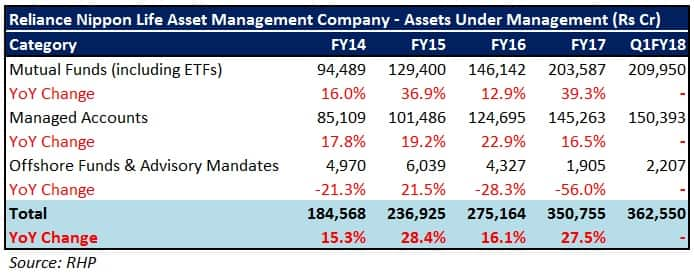

Reliance Nippon Life Asset Management, India's third largest mutual fund company, could be a unique play in a highly under-penetrated mutual fund market. The ratio of India's equity assets under management (AUM) to GDP is only 3 percent as against the global average of 30 percent. Barring the initial expenses, mutual fund/asset management businesses are primarily asset-light in nature with the ability to generate good cash flows over a period of time. Being a highly scalable business, Reliance Nippon, with AUM exceeding Rs 3.5 lakh crore and market share of 11.5 percent, is poised to do well on the back of high margins, strong brand value, and good returns on equity.

About the company

Co-promoted by Reliance Capital and Nippon Life Insurance Company, Reliance Nippon manages mutual funds (including exchange-traded funds), institutional accounts (includes portfolio management services, alternative investment funds, pension funds), and offshore funds. Reliance Growth Fund, its oldest mutual fund scheme (launched in 1995), compounded investors’ money at 24 percent annually. In the mutual fund space, a long track record becomes an advantage in terms of scale and brand equity.

Extensive distribution network, top-ranked player

Reliance Nippon’s pan-India presence spans 171 branches through its 58,000 distributors (comprising independent financial advisors, foreign banks, Indian private and public sector banks, broking companies, national distributors, and digital platforms). What is worth noting is that the company has built a strong portfolio of 1.86 million systematic investment plan (SIP) accounts that generate inflows of close to Rs 510 crore per month or Rs 6,120 crore annually. SIPs account for 10 percent of the company’s equity AUM.

Not just retail, Reliance Nippon plays a pivotal role in the institutional market as well. The company has been entrusted with the responsibility to manage portfolios of regulatory bodies such as Employees Provident Fund Organization, Pension Fund Regulatory and Development Authority, and Coal Mines Provident Fund Organization.

Growth Strategy

The current AUM of all mutual funds in India, amounting to approximately Rs 18 lakh crore, is likely to grow at a compounded annual growth rate (CAGR) of 20 percent (to Rs 45 lakh crore) by the end of FY22, as per an ICRA report. Reliance Nippon is well-positioned to tap the structural expansion of the savings pool in the country.

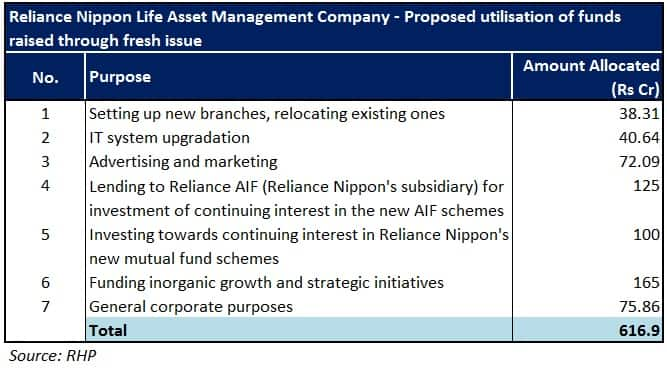

Reliance Nippon’s strategy is to add 150 new branches, mainly in the tier-2 and 3 regions of India by the end of FY21, thereby taking the total count of branches to 321. Furthermore, 54 existing branch offices of the company will also be relocated. To broaden the distributor reach to retail investors across the country, the company aims to tie up with more scheduled public sector banks in due course.

Additionally, Reliance Nippon’s target is to ensure that the contribution of equity and debt funds to the total AUM remains fairly well balanced (more or less 50 percent in each category) over the long term to limit downside risks. Building better visibility internationally (in connection with offshore fund management and advisory mandate domains) and exploring inorganic growth opportunities are some of the other priority areas.

Valuation

At the upper end of the price band (Rs 252 per share), the issue is valued at 5.7 times price to FY18 projected book value. Though Reliance Nippon has no listed peers, given its growth trajectory and consistent return ratios, the valuation looks reasonable. To put things in perspective, over the last four years, the company’s top-line and bottom-line registered an impressive CAGR of 21 percent and 15 percent, respectively.

More importantly, the company sold a small portion of its stake at a relatively higher valuation in the past. In July 2017, a group of US and Singapore funds picked up a 4.43 stake in the company for Rs 675 crore, valuing it at around Rs 15,000 crore or 8 times its FY17 book value.

Key risks

Despite Reliance Nippon’s widespread geographical coverage, its dependence on third-party distribution channels is significant. The competitive intensity in India’s mutual fund space is high, particularly from mutual fund companies of leading banks in the country. Underperformance or non-performance of investment products has a direct bearing on the company’s AUM and revenues.

Compliance measures undertaken to align Reliance Nippon’s investment products with a recently-issued SEBI circular, that restricts mutual fund houses from operating numerous schemes under specific categories, may result in loss of existing business owing to scheme mergers and wind-ups.

For more research articles, visit our Moneycontrol Research Page.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!