Moneycontrol ResearchRuchi Agrawal | Nitin Agrawal

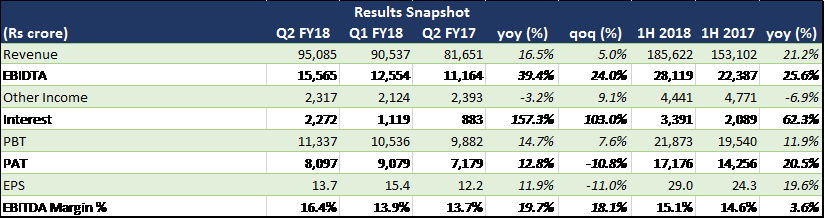

Reliance industries reported an operationally good quarter with mixed surprises. Petrochemical margins surprised positively, but the quarter-on-quarter increase in refining margins was not as big as analysts had expected.

The quarter marked the first standalone reporting for Jio, and the numbers were better-than-expected with both earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation and amortization (EBITDA) being positive.

The operating performance was boosted by internal efficiencies as well as conducive external environment.

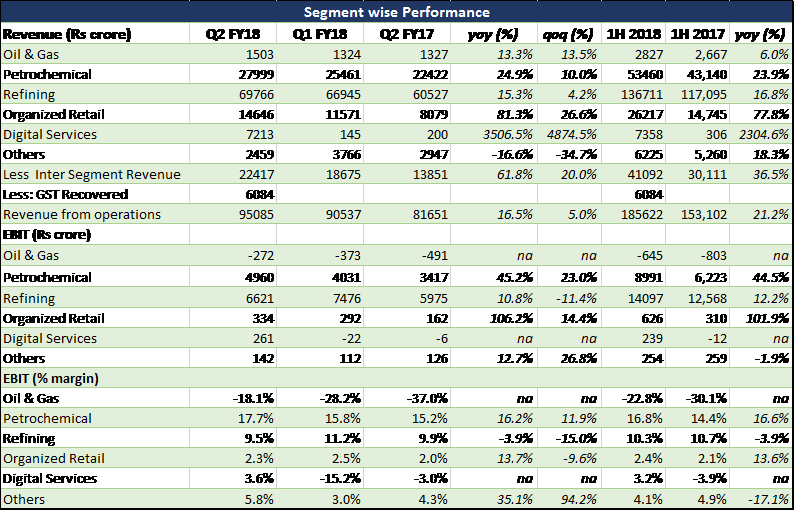

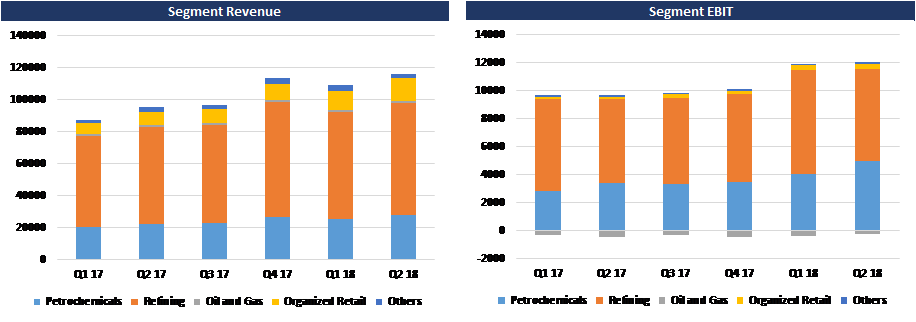

Segment wise performance –

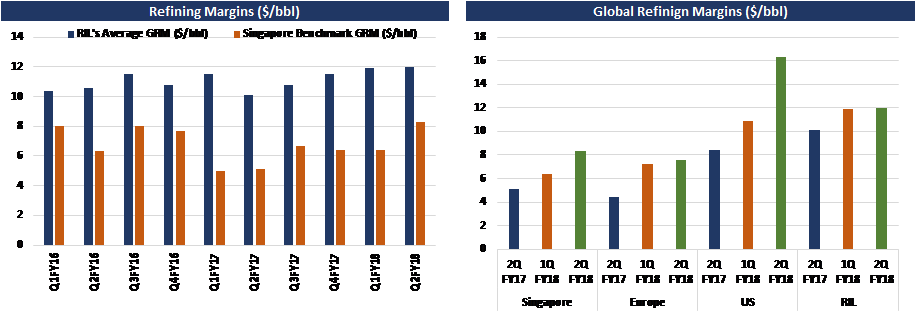

Refining–slight miss on expectation

Refining contributes more than two third of the group’s revenues. Although performance was slightly below expectations, GRM at $12 per barrel (bbl) (Q117: $11.9/bbl, Cons: $12.5/bbl) remained at a nine- year high and almost $3.7/bbl above the Singapore benchmark margins. Revenues and EBIT were up 15.8 percent and 10.8 percent YoY respectively and mostly aided by 1) higher volumes and strong demand 2) wider transportation fuel cracks 3) global supply disruptions on US Gulf coast.

The miss could mostly be attributed to lower refinery utilization on account of capacity additions in China and near flattish performance of export volumes of refined products at 11.2 million metric tonnes (MMT).

The company has also fully resumed operations at 1260 fuel stations across the country which facilitated an increased throughput for diesel and petrol.

Petrochemicals– beating the streets expectation

Petrochemicals has another robust quarter, with EBIT margins swelling to a 10-year high of 17.7 percent, a rise of 190 basis points QoQ and 250 basis points YoY. Domestic production was at 7.5 MMT, up 17 percent YoY.

This was aided by 1) strong volumes and margin expansion across most products 2) uptick in ethylene prices due to higher feedstock prices and tight supply 3) improved product mix 4) healthy domestic polyester demand owing to festive season 5) strong seasonal PET demand from bottlers and low supplies due to global plant shutdowns 6) uptick in prices in polyester chain.

Less erosion in upstream segment

Erosion in the oil exploration and production segment reduced mainly due to Rs 198 crore received for settlement of issues related to Panna Mukta fields. On a comparable basis, the performance continued to be weighed down by lower gas price realizations and declining production volumes from PannaMukta blocks. Also, the CGA production is ramping up and the company expects good returns in the upcoming quarters.

After a Q1 uptick, US shale gas production witnessed a decline during the quarter due to a combination of soft oil and gas prices and lower volumes.

Jio – adding to the muscle

Jio was started as a free service last year and became paid since April this year, after building a huge customer base

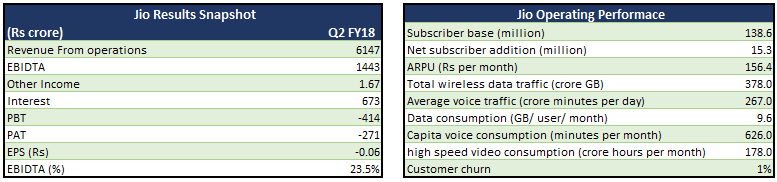

Jio’s operating performance was a surprise, with the company turning EBITDA positive for the September quarter.

Jio reported revenues of Rs 6147.06 crores on a subscriber base of 138.6 million at the end of September. This translates into an average revenue per user (ARPU) of Rs 156.4 per month, which is comparable to other players in the industry.

On the back of pan-India distribution network of over 1 million retailers and wide 4G reach, the company was able to add 15.3 million net subscribers during the quarter. Jio’s VoLTE technology, which provides fast speed data streaming and allows to make calls through data, led to the highest per capita voice consumption at 626 minutes per month and 178 crore hours of high-speed video consumption per month.

Jio’s EBITDA margin stood at 23.5 percent, a commendable feat. The management attributes this performance to use of efficient 4G technology and significant addition of the paying customers during the quarter.

On costs, access charges (net) was the largest component with 34.8 percent of revenues from operations. With TRAI slashing Interconnect Usage Charges (IUC) from 14 paise per min to 6 paise per min effective from October 1, 2017, Jio’s operating margins could improve further because of the cost savings.

Organized retail

The retail business has started to meaningfully contribute towards the consolidated EBIT. Quarterly revenues grew by 81.3 percent YoY and EBITDA grew 68.2 percent YoY. GST-led disruptions notwithstanding, the segment managed strong growth on account of 1) strong retail demand as customers preponed discretionary spend 2) new product launches in reliance fresh and smart segment 3) new store launches across brands.

What next?

The company stands almost at the end of an aggressive capex cycle, and is set to reap the benefits. The net capex stood at 15600 crore which is significantly lower QoQ and expected to shrink further going ahead. Most investment projects have either stabilized (cracker, paraxylene, ethane) or are under the startup phase (gasification). This should lift the return on capital employed in the coming years.

With the resumption of the oil marketing business, we expect greater vertical integration which would bring in better margins and economies of scale in the coming quarters.

We believe that Jio will be able to sustain the current momentum, on the back of innovative strategies, latest 4G technology and huge unmet potential available in India.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!