Diversified conglomerate ITC, which is scheduled to report results for the quarter ended December 31, could see a 7.5 percent rise in net profits to Rs 2,843 crore, compared to Rs 2,646.70 crore reported in the corresponding quarter last fiscal.

Analysts polled by CNBC-TV18 expect some weakness to continue for the salt-to-hotels conglomerate. The sentiment is largely weighed down by regulatory changes, particularly on the GST front, which have hurt cigarette volumes.

More than the results, the Street would be on the watch to see if there is an adverse tax imposition in the Budget to fuel fiscal slippage. The stock has underperformed the benchmark index by a wide margin.

The revenues (excise adjusted) are likely to grow by 9.1 percent on a year-on-year (YoY) basis to Rs 10,086 crore for the quarter ended December, compared to Rs 9,248 crore reported in the corresponding quarter of last fiscal, the poll revealed.

Earnings before interest, tax, depreciation, and amortisation (EBITDA) is likely to rise by 10 percent to Rs 3,900 crore for the quarter ended December, compared to Rs 3,630 crore reported in the year-ago period.

The operating profit margin is likely to contract marginally to 38.7 percent for Q3 compared to 38.3 percent reported in the year-ago period.

Cigarette sales, which account for nearly 50 percent of the revenues for ITC, could fall by 3 percent for the quarter ended December.

Things to Watch:

A) Cigarette Volume Decline Seen at 3% YoY

B) Blended Cigarette Price Increase 14% YoY

C) Cigarette Biz Accounts for 50% of Revenue, 90% EBIT

D) Analysts also expect 12-15 percent growth in FMCG revenue. They also expect 10-12 percent growth in the hotel business as the occupancy trend has improved. The paper business is expected to show 10 percent revenue growth. Investors should watch for margins in agriculture trading business.

Here’s what other brokerage firms are recommending:

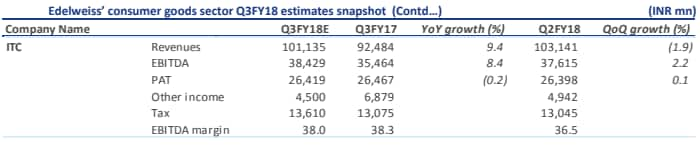

Edelweiss

The domestic brokerage firm expects ITC to post 2 percent decline in its cigarette business on a flat base.

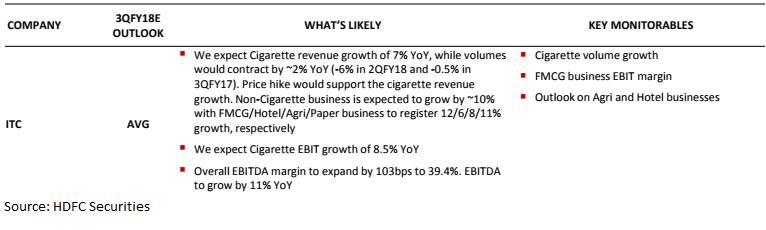

HDFC Securities:

JM Financial

ITC’s cigarette volumes are estimated to decline by 3 percent compared to 6-7 percent decline in the second quarter – a result of the sharp unexpected increase in cigarette taxes post GST rollout.

It expects cigarette EBIT to grow by 4 percent as a result. The FMCG sales expected is to grow 14 percent and remain profitable. The brokerage firm is forecasting 3 percent decline in cigarette volumes on tax-led price hikes. Cigarette EBIT expected is expected to grow by 4 percent.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!