Madhuchanda Dey

Moneycontrol Research

The media has been abuzz with the rumours of IndusInd Bank (IIB) and Bharat Financial Inclusion (BHAF) coming together. This isn’t the first marriage in the space. In the past, IDFC Bank had acquired Tamil Nadu-based Grama Vidiyal Microfinance and Kotak Bank had acquired BSS Microfinance. So there are clearly merits of acquiring a Micro Finance Institution (MFI) for a bank.

IIB already has a Business Correspondent arrangement with Bharat Financial. With a tiny loan book of Rs 3000 crore under MFI (2.9 percent of loan book), the ambition to scale up this high-yielding book is understandable. That the Return on Assets (ROA) on the MFI business is much higher than banking stands to boost the return ratios of the bank. The acquisition gives IIB access to priority sector lending (PSL) assets, and the bank can earn fees by selling PSL Certificates. The access to the largely non-urban pan-India network of 1,252 branches opens up significant cross-selling opportunities. Finally, MFI assets are classified under retail attracting a lower risk weight of 75 percent compared to lending to Non-Banking Finance Companies where the risk weight is 100 percent, thereby boosting the Capital Adequacy Ratio (CAR).

But rarely is a marriage an unmixed blessing. The increase in share of MFI book from 3 percent to 10 percent will change the risk perception of the retail book for IIB as this piece is unsecured lending and the risk of a credit event is much higher. Though Bharat Financial follows a conservative 60-days overdue NPL (Non Performing Loan) recognition norm compared to 90-days overdue for most banks, collection efficiency number remains a key monitorable for the company.

Recently, BHAF intimated the market that its collection efficiency remains significantly below pre-demonetisation levels, especially in the states of Uttar Pradesh and Maharashtra. Recently RBI, in line with Income Tax regulations, has prescribed a limit of Rs 20,000 for loan disbursements or repayments in cash. While this is initially applicable for gold loan disbursement, we reckon that it will eventually apply to all categories of NBFC. So the road ahead has speed breakers for BHAF and scaling up the business without compromising on earnings quality may not be easy.

Hence, a marriage proposal makes immense sense. It reduces political risk, gives its customers access to bank accounts and also reduces the cost of funds. Incidentally, BHAF had earlier applied for a Small Finance Bank licence that didn’t sail through.

Micro finance companies operate with several restrictions – on loan size (less than Rs 60,000 and Rs 30,000 for one-year loan), category of borrowers (family income capped at Rs 100,000 /Rs 160,000 per annum for rural/urban) and indebtedness (less than Rs 100,000 per borrower). Not more than two MFIs can lend to a borrower at a time, the loan processing charge is capped at 1 percent and finally there is a spread cap of 10 percent above the cost of borrowings. The operational flexibility post conversion to bank along with the reduction in excess liquidity (which is required in day-to-day operations and for first loss margins for off balance sheet), should give a boost to margins.

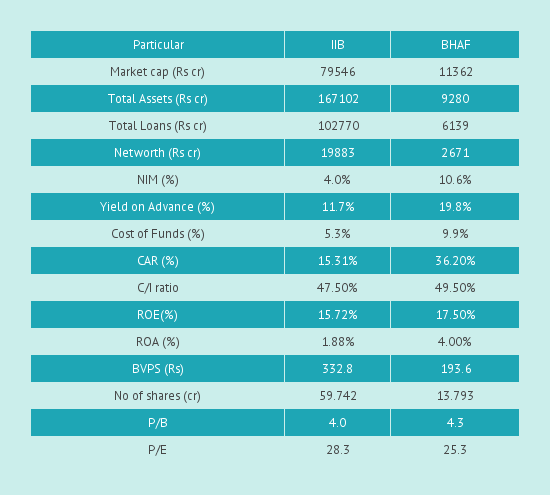

For the deal to be value-accretive and ‘win-win’, the pricing has got to be right. Our analysis suggests that at today’s closing price, the deal value works out to 4.3X trailing book of BHAF resulting in an equity dilution of 12.5%. If the rumoured swap ratio (7 shares of IIB for 10 shares of BHAF) holds, then the deal is at 13.6 percent premium to the current price, valuing BHAF at 4.8x trailing book and equity dilution of 13.9 percent for IIB shareholders. Even at this premium, the deal will be earnings neutral for IIB from the current year, and earnings accretive from FY18, if the aforesaid synergy benefits play out. While IIB gets a profitable portfolio through the deal, given the need for MFIs to come under a bigger/stable banking umbrella, shareholders of IIB should be in the drivers’ seat.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!