Indian banks need to provide a bare minimum Rs 18,000 crore additionally towards the 12 accounts identified by the Reserve Bank of India (RBI) for reference to the National Company Law Tribunal under the Insolvency and Bankruptcy Code in FY18, estimates India Ratings and Research (Ind-Ra).

Ind-Ra's analysis pegs the weighted average provisioning currently at 42 percent by banks towards the 12 identified accounts. Ind-Ra forecasts the additional provisioning to eat into banks’ profits by around 25 percent in FY18. This indicates a shave-off in return on assets of 12bp in FY18.

The agency notes that the new minimum required provisioning stands at 50 percent towards each of the 12 identified accounts, which indicates that banks with average provisioning of 50 percent on these accounts may also need to provide additional provisions to reach 50 percent towards each of the 12 accounts.

Ind-Ra believes that the additional provision burden could add disproportionate pressure on the profit and loss accounts (P&L) of a few mid-size public sector banks (PSBs) and hence the agency’s outlook towards these banks remains negative.

The agency also notes that the additional provision requirement may stretch the profitability of a few large PSBs in FY18, putting the standalone ratings of these entities under pressure.

Ind-Ra continues to maintain there is an increasing divide between the large and smaller PSBs, with the former having some access to growth capital, better market valuation, and also some non-core assets to divest while the latter would only receive bailout capital if required and would need to ration their capital consumption over next two years.

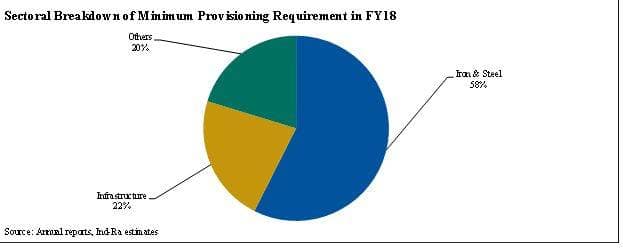

The 12 accounts are broadly classified across five sectors, which have been further reclassified as iron and steel, infrastructure and others in Ind-Ra's study.

The weighted average provisioning of 45 percent (as of March 2017) towards the iron and steel sector exposure continues to be the highest across all sectors, given the deep entrenchment of stress in the sector, low capacity utilisation, and high expected ultimate haircuts.

The weighted average provisioning as of March 2017 for the infrastructure sector exposure is 36 percent. Ind-Ra highlights much of the unrecognised stress forms a part of the infrastructure sector where a going concern approach towards resolution could fetch a more favourable value in comparison to a liquidation approach given the nature of the assets in the sector and the fact that many of the projects in the sector are under stress on account of cash flow mismatches and project overruns.

Out of the total Rs18000 crore required provisioning, the iron and steel sector contributes around Rs10,500 crores and the infrastructure sector Rs4100 crores.

The iron & steel sector had faced severe stress at the time of the ‘Asset Quality Review’ exercise conducted by the RBI last fiscal.

India Ratings highlighted in the report ‘FY18 Bank Outlook: Long Tail of Credit Costs to Subdue Profitability Despite Plateauing Stressed Assets’ that impaired assets will peak at 12.5 percent-13 percent by FY18/FY19.

Credit costs, however, will show an extended recovery period (FY18F:185bp; FY16:230bp), as a large proportion of recently acquired higher–bucket NPLs keep aging.

This would keep the return on assets for PSBs and private banks at around 20bp below their respective long-term medians. Factoring this in Ind-Ra expects banks to require INR 91,000 crore in the tier-1 capital till March 2019 to grow at a bare minimum pace of 8-9 percent CAGR.

This includes the INR 20,000 crore of residual tranches from the government of India’s Indradhanush programme.

The banks have been given six months to finalise the resolution plans for other non-performing accounts that do not currently qualify under this criterion, close to around 500 accounts.

If no resolution plan emerges in that period then banks will have to begin insolvency proceedings on these accounts too said RBI, which Ind-Ra believes will translate into more resolutions in FY19.

Ind-Ra believes the fear of insolvency will force all stakeholders to seek remedial measures and resolve stress swiftly, which will be positive, in the event it occurs.

The fear of liquidation or winding up could have a positive impact as stakeholders would be willing to arrive at the common ground to escape liquidation, nevertheless, haircuts especially towards the larger exposures are inevitable.

Also watch accompanying video of Prakash Agarwal, Director of Financial Institutions at India Ratings & Research for more details.

Discover the latest business news, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!