After weeks of speculation, Google officially announced its UPI-based payments app called Tez (read fast) at an event in New Delhi on Monday. With this tailor-made app for India, the tech giant aims to capitalise on the ever-expanding digital payments and commerce market in the country.

At the event, Caeser Sengupta, Google vice-president for its Next Billion Users project, revealed that Tez will work with all banks that support the Unified Payments Interface (UPI), which is backed by the National Payments Corporation of India (NPCI), and will aim to connect the maximum number of users. It is also the first standalone app to integrate multiple payment platforms, he said.

“We are deeply committed to bringing the best of Google’s technologies to Indian users, and Tez takes that to the next level,” Sengupta said.

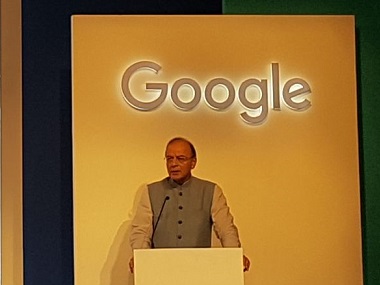

The event was also attended by Union finance minister Arun Jaitley, who highlighted the need for simpler monetary platforms and the need for a shift from a cash-heavy economy . He said that post-demonetisation, the country had seen a shift towards digital payments but only out of compulsion.

“Though 8 November came as a shock to the economy, it was something that was only waiting to happen. There is still a lack of understanding around the idea of going cashless but in my understanding it is only natural and necessary for an economy to grow. It is time that we embrace digitisation not out of compulsion but out of choice. Google, via Tez, is a step in that direction,”

He said that the need for finding alternatives to a high-cash economy had never been raised as an issue in India. “It was never debated seriously in Parliament or in political circles. Prior to demonetisation, we were all in a habit of living in a high-cash economy and were all bearing the cost for it,”

“Low tax-GDP ratio, two sets of accounts in businesses, Illegal tax practices… are all by-products of a cash-heavy economy. With a shift towards a cashless economy, we can squeeze the volume of currency printed, expand assesses in terms of indirect and direct tax and benefit in the short as well as long run,” Jaitley said.

The app is available on the Play Store as well as the Apple App Store . Here is all you need to know about its functionality and a guide on how to use it.

Focus on inclusivity

While an attempt to make inroads into the Indian e-payments market some 10 months after demonetisation might seem a bit too late – especially with e-wallet apps like Paytm and MobiKwik and an array of UPI-based apps like Bhim already going strong – Google is looking to capture the lion’s share with Tez.

In order to expand the app’s digital footprint, Tez has been armed with certain features and technologies to make it more user-friendly and hardware compatible.

The app has dropped NFC (near field communication) for interacting with other devices and has gone with a new, more-accessible technology called audio QR, that allows users to transfer money using ultrasonic sound signatures between two devices.

Since all smartphones possess a speaker and a microphone, the app is compatible with almost all devices and can effectively enable it to capture a much bigger market. Users can transfer cash directly to nearby devices (cash mode) via these sound signatures without sharing any financial or contact information between the payer and the payee.

The inclusivity has been extended on the software front as well, with retrospective support for devices running Android KitKat and iPhone-support down till the 4S model.

Considering that of the close to 300 million smartphone users in India, hardly 14 percent have NFC-capabilities the move is bound to increase users with entry-level and mid-tier devices.

Tez offers language support for English, Hindi, Bengali, Gujarati, Kannada, Marathi, Tamil, and Telugu, which will help further its footprint in regional markets as well.

Playing catch-up to PayTM, Bhim?

While it is clear that Tez will have to vie for market space currently occupied by PayTM, Bhim and other bank-operated UPI apps, Sengupta seems to suggest otherwise.

“Our primary competitor is cash. There is a lot of room for new players and there is no contest with Bhim, PayTM or other such apps. There is enough room for everyone to innovate and because UPI is an open standard, the entire system will only become better with more players,” he said.

In order to accelerate its reach, Tez has also incentivized the payments process by awarding scratch-cards to users for all transactions above Rs 50. The app also plans to have a weekly lucky-draw of Rs one lakh.

This approach is in stark contrast to Google’s philosophy and betrays the tech giant’s desire to capitalise on a ripe market for mobile payment services that comprises a rapidly expanding middle class with high disposable income.

An eye on the future

The app has been launched with support for three major partner banks – Axis, HDFC and ICICI – with SBI to join the ranks soon. It will eventually allow users to transact with close to 55 UPI-enabled banks in across India.

Diana Layfield, vice-president, product management, said that the app will add support for multiple merchants and e-wallet platforms in the near future as well as the ability to link credit and debit cards.

She said that the India-centric app is likely to be replicated in other growing Asian markets as well.

Concerns over data privacy

While the app promises to be the final answer to unified digital payments in India, many are concerned over the outflow of financial information of Indian users onto Google cloud (which doesn’t necessarily have localised servers).

Responding to such a question at the event, Sengupta took a rather diplomatic route by saying, “Tez adheres to all rules and regulations of NPCI”, and refused to rule out the outflow of data.

On being asked about data collection as part of the terms to use the app, he said that “Google allows users to delete this data at anytime, however it is collected to improve the app’s functionality.”

)

)

)

)

)

)

)

)

)