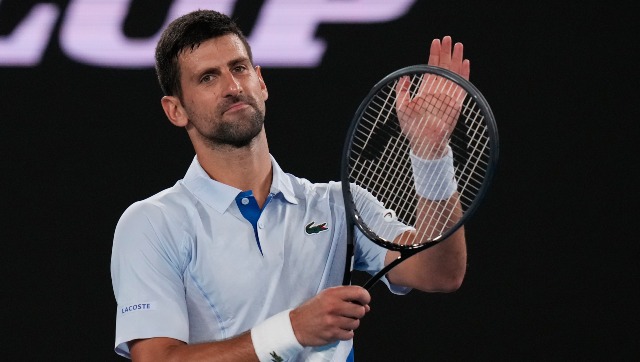

Boris Becker the German tennis sensation of yesteryears and more recently known for being the coach of the current sensation Novak Djokovic has been declared a bankrupt by a London court. His lawyer tried his best to avoid this stigma but the court was in no mood to relent. The lady judge observed Boris Becker had buried his head in the sand. She was not impressed by the impassioned plea that while bankruptcy normally shakes off pestering creditors from the heels of the beleaguered debtors, in Boris Becker’s case it would be a huge stigma and not a boon.

Why do we in India not get to witness an event such as the one witnessed in London despite India being home to huge loan defaults? In India too the rich borrowers not only bury their heads in the sand ostrich like but also take cynical comfort from the fact that they are insulated from bankruptcy proceedings thanks to the veil of incorporation.

Vijay Mallya the quintessential fugitive bank loan defaulter was till recently strutting about the social and corporate corridors with singular nonchalance bordering on the arrogance. When accosted by intrepid journalists for defaulting on loan repayments even while leading an unabashedly lavish lifestyle bordering on the scandalous, he would quip that his companies are providing him those creature comforts.

For too long have borrowers been allowed to take shelter behind the fig leaf of incorporation. The saga of Indian loan default is the saga of investigators’ inability to tell between genuine business failure and diversion of funds by the self-indulgent promoters. Corporate debt restructuring (CDR) and strategic debt restructuring (SDR) are all at the end of the day euphemisms for indulgence of the defaulters. At least that is how the man on the streets perceives the issue because the home loan company he has borrowed from is quick to seize his mortgage property the moment he defaults on a couple of EMIs. His fault is he is not insulated by incorporation.

Indeed bulk of the outstandings to the banking system in India is by Indian corporates who see in incorporation the Godsend opportunity to siphon of funds through several labyrinthine webs of companies. The liberal regime obtaining for inter-corporate loan is conducive to this loot and smoothens and lubricates the illicit passage of funds.

The Modi government would do well to address this issue squarely. It has satisfactorily addressed the issue of benami holdings which the previous governments were guilty of dithering on since 1988. The results have started showing with the first big test case—Lalu Prasad Yadav’s famed fodder scam misdemeanors hiding behind benamis now coming out in the open thanks to the relentless scrutiny of the income-tax department armed with new-fangled powers. It should now address the other issue—-hiding behind incorporation.

Indeed benami was not the only latitude crooks enjoyed as is commonly believed. Hiding behind incorporation has always been an equally fecund escape route. Courts in this country have pierced the veil of incorporation in tax evasion cases as well as in larger public interest like it happened with the famous Skipper Construction case where the Supreme Court intervened decisively to cast as under the veil of incorporation to retrieve money for the harried buyers of property in Delhi.

But far from blocking this escape route completely, the previous governments as well as the one in saddle are guilty of extending this escape route through Limited Liability Partnerships (LLPs) and the rather oxymoronic One-Person-Companies (OPC). It is time promoters and partners were told in unmistakable terms that they cannot hide behind incorporation.

Had Boris Becker borrowed from Indian system, he would have most certainly done so through the conduit of a private company and thus escaped the stigma of being bankrupt.

)

)

)

)

)

)

)

)

)