Avoid taking home loan for interest benefit : It has been an established trend among high net worth individuals (HNIs) to avail of a home loan to invest in real estate rather than using this for taking advantage of the available tax breaks. One, they could reserve their own funds for more liquid asset classes rather than high-value real estate which cannot be easily liquidated and two, they could claim the deduction on the entire interest paid to the bank against rental income generated from the property.

However, with the recent amendment in Budget 2017, a person can claim a total loss limited to Rs 2 lakh on house property, with respect to the interest he pays on home loan. The balance loss, if any will be carried forward and claimed as expenditure in subsequent eight years. As the interest deduction has been limited to Rs 2 lakh, HNIs should avoid taking a home loan and cut down the interest outflow if it was being done purely for the tax saving purpose.

Go for separate legal entities : HNIs can also form separate legal entities to park their investments and generate income therein. The simplest form of entity which is the Hindu Undivided Family and they claim the benefit as per the usual tax slabs and chapter VI deductions. Large-ticket size investments can be routed through a private investment trust. The advantage of forming an investment trust is that it is managed by professionals, you get a diversified portfolio, no disputes at the time of distribution/inheritance, assets are safeguarded against personal liabilities and no personal onus of tax liability on income generated.

Park funds in tax-free investments : Indian households still love to invest in term deposits, which are principally safe options. However, income generated in form of interest on time deposits is taxable. With interest rates falling, these investments do not generate high returns and also gets taxed at maximum rate in hands of HNIs. Rather than investing in these instruments, it is advisable to invest in tax-free bonds such as the ones issued by Hudco, NHAI, Ireda, etc, where the principal is protected, while interest earned is not taxable. The income after tax will also be greater than what one earns from a term deposit.

Saving tax on long-term capital gains : Generally, people assume that the exemption on long-term capital gain is available on sale proceeds of residential property. However, this exemption is also available on other asset classes such as gold, shares of unlisted companies, unit of AIFs, commercial properties, etc. HNIs tend to have huge holdings in these asset classes and the sale proceeds can be invested in house property or specified bonds, thereby saving tax at the rate of 20% on the capital gains earned.

Check tax outflow to avoid interest burden : Most HNIs and ultra HNIs have incomes exceeding Rs 1 crore and hence are liable to pay a surcharge of 15% on their tax liability. While paying advance tax during the year, individuals usually forget to pay this surcharge and hence end up paying a simple interest of 1% per month on the quarterly shortfall. Similarly, HNIs having income more than Rs 50 lakh but not exceeding Rs 1 crore also need to pay surcharge of 10%. There is also an additional 1% simple interest per month if the person fails to pay 90% of his tax liability in the form of advance tax. The lesson therefore is to consider the surcharge while paying advance tax so as to avoid the interest penalty.

Avoid short term trading and F&O transactions : HNIs tend to cash in on stock market rallies do short-term trading, or deal with Futures and Options (F&O). Short-term equity trading is chargeable to tax at the rate of 15%, but F&O transactions are chargeable under business gains and are liable for tax at the maximum rate of 30%. Moreover, if the margin on transaction exceeds Rs 1 crore during the year, the person is liable to maintain books of accounts and carry out audit of the same before filing his income tax returns.

Avail full deductions benefits : For HNIs, deductions under section 80C only lead to a nominal reduction in tax liability. However, there are other sections which the HNIs need to look at – Mediclaim, education loan, National Pension Scheme.

STAY INFORMED

- Invest in tax-free bonds such like those issued by Hudco, NHAI, Ireda

- Consider the surcharge while paying advance tax to avoid interest penalty

- Avoid short-term trading and Futures and Options transactions

- Avail tax-deduction benefits to the fullest like mediclaim, pension, etc

The writer is CEO, Karvy Private Wealth

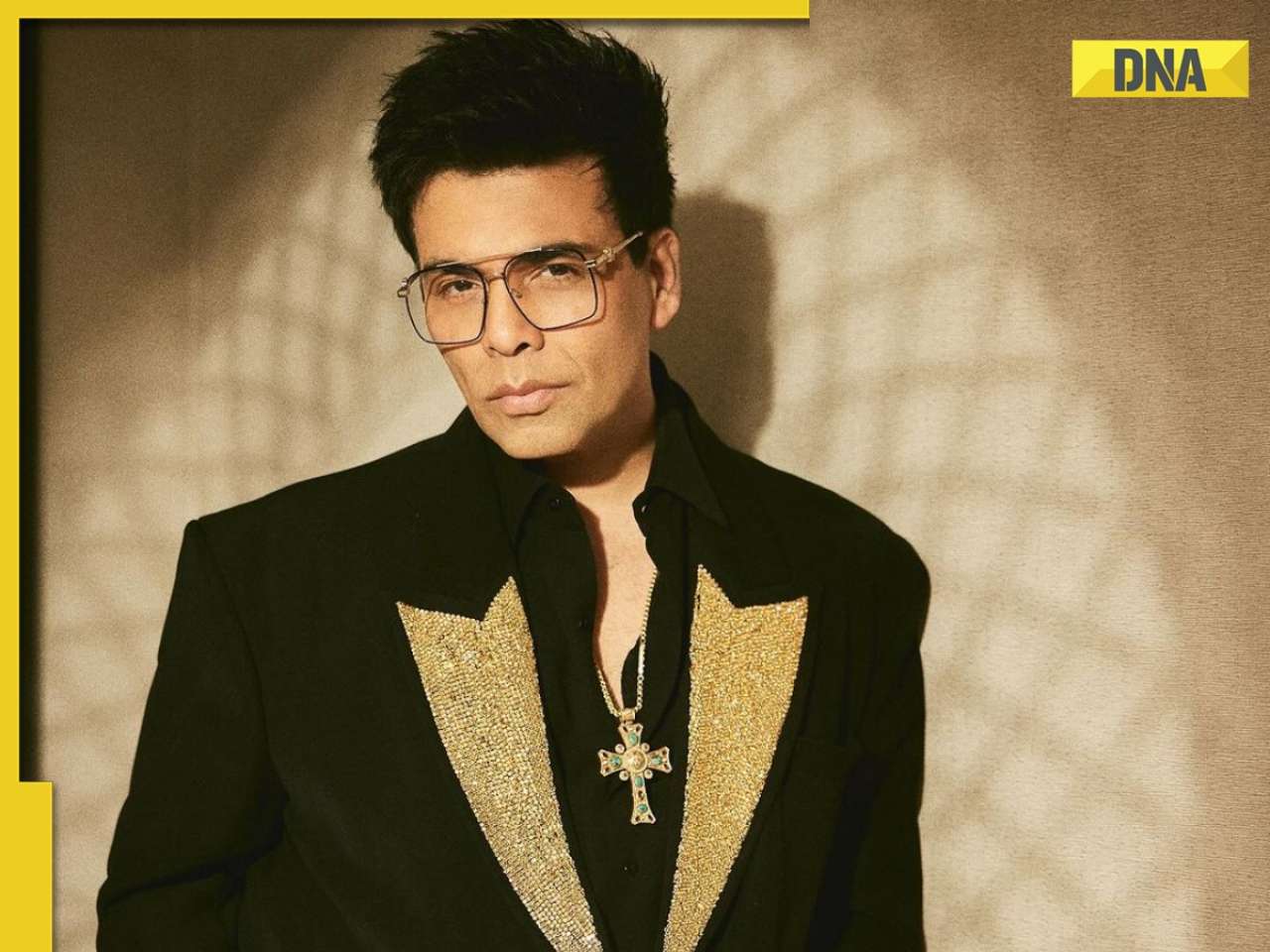

![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() Indian government issues warning for Google users, sensitive information can be leaked if…

Indian government issues warning for Google users, sensitive information can be leaked if…![submenu-img]() Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report

Prajwal Revanna Sex Scandal Case: Several women left home amid fear after clips surfaced, claims report![submenu-img]() Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…

Meet man who studied at IIT, IIM, started his own company, now serving 20-year jail term for…![submenu-img]() Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…

Gautam Adani’s project likely to get Rs 170000000000 push from SBI, making India’s largest…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

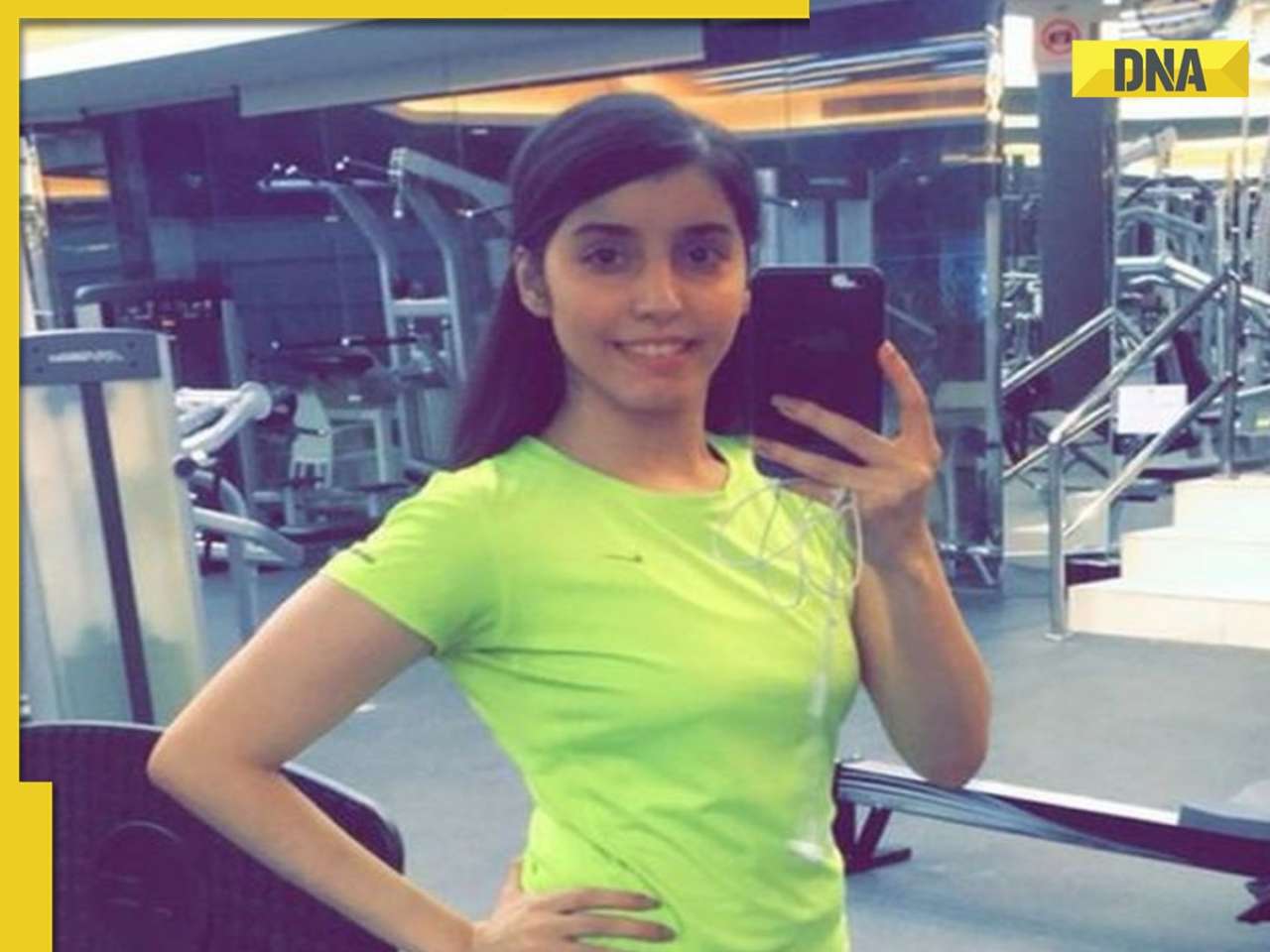

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar

Meet India's highest paid director, charges 30 times more than his stars; not Hirani, Rohit Shetty, Atlee, Karan Johar![submenu-img]() This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...

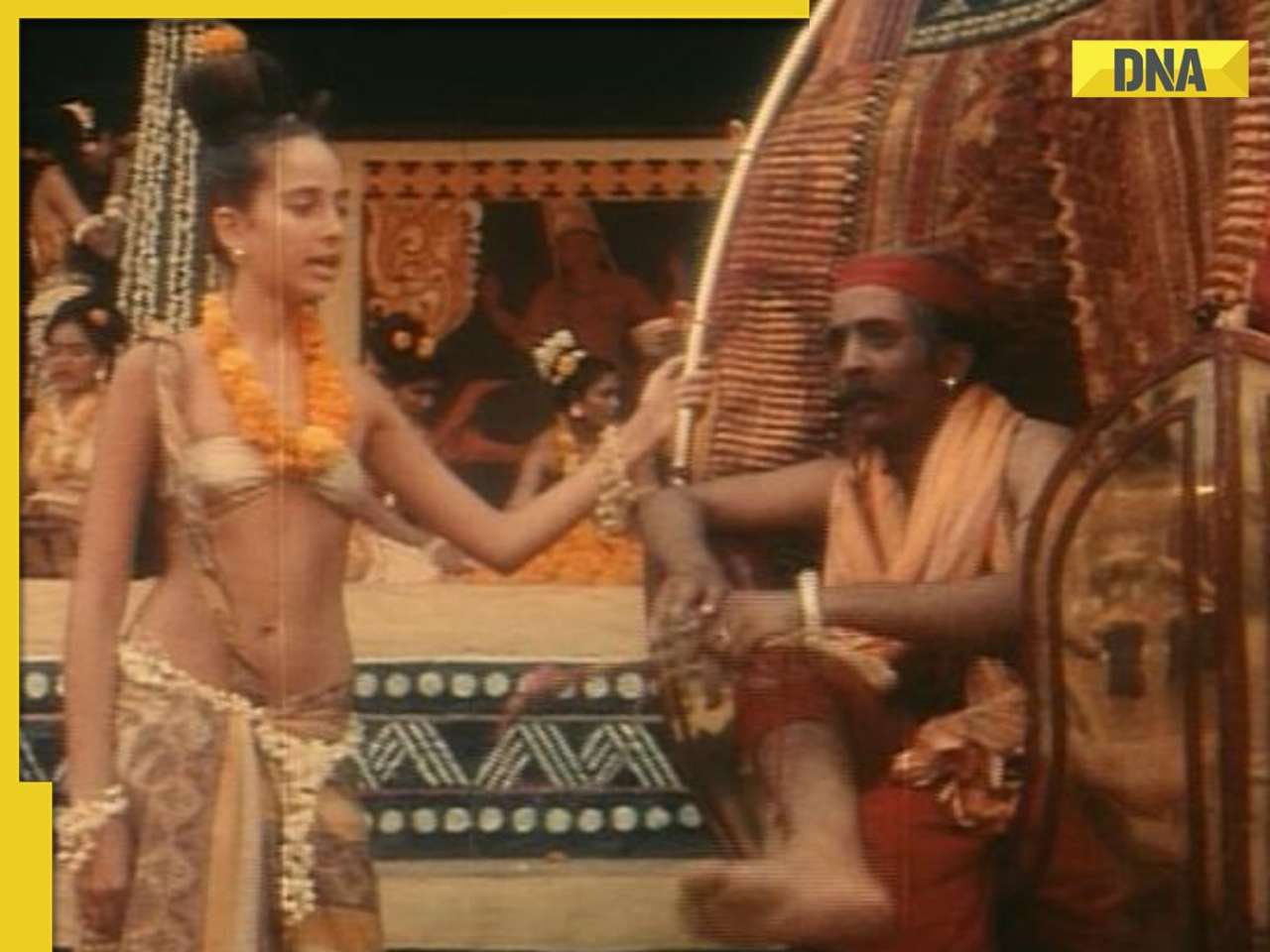

This superstar worked as clerk, was banned from wearing black, received death threats; later became India's most...![submenu-img]() Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'

Karan Johar slams comic for mocking him, bashes reality show for 'disrespecting' him: 'When your own industry...'![submenu-img]() Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...

Kapoor family's forgotten hero, highest paid actor, gave more hits than Raj Kapoor, Ranbir, never called star because...![submenu-img]() Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...

Meet actress who lost stardom after getting pregnant at 15, husband cheated on her, she sold candles for living, now...![submenu-img]() IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants

IPL 2024: Kolkata Knight Riders take top spot after 98 runs win over Lucknow Super Giants![submenu-img]() ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....

ICC Women’s T20 World Cup 2024 schedule announced; India to face Pakistan on....![submenu-img]() IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs

IPL 2024: Bowlers dominate as CSK beat PBKS by 28 runs![submenu-img]() IPL 2024: Big blow to CSK as star pacer returns home due to...

IPL 2024: Big blow to CSK as star pacer returns home due to...![submenu-img]() SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next

Job applicant offers to pay Rs 40000 to Bengaluru startup founder, here's what happened next![submenu-img]() Viral video: Family fearlessly conducts puja with live black cobra, internet reacts

Viral video: Family fearlessly conducts puja with live black cobra, internet reacts![submenu-img]() Woman demands Rs 50 lakh after receiving chicken instead of paneer

Woman demands Rs 50 lakh after receiving chicken instead of paneer![submenu-img]() Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?

Who is Manahel al-Otaibi, Saudi women's rights activist jailed for 11 years over clothing choices?![submenu-img]() In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

In candid rapid fire, Rahul Gandhi reveals why white T-shirts are his signature attire, watch

)

)

)

)

)

)

)