Reliance Communications and Aircel announced plans to merge their operations to create what will be the third largest telecom company in the country on the basis of subscriber base.

Reliance Communications and Maxis Aircel announced plans to merge their operations into a single merged entity which will create the third largest telecom company on the basis of a subscriber base. While the deal promises to ruffle up the domestic telecom sector even further, with intense competition already a part of the mix with Reliance Jio's entry, brokerages hold different views about what this merger would possibly mean for the sector.

Anil Ambani-led RCom and Maxis Communication Berhard's Aircel will entry into a 50-50 deal and create a new entity with a new name and image. The merged entity will have equal representation on the board from both the companies.

India Ratings and Research, in a report, said that "The merger of the wireless business of Reliance Communications (RCom) with Aircel Limited (Aircel), is a key milestone in the ongoing consolidation in the telecom sector. the merger will enable the new entity RCom-Aircel to give strong competition to its peers in the backdrop of the disruption that the launch of operations by Reliance Jio Infocomm (RJio) has caused."

Fitch Ratings, in a report said that the sector should continue to consolidate. It said that about five to six players could emerge from the shake out. "Unprofitable telcos, such as Telenor and Tata, could exit, given that their businesses will struggle to compete and they are now able to monetise their most valuable assets — their under-utilised spectrum," the research report said.

Telecom Spectrum

The deal will give the RCom - Aircel combined entity to have an edge in terms of spectrum too, especially the 4G spectrum, Ind-Ra said. "This deal provides RCom access to the superior 800MHz band in eight circles with extended validity till 2033, as its own spectrum is scheduled to expire in 2021-2022. The merged entity will have 448MHz spectrum, which is about 17% of the total spectrum held,is the third largest spectrum holding, following 770MHz of Bharti and 596MHz of RJio," the report said.

ICICI Securities also said that the RCom - Aircel merger will increase the residual licence period of RCom's 1,800 MHz airwaves by six years.

Telecom Circles

If the merger goes through successfully, the merged entity will have access to Aircel's top five circles -- Assam, UP East, Bihar, Jammu & Kashmir and Gujarat. RCom's top circles are Bihar, Tamil Nadu and Chennai.

"The merged entity will be positioned as the second largest in the Bihar circle, after Bharti Airtel, and overtaking Vodafone and Idea, which were number two and number three, respectively.

"In the Tamil Nadu and Chennai circle, the merged entity will vie for the second spot with Vodafone, which is ranked the second largest after Bharti, the Ind-Ra report said.

Market share

RCom has a wireless active subscriber base of 92.2 million as on March 2016 (market share 9.8%), whereas Aircel has 63.3 million subscribers (market share 6.8%), leading to a combined subscriber market share of 16.1% with 155.5 million subscribers; which will rank fourth after Idea with 19.6% subscriber share and Vodafone with 20.4% subscriber market share as of March 31, 2016. The merged entity could potentially have a revenue market share of 14%, given RCom’s existing revenue market share at around 11% in FY16 and Aircel’s 3% revenue market share, the report said.

Source: India Ratings & Research

Debt

While the merger is likely to prune Reliance Communications' debt by Rs 20,000 crore and Aircel's debt by Rs 4,000 crore, RCom has said that the new entity will have a total debt of Rs 35,000 crore, including Rs 7,000 crore in the form of deferred spectrum payment liabilities, a LiveMint report said.

"This is clearly a negative surprise, as the combined entity may end up with a net debt/Ebitda (earnings before interest, taxes, depreciation, and amortization) ratio of around five times even under a best-case scenario. This includes rosy assumptions that revenues remain at current levels and that the combined entity’s margins settle around 30%. This is despite falling tariffs and notwithstanding the fact that the separation of the wireless and tower operations will result in a huge additional cost overhead in the form of tower rentals," the report quoted a an unnamed brokerage firm.

According to an Economic Times report, the debt will need about Rs 3,500 crore of free cash to service, even though RCom said that the loans were taken at below 7% interest.

"This is a highly leveraged entity with little of no scope for capex at a time all operators are reinventing, an MNC brokerage was quoted as saying by ET.

Wireless business

RCom has also announced the transfer of its wireless business undertaking of its subsidiary Reliance Telecom (RTL) to Aircel and its "Consolidation of the wireless telecom business of the company and RTL with AL (Aircel) and DWL (Dishnet Wireless-Aircel) provides an opportunity to the company to acquire equity interest in AL," RCom cited as one of the reasons for transferring RTL business to Aircel subsidiaries.

IDFC analysts said in an ET report, that "managing a three-way merger" along with RCom's global and other wireless operations would be a complex affair, which could be further shackled by the "ongoing CBI probe on the Aircel-Maxis deal".

The Aircel-Maxis case

Then there's the ongoing Aircel - Maxis case pertaining to unfair 2G spectrum auction, where Maxis owners have currently denied any wrongdoing and the Central Bureau of Investigation's (CBI) investigation about the sale of Aircel founder C Sivasankaran's stake to Maxis.

Review for downgrade

Following the merger announcement Moody's Analytics put Reliance Communications' credit rating on a "review for downgrade".

"While we view the combination of the wireless businesses positively, we will also need to re-evaluate the credit profile of RCom in conjunction with the proposed organisational and financial restructuring, as the remaining business will be smaller in scale with - in our view - a weaker business risk profile," Moody's Investors Service VP and Senior Credit Officer Annalisa Di Chiara said.

Thereby, Moody's has placed Reliance Communications Ltd's Ba3 corporate family rating and senior secured rating under "review for downgrade", it said in a statement.

A day after the news, Reliance Communications opened slightly up but trimmed the gains quickly and was trading under the red line, along with the broader 30-share BSE Sensex. At the time of publishing, RCom's shares were down 0.30% at Rs 49.65 apiece, while the BSE Sensex was trading up 1.03% at Rs 293.65 a share.

![submenu-img]() 'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency

'They unilaterally took some measures': EAM Jaishankar on new Nepal 100 rupee currency![submenu-img]() Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…

Meet Ice Cream Lady of India, who built Rs 6000 crore company, started with small investment of Rs…![submenu-img]() ‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder

‘Canada a rule-of-law country’: PM Trudeau after 3 Indian arrested over Hardeep Nijjar's murder![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding

In pics: Arti Singh stuns in red lehenga as she ties the knot with beau Dipak Chauhan in dreamy wedding![submenu-img]() Actors who died due to cosmetic surgeries

Actors who died due to cosmetic surgeries![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() 'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set

'Baap re baap': Imtiaz Ali reveals Diljit Dosanjh was scandalised by old women's 'vulgar' improvisation on Chamkila set![submenu-img]() This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..

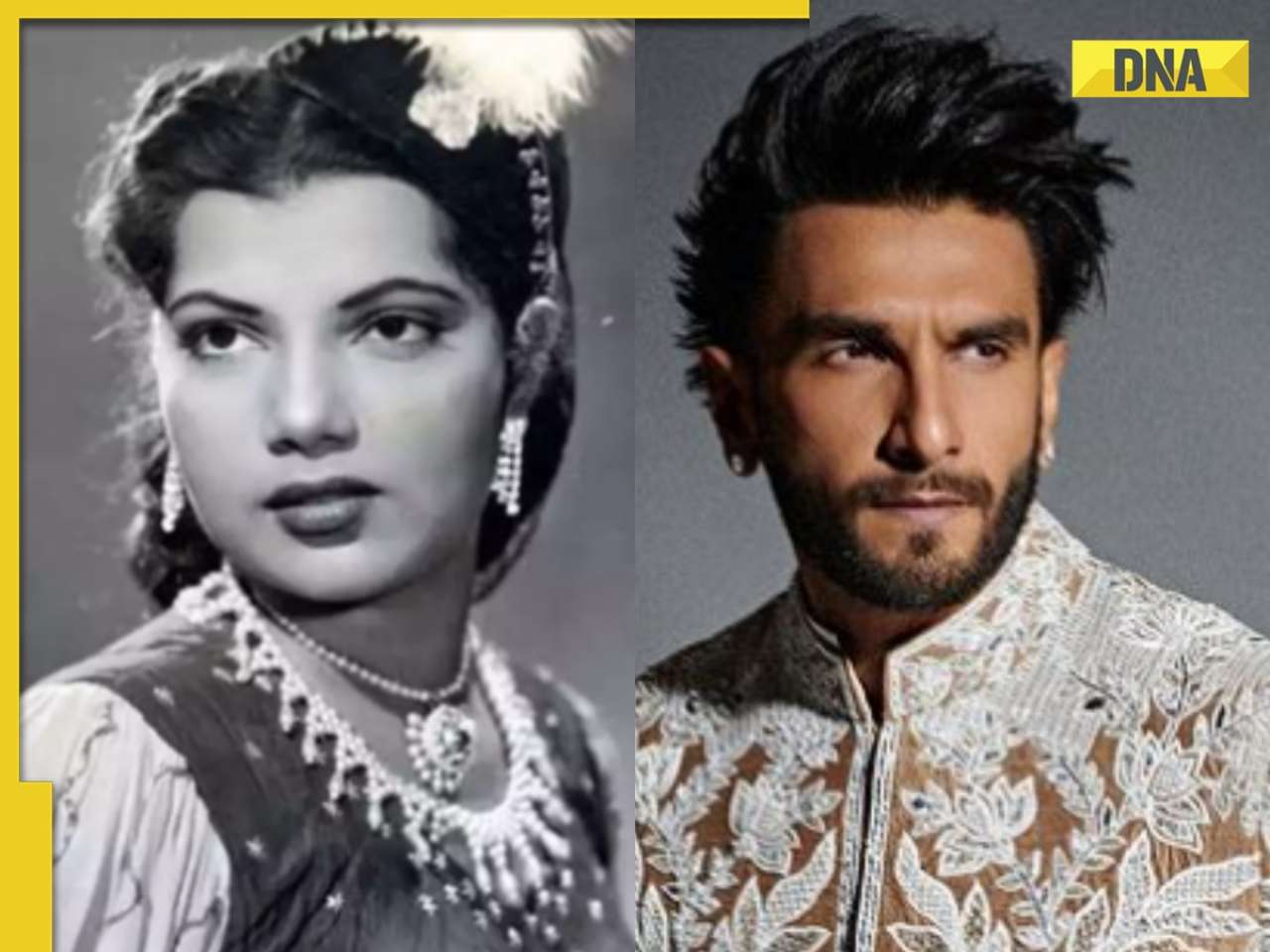

This actor, who worked with Karan Johar and Farhan Akhtar, gave superhit shows, saw failed marriage, killed himself at..![submenu-img]() Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...

Did you know Ranveer Singh's grandmother was popular actress? Worked with Raj Kapoor; her career affected due to...![submenu-img]() India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...

India's highest-paid TV actress began working at 8, her Bollywood films flopped, was seen in Bigg Boss 1, now charges...![submenu-img]() Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'

Shreyas Talpade wonders if his heart attack was due to Covid vaccine: 'We don’t know what we have taken inside...'![submenu-img]() IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets

IPL 2024: Faf du Plessis, Virat Kohli help Royal Challengers Bengaluru defeat Gujarat Titans by 4 wickets![submenu-img]() IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?

IPL 2024: Why is Sai Kishore not playing today's RCB vs GT match?![submenu-img]() 'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede

'Mumbai Indians ki kahani khatam': Ex-India star slams Hardik Pandya after MI's loss to KKR at Wankhede![submenu-img]() LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

LSG vs KKR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders

LSG vs KKR IPL 2024 Dream11 prediction: Fantasy cricket tips for Lucknow Super Giants vs Kolkata Knight Riders![submenu-img]() Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch

Viral video: Specially-abled girl’s energetic dance to Bollywood song wows internet, watch![submenu-img]() Viral video: Man educates younger brother about mensuration, internet is highly impressed

Viral video: Man educates younger brother about mensuration, internet is highly impressed![submenu-img]() Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts

Girl's wedding dance to Haryanvi song interrupted by mother in viral video, internet reacts![submenu-img]() Viral video: Man fearlessly grabs dozens of snakes, internet is scared

Viral video: Man fearlessly grabs dozens of snakes, internet is scared![submenu-img]() This mysterious mobile phone number was suspended after three users...

This mysterious mobile phone number was suspended after three users...

)

)

)

)

)

)

)

)