Mumbai is 21st on the list, ahead of Washington DC, Moscow and Shenzhen while New Delhi is at the 35th spot, ahead of Rome, Jakarta and Seattle

Mumbai and New Delhi have been ranked among top 40 global cities in the world by Knight Frank in its wealth index.

Mumbai is 21st on the list, ahead of Washington DC, Moscow and Shenzhen while New Delhi is at the 35th spot, ahead of Rome, Jakarta and Seattle.

In the last decade, around 500 new ultra high net worth individuals (UHNWI) were every year in India, and for the next 10 years, the annual increase is likely to touch 1000 UHNWIs. Those having wealth of $30 million and above have been categorised as UHNWI by Knight Frank in its latest 'The Wealth Report 2017'.

At 13.6 million, India has 2% of the world's millionaires, and 5% of the world's billionaires (2,024).

The number of UHNWIs in India increased 290% during the last decade and is forecast to grow 150% during 2016-26. The country ranks sixth in UHNWI growth rate for 2016, to move up to the third rank for the next decade.

As on 2016, in India, there are 6,740 UHNWIs, with Mumbai leading at 1,340 individuals, followed by Delhi where 680 such people reside.

As on 2016, in India, there are 6,740 UHNWIs, with Mumbai leading at 1,340 individuals, followed by Delhi where 680 such people reside.

In terms of growth, Pune leads the wealth index with 18%, followed by Hyderabad and Bengaluru with 15% each. Mumbai and Delhi's growth rate has been at 12% and 10% respectively.

On the other hand, there has been de-growth in the number of UHNWIs as compared to 2015-16 in the Venezuela (36%), Turkey (22%), Nigeria (20%), Brazil (14%), France (10%) and United Kingdom (5%). Whereas, Vietnam (18%), Canada (15%), India (12%), Australia (11%), New Zealand (11%), China (10%) and America (5%) have witnessed growth.

Nicholas Holt, head of research for Asia-Pacific, Knight Frank, said Mumbai ranks 15th when compared with other 124 cities on how much can $1 million can buy with 99 square metre while Delhi is at 196 sq mt. Monaco tops the chart with 17 sq mt for the same price followed by Hong Kong and New York at 20 sq mt and 26 sq mt, respectively.

Despite having millions of dollars and being among the wealthiest, philanthropy figures among the least important issues for the UHNWIs. "It concerns the least and is not a very important aspect," said Samantak Das, chief economist and national director research (India) for Knight Frank.

Their top priority or concern being sending their children overseas for education, succession plan and passing their wealth to the next generation.

The wealthy Indians allocate the highest proportion of their wealth for personal business followed with realty investments (domestic and abroad), investments in equities, precious metals, bond, etc, primary residences, collectables and others (that includes philanthropy).

The study showed that 40% Indians are anticipated to buy residential property outside India; the five most preferred countries being Singapore, UK, United Arab Emirates, US and Hong Kong.

Globally, UHNWIs prefer residential property in Europe. The primary factor for buying abroad is an overseas education for their children.

Within India, the report has identified seven hotspots around the world, presenting opportunities for private property investors, one of which is Bengaluru, others being Amsterdam, Miami, Berlin, Mexico City, Melbourne and Austin.

While Thane, next to Mumbai, has emerged as neighbourhood hotspot that is poised to outperform in four key categories of infrastructure, gentrification, technology and value hunters. The other being Mayfair – London, West – Aspen, Kamogawa River Area – Kyoto.

"Policy decision by the government has stalled luxury spendings," said Das. Similarly, there has been short-term adverse impact due to demonetization.

![submenu-img]() MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here

MBOSE 12th Result 2024: HSSLC Meghalaya Board 12th result declared, direct link here![submenu-img]() Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount

Apple iPhone 14 at ‘lowest price ever’ in Flipkart sale, available at just Rs 10499 after Rs 48500 discount![submenu-img]() Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…

Meet man who left high-paying job, built Rs 2000 crore business, moved to village due to…![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'

Remember Heyy Babyy's cute 'Angel' Juanna Sanghvi? 20 year-old looks unrecognisable now, fans say 'her comeback will...'![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...

Meet star, who grew up poor, identity was kept hidden from public, thought about suicide; later became richest...![submenu-img]() Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'

Watch: Ranbir Kapoor recalls 'disturbing' memory from his childhood in throwback viral video, says 'I was four years...'![submenu-img]() This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..

This superstar was in love with Muslim actress, was about to marry her, relationship ruined after death threats from..![submenu-img]() Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to…

Meet Madhuri Dixit’s lookalike, who worked with Akshay Kumar, Govinda, quit films at peak of career, is married to… ![submenu-img]() Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..

Meet former beauty queen who competed with Aishwarya, made debut with a superstar, quit acting to become monk, is now..![submenu-img]() IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR

IPL 2024: Jake Fraser-McGurk, Abishek Porel power DC to 20-run win over RR![submenu-img]() SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

SRH vs LSG, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS

IPL 2024: Here’s why CSK star MS Dhoni batted at No.9 against PBKS![submenu-img]() SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants

SRH vs LSG IPL 2024 Dream11 prediction: Fantasy cricket tips for Sunrisers Hyderabad vs Lucknow Super Giants![submenu-img]() Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral

Watch: Kuldeep Yadav, Yuzvendra Chahal team up for hilarious RR meme, video goes viral![submenu-img]() Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...

Not Alia Bhatt or Isha Ambani but this Indian CEO made heads turn at Met Gala 2024, she is from...![submenu-img]() Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…

Man makes Lord Hanuman co-litigant in plea, Delhi High Court asks him to pay Rs 100000…![submenu-img]() Four big dangerous asteroids coming toward Earth, but the good news is…

Four big dangerous asteroids coming toward Earth, but the good news is…![submenu-img]() Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics

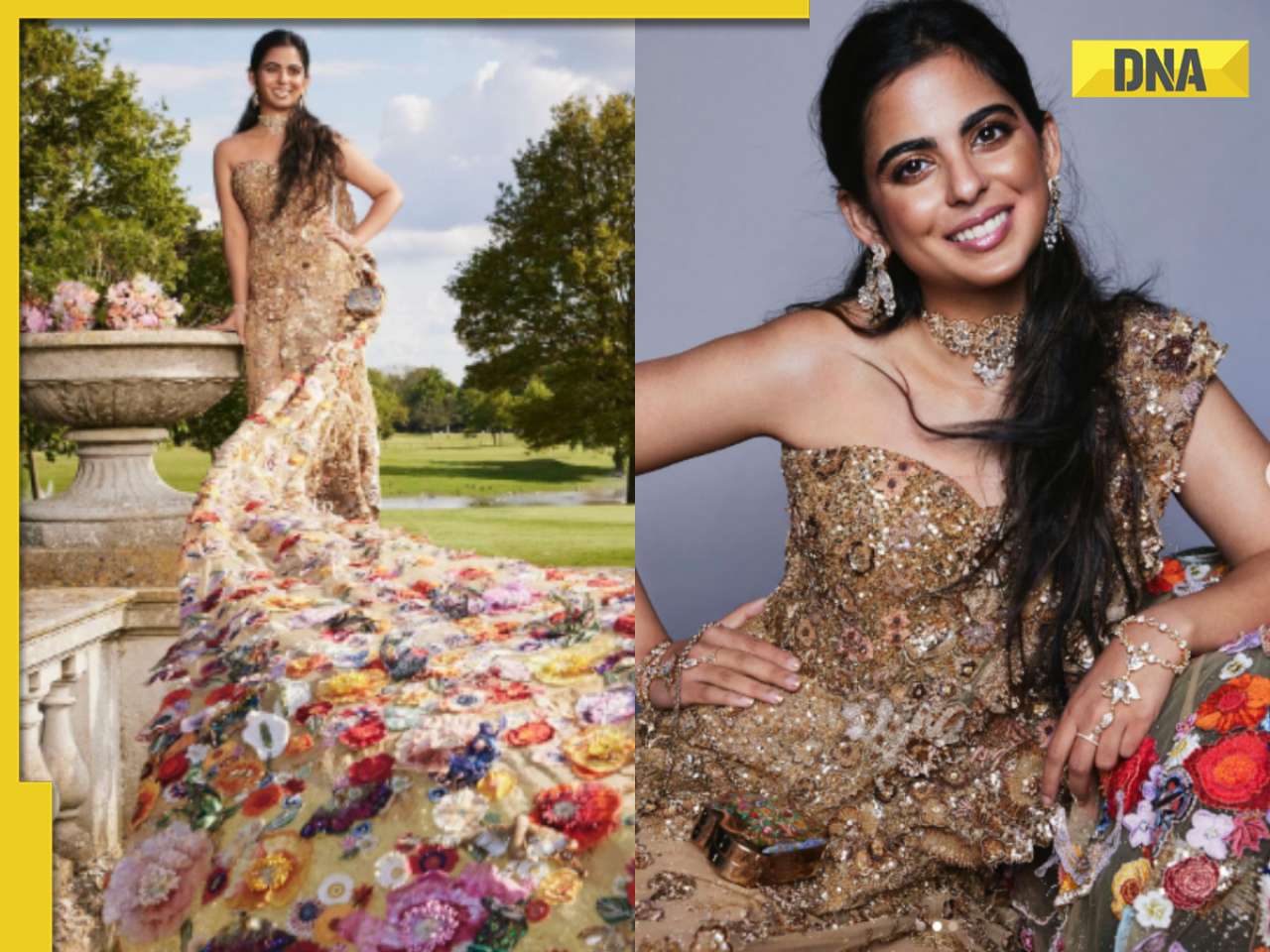

Isha Ambani's Met Gala 2024 saree gown was created in over 10,000 hours, see pics![submenu-img]() Indian-origin man says Apple CEO Tim Cook pushed him...

Indian-origin man says Apple CEO Tim Cook pushed him...

)

) As on 2016, in India, there are 6,740 UHNWIs, with Mumbai leading at 1,340 individuals, followed by Delhi where 680 such people reside.

As on 2016, in India, there are 6,740 UHNWIs, with Mumbai leading at 1,340 individuals, followed by Delhi where 680 such people reside.

)

)

)

)

)

)