U. S. shale producers are growing production again, renewing the challenge to OPEC's market share and potentially limiting further increases in oil prices during 2017/18.

U.S. shale producers are growing production again, renewing the challenge to OPEC's market share and potentially limiting further increases in oil prices during 2017/18.

U.S. crude and condensate production increased in both October and November, the first back to back increases since early 2015, according to the U.S. Energy Information Administration (http://tmsnrt.rs/2lOpdAs).

Domestic oil production rose to 8.9 million barrels per day (bpd) in November, up from a cyclical low of 8.6 million bpd in September ("U.S. crude oil production increases following higher drilling activity", EIA, Feb. 21).

Offshore production from the Gulf of Mexico accounted for more than half the total gain, adding an extra 175,000 bpd, with output from Alaska's North Slope also up 61,000 bpd.

However, production increases were also reported from onshore predominantly shale plays in North Dakota (an extra 65,000 bpd), Oklahoma (11,000 bpd), New Mexico (15,000) and Texas (43,000 bpd).

Production from the contiguous United States excluding the Gulf of Mexico was still down by almost 550,000 bpd (7.5 percent) in November 2016 compared with November 2015.

But the annual decline was sharply lower than in May 2016 when output was down by almost 820,000 bpd (11 percent) compared with the same month a year earlier (http://tmsnrt.rs/2mfDDXA).

GROWING AGAIN

U.S. oil production appears to have resumed an upward trend, after reaching a trough in September, and output was likely flat or higher in December, January and February.

The number of rigs drilling for oil has risen by more than 280 (almost 90 percent) since the end of May 2016, according to oilfield services company Baker Hughes.

Exploration and production firms are deploying an average of an extra 10 to 15 rigs each week to boost their oil output (http://tmsnrt.rs/2ltZmgn).

There are now more rigs drilling for oil than at the same time a year earlier, the first year-on-year increase in drilling since early 2015 (http://tmsnrt.rs/2mfVBth).

And the increase in the rig count understates the extra new production because drilling and fracking operations have become much more efficient.

Rig counts tend to affect recorded output with a significant lag because of delays in fracturing and other completion services as well as the gap before new production is reported.

Recorded increases in output during October and November were likely the result of extra rigs deployed several months earlier.

So the continued rise in the rig count during the fourth quarter of 2016 and the start of the first quarter of 2017 should ensure that recorded output rises for at least the next six months.

UPWARD REVISIONS

The EIA has forecast that U.S. domestic production will rise by 430,000 bpd between December 2016 and December 2017.

Output from the Lower 48 states excluding the Gulf of Mexico is forecast to rise by 360,000 bpd ("Short-Term Energy Outlook", EIA, Feb 2017).

Past experience suggests shale output often turns out higher than forecast which suggests a strong possibility it will increase by even more than 360,000 bpd over the course of 2017.

The EIA has already revised up domestic production growth for the period December 2016 to December 2017 from 210,000 bpd as recently as November, and shale growth up from just 10,000 bpd.

EIA is now forecasting U.S. domestic output of 9.28 million bpd in December 2017, up from 8.94 million bpd at the time of the November forecast ("Short-Term Energy Outlook", EIA, Nov 2016).

Forecast production from the Lower 48 states excluding the Gulf of Mexico has been revised to 7.06 million bpd, up from 6.48 million bpd in November.

The EIA has revised both the baseline and predicted growth rates higher in recent months, adding hundreds of thousands of barrels per day of extra production by the end of the year.

OIL PRICE CEILING?

The rapid expansion of shale production was the main reason for the slump in oil prices that began in June 2014 by threatening to increase global stocks and reduce OPEC's market share.

The forecast growth in shale production in 2017 is still much slower than during the boom of 2013/2014 when production was rising by more than 1 million bpd each year.

OPEC ministers have repeatedly stated they believe oil demand will grow strongly enough to absorb extra shale production while protecting the organisation's own exports.

But the organisation will not want to see the shale revival turn into a new boom because it would risk a re-run of the price crisis of 2014.

So oil prices may struggle to rise above $60 per barrel for any length of time this year because the resulting surge in shale production and likely reversal of OPEC's production curbs would tend to undercut sustained gains.

The implied ceiling on crude oil prices for the remainder of 2017 is entrenched in market expectations.

Most energy market professionals expect Brent oil prices to average around $55-60 per barrel in 2017, according to the results of a Reuters survey conducted in January (http://tmsnrt.rs/2ijPcd9).

Brent prices have been very stable at around $55.50 +/- $1.50 since the middle of December.

Related columns:

* Shale revival looms over oil prices and spreads, Reuters, Jan. 24

* Shale oil and gas sector surges back to life, Reuters, Jan. 23

* U.S. oil and gas industry has turned the corner, Reuters, Jan. 17

* Oil price forecasts for 2017, 2018 rise as downside risks fall, Reuters, Jan. 12

(This article has not been edited by DNA's editorial team and is auto-generated from an agency feed.)

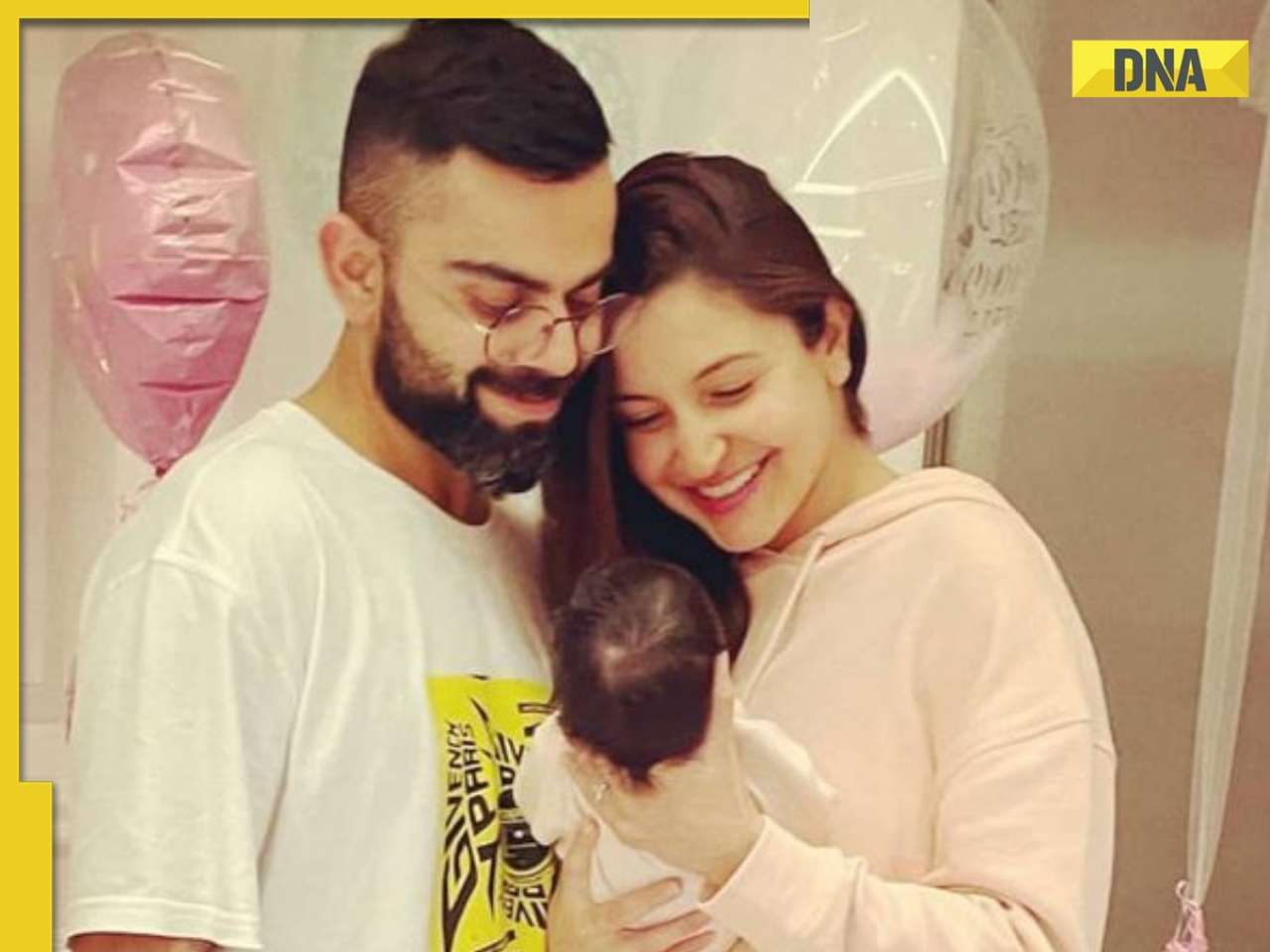

![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() Elon Musk's Tesla to fire more than 14000 employees, preparing company for...

Elon Musk's Tesla to fire more than 14000 employees, preparing company for...![submenu-img]() Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...

Meet man, who cracked UPSC exam, then quit IAS officer's post to become monk due to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…

Ola S1 X gets massive price cut, electric scooter price now starts at just Rs…![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding

In pics: Rajinikanth, Kamal Haasan, Mani Ratnam, Suriya attend S Shankar's daughter Aishwarya's star-studded wedding![submenu-img]() In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month

In pics: Sanya Malhotra attends opening of school for neurodivergent individuals to mark World Autism Month![submenu-img]() Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now

Remember Jibraan Khan? Shah Rukh's son in Kabhi Khushi Kabhie Gham, who worked in Brahmastra; here’s how he looks now![submenu-img]() From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend

From Bade Miyan Chote Miyan to Aavesham: Indian movies to watch in theatres this weekend ![submenu-img]() Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch

Streaming This Week: Amar Singh Chamkila, Premalu, Fallout, latest OTT releases to binge-watch![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence

DNA Explainer: How Iranian projectiles failed to breach iron-clad Israeli air defence![submenu-img]() DNA Explainer: What is India's stand amid Iran-Israel conflict?

DNA Explainer: What is India's stand amid Iran-Israel conflict?![submenu-img]() DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles

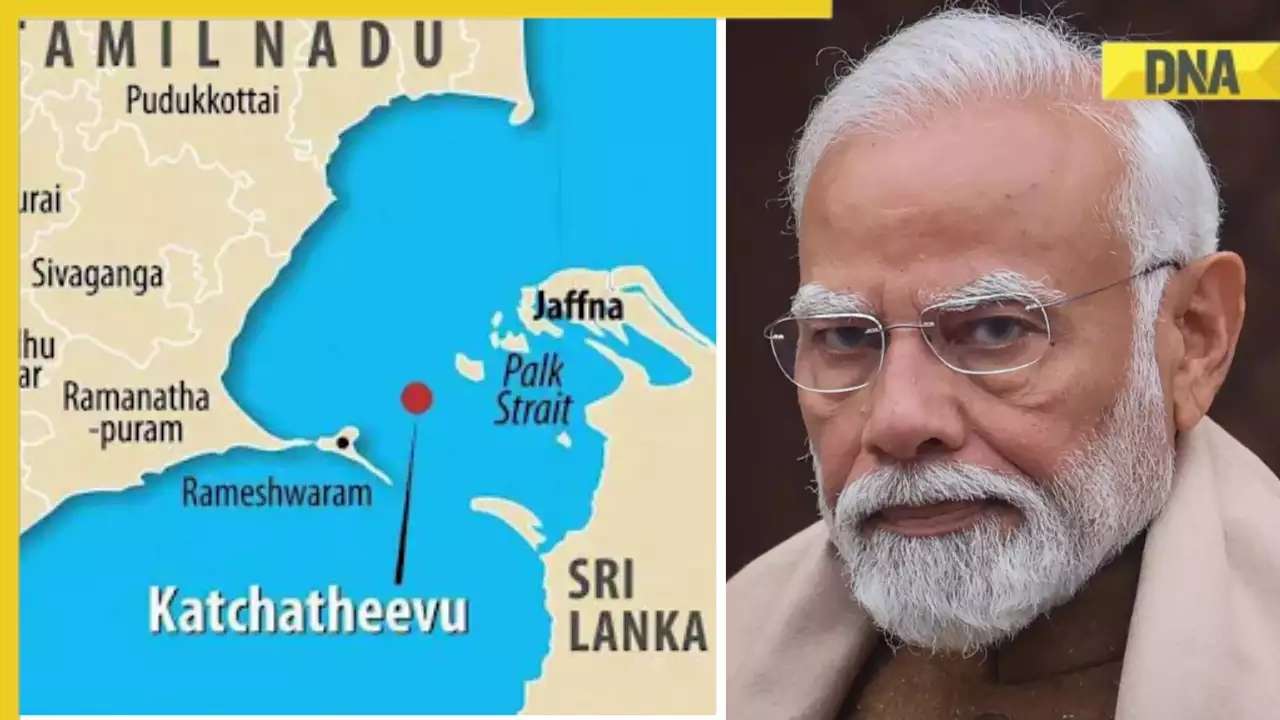

DNA Explainer: Why Iran attacked Israel with hundreds of drones, missiles![submenu-img]() What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?

What is Katchatheevu island row between India and Sri Lanka? Why it has resurfaced before Lok Sabha Elections 2024?![submenu-img]() Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...

Anushka Sharma, Virat Kohli officially reveal newborn son Akaay's face but only to...![submenu-img]() How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion

How Imtiaz Ali failed Amar Singh Chamkila, and why a good film can also be a bad biopic | Opinion![submenu-img]() Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'

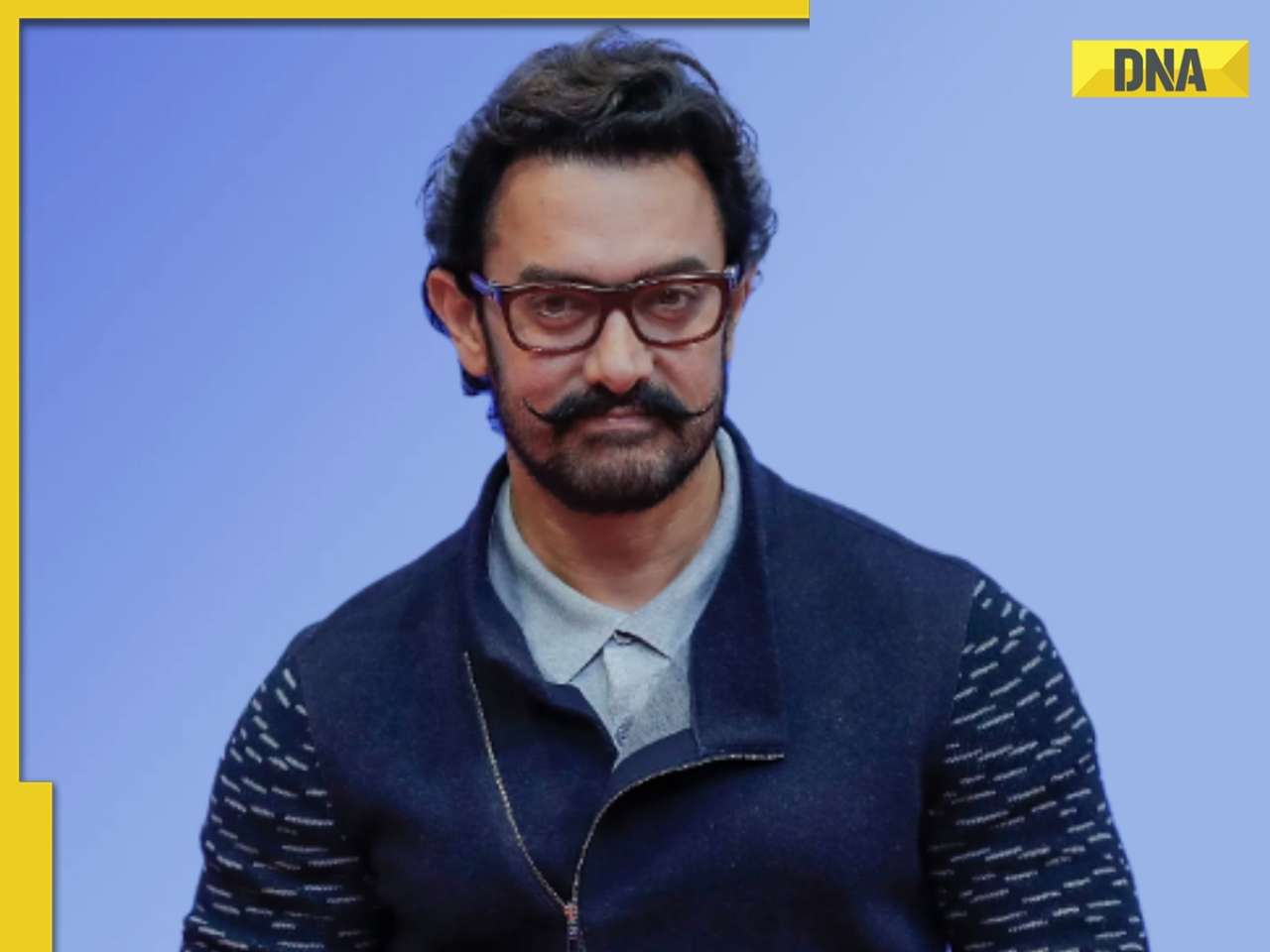

Aamir Khan files FIR after video of him 'promoting particular party' circulates ahead of Lok Sabha elections: 'We are..'![submenu-img]() Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'

Henry Cavill and girlfriend Natalie Viscuso expecting their first child together, actor says 'I'm very excited'![submenu-img]() This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...

This actress was thrown out of films, insulted for her looks, now owns private jet, sea-facing bungalow worth Rs...![submenu-img]() IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB

IPL 2024: Travis Head, Heinrich Klaasen power SRH to 25 run win over RCB![submenu-img]() KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs RR, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals

KKR vs RR IPL 2024 Dream11 prediction: Fantasy cricket tips for Kolkata Knight Riders vs Rajasthan Royals![submenu-img]() RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

RCB vs SRH, IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs

IPL 2024: Rohit Sharma's century goes in vain as CSK beat MI by 20 runs![submenu-img]() Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home

Watch viral video: Isha Ambani, Shloka Mehta, Anant Ambani spotted at Janhvi Kapoor's home![submenu-img]() This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...

This diety holds special significance for Mukesh Ambani, Nita Ambani, Isha Ambani, Akash, Anant , it is located in...![submenu-img]() Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video

Swiggy delivery partner steals Nike shoes kept outside flat, netizens react, watch viral video![submenu-img]() iPhone maker Apple warns users in India, other countries of this threat, know alert here

iPhone maker Apple warns users in India, other countries of this threat, know alert here![submenu-img]() Old Digi Yatra app will not work at airports, know how to download new app

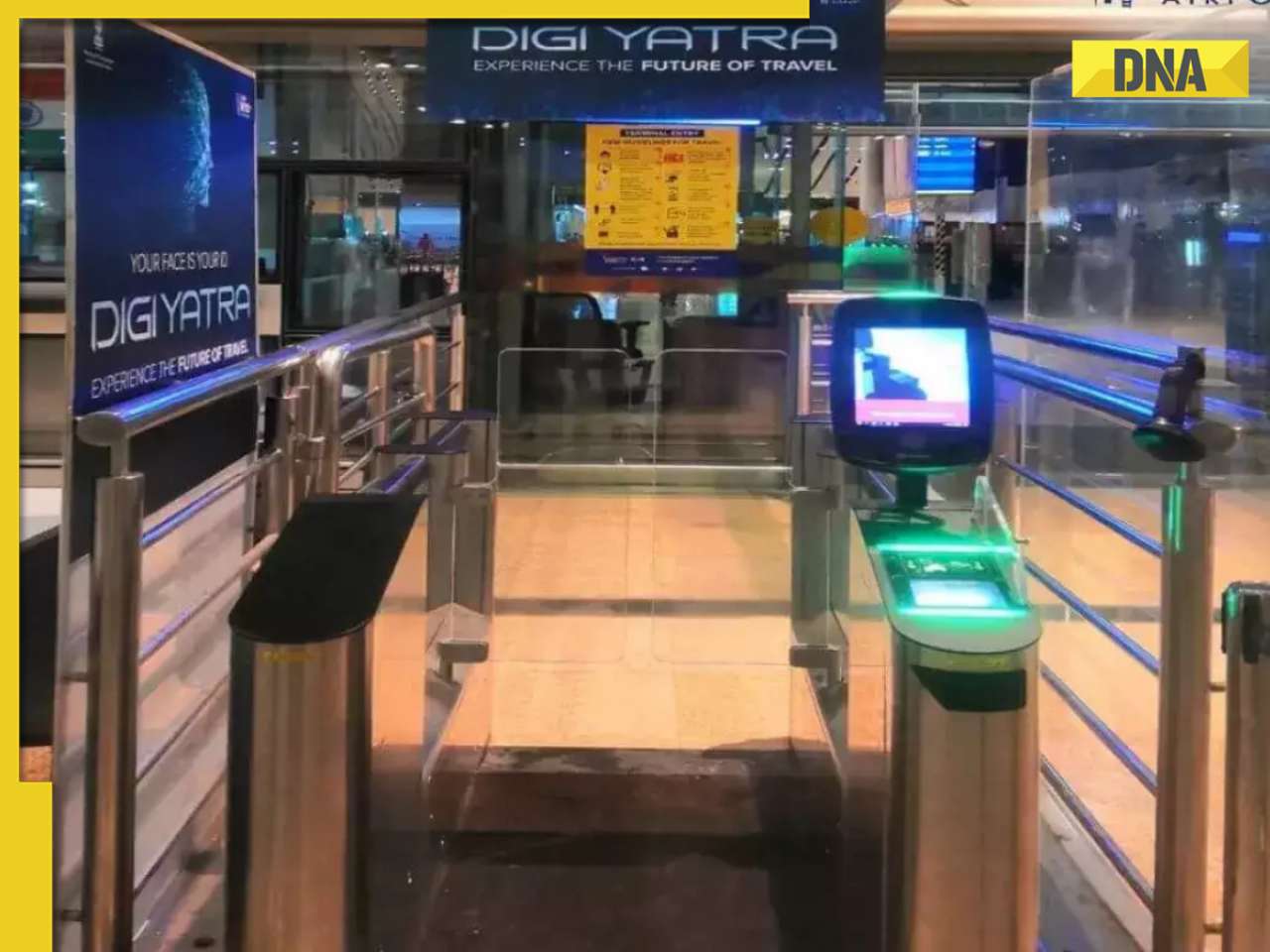

Old Digi Yatra app will not work at airports, know how to download new app

)

)

)

)

)

)