Market experts say AIFs are popular as they offer best of both mutual funds and portfolio management services

The stock market regulator-controlled investment vehicles -- known as alternative investment funds (AIFs) -- are on a high, reporting a massive growth in terms of investments made and funds raised in recent times.

AIFs have investment commitments of over Rs 1.1 lakh crore, raised over Rs 61,000 crore and investments made to the tune of Rs 43,000 crore, recording a 70-112% growth in last 12 months, as per Securities and Exchange Board of India (Sebi) data.

Market experts say AIFs are popular as they offer best of both mutual funds (MF) and portfolio management services (PMS), giving more freedom to fund managers in terms of investment strategies, lower costs and performance.

AIFs are privately-pooled investment funds, categorised by Sebi into three broad categories. Category I funds primarily invests in start-ups, small and medium-sized enterprises (SMEs), venture capital and infrastructure. This category has commitments of nearly Rs 23,000 crore, funds raised worth Rs 8,280 crore and over Rs 6,400 crore invested as of September 30, 2017.

Commitments raised refer to a contractual agreement between an investor and an AIF that obligates the investor to contribute money to the fund.

Category II alternative investment funds are private equity funds or debt funds for which no specific incentives or concessions are given by the government or any other regulator. This category has the largest investor commitments at Rs 70,498.38 crore, over Rs 37,000 crore funds raised and nearly Rs 24,000 crore invested.

Category III AIFs are hedge funds or funds which trade with a view to making short-term returns or such other funds which are open-ended. They have commitments raised of Rs 22,656 crore, funds raised over Rs 16,000 crore and about Rs 13,200 crore investments made.

Unlike PMS, where minimum ticket size is Rs 25 lakh, the minimum investment under AIF is Rs 1 crore.

"This makes it suitable only for rich individuals. The relatively higher ticket size comes with many advantages. Firstly, investments are staggered, which means investors don't need to put the money in one go. Secondly, the management fee is between 150-175 basis points, which is lower than 2-2.5% charged by many mutual funds. There is a performance fee aspect, which means the fund manager in AIF makes more when investors make more. Thirdly, execution and tax aspects are also in favour of AIF investors given the structure," said Akhil Chaturvedi, executive vice president - head-sales and distribution, Motilal Oswal Asset Management Company.

Noted investor Porinju Veliyath, who runs Sebi-registered Equity Intelligence AIF Trust, feels that AIF format is just in its infancy in India.

"AIF is most suited for talented, emerging fund managers given the ease of setting up, operational convenience and execution. I expect AUM (assets under management) under category-III alone to cross Rs 1 lakh crore in the next 2-3 years," opines Veliyath, who launched EQ India Fund (an AIF) in July and raised nearly Rs 100 crore.

In the recent times, quite a few fund houses have raised a lot of money under AIF II & AIF III.

Sachin Shah, fund manager, Emkay Investment Managers, says, "There is a wide variety of options available under AIF – like investments in listed, unlisted, leverage/derivative-based funds. Depending on every HNI investor's individual risk appetite and goals, they could select from the available AIF platforms. AIFs also qualify as qualified institutional investors (QIIs), which opens up many opportunities for investment managers to participate in preferential allotments or as anchor investors in IPOs (initial public offerings), among others."

"The Indian AIF industry is giving investors a wider platform for investing across asset classes as this is evident from the steady rise in assets across all categories. The ability to customise AIF schemes as per the need of the market conditions, in addition to regularly listed equity and debt instruments is a huge draw. Moreover, with opportunity to invest in unlisted equity and real estate, and now, along with the launch of AIF for commodities, this industry is set to scale new heights," said a fund manager at IIFL Investment Managers.

The focus on developing AIF business is a priority for many asset managers. Newly-listed Reliance Nippon Asset Management's subsidiary Reliance AIF intends to launch between six and 10 new schemes (Category II and Category III) over the next three financial years and utilise Rs 1,250 million from the IPO net proceeds towards maintaining continuing interest at or above the minimum level prescribed by law for the proposed schemes, public issue documents show.

The Sebi (AIF) Regulations mandate that the manager or sponsor of such schemes have a certain minimum amount of continuing interest in the AIF in the form of investment in the fund. However, from time-to-time, a higher capital investment is requested for by investors to demonstrate the manager's confidence in the scheme through the "skin in the game" approach and consequently boost investor confidence.

![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here

DNA Verified: Modi govt giving students free laptops under 'One Student One Laptop' scheme? Know truth here![submenu-img]() DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar

DNA Verified: Shah Rukh Khan denies reports of his role in release of India's naval officers from Qatar![submenu-img]() DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth

DNA Verified: Is govt providing Rs 1.6 lakh benefit to girls under PM Ladli Laxmi Yojana? Know truth![submenu-img]() Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening

Aamir Khan, Naseeruddin Shah, Sonali Bendre celebrate 25 years of Sarfarosh, attend film's special screening![submenu-img]() Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’

Alia Bhatt wears elegant saree made by 163 people over 1965 hours to Met Gala 2024, fans call her ‘princess Jasmine’![submenu-img]() Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates

Jr NTR-Lakshmi Pranathi's 13th wedding anniversary: Here's how strangers became soulmates![submenu-img]() Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch

Streaming This Week: Heeramandi, Shaitaan, Manjummel Boys, latest OTT releases to binge-watch![submenu-img]() Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years

Remember Ayesha Kapur? Michelle from Black, here's how actress, nutrition coach, entrepreneur looks after 19 years![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?

DNA Explainer: Why Harvey Weinstein's rape conviction was overturned, will beleaguered Hollywood mogul get out of jail?![submenu-img]() What is inheritance tax?

What is inheritance tax?![submenu-img]() DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?

DNA Explainer: What is cloud seeding which is blamed for wreaking havoc in Dubai?![submenu-img]() DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?

DNA Explainer: What is Israel's Arrow-3 defence system used to intercept Iran's missile attack?![submenu-img]() Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'

Ashutosh Rana breaks silence on his deepfake video supporting a political party: 'I would only be answerable to...'![submenu-img]() Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman

Meet India's most talented superstar, is actor, dancer, stuntman, singer, lyricist; not Ranbir, Shah Rukh, Aamir, Salman![submenu-img]() This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...

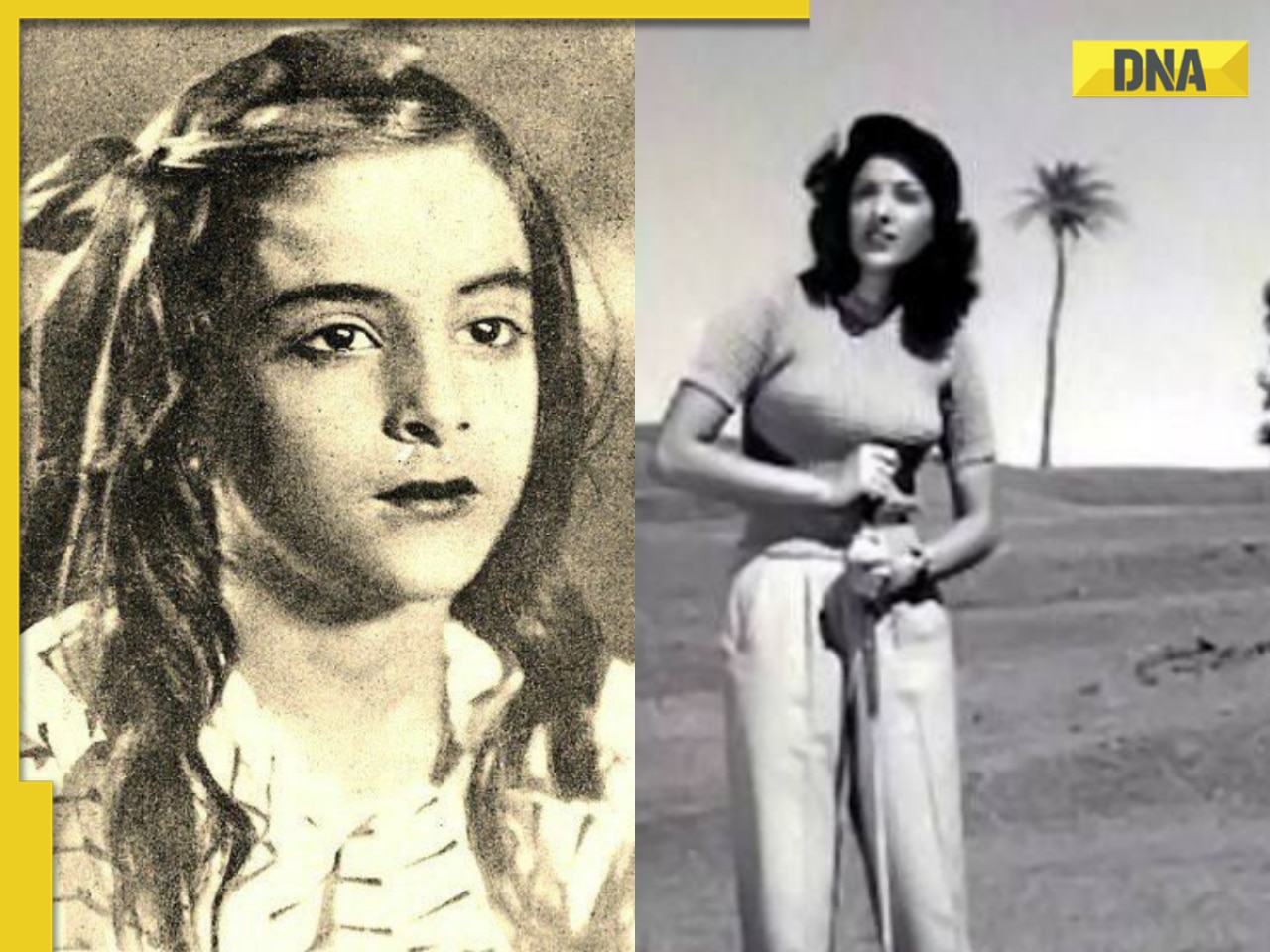

This flop film was headlined by star kid, marked south actress's Bollywood debut, made in Rs 120 crore, earned just...![submenu-img]() India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...

India's most successful star kid was superstar at 14, daughter of tawaif, affair with married star broke her, died at...![submenu-img]() India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..

India's biggest flop actor, worked with superstars, married girl half his age, once left Aamir's film midway due to..![submenu-img]() England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum

England pace legend James Anderson set to retire from Test cricket after talks with Brendon McCullum![submenu-img]() IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings

IPL 2024: Shubman Gill, Sai Sudharsan centuries guide Gujarat Titans to 35-run win over Chennai Super Kings![submenu-img]() KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report

KKR vs MI IPL 2024: Predicted playing XI, live streaming details, weather and pitch report![submenu-img]() 'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024

'It's ego-driven...': Ex-RCB star on Hardik Pandya's captaincy in IPL 2024![submenu-img]() BCCI to advertise for Team India's new head coach after T20 World Cup

BCCI to advertise for Team India's new head coach after T20 World Cup![submenu-img]() Viral video: Kind man assists duck family in crossing the road, internet lauds him

Viral video: Kind man assists duck family in crossing the road, internet lauds him![submenu-img]() Can you see the Great Wall of China from space? here's the truth

Can you see the Great Wall of China from space? here's the truth![submenu-img]() Mother bear teaches cubs how to cross a road with caution, video goes viral

Mother bear teaches cubs how to cross a road with caution, video goes viral![submenu-img]() Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....

Meet the tawaif, real courtesan of Heeramandi, was once highest paid item girl, was killed by....![submenu-img]() Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

Mukesh Ambani’s old image with billionaire friends go viral, Harsh Goenka makes joke of…

)

)

)

)

)

)

)

)