Having spent 18 months in the cocoon after the demonetisation, India is not exactly the colourful butterfly that’s all set to fly into the sky.

Inside the quiescent chrysalis, it is still an underdeveloped embryo. The caterpillar’s dreams of creating a cashless economy, or at least a less-cash economy, and cleaning up the system of black money and counterfeits from a thriving parallel market seem to have fallen by the wayside.

Tired of counting the currency notes returned to banks during the note ban, the Reserve Bank of India (RBI) has now begun counting the cost of demonetisation. Not as complicated as the previous, surely.

The drastic fall in RBI’s annual cheque to the government was being squarely blamed on note ban. The apex bank transferred Rs 30,659 crore of its surplus to the government for 2016-17 fiscal (July-June), less than half of the Rs 65,876 crore it had transferred in the previous year, and substantially lower than the Rs 58,000 crore government had estimated in the Budget.

The 2017-18 fiscal doesn’t look any different. RBI, which is furiously printing currenciess and feeding rural and semi-urban markets as India stares at an intense currency crunch, may end up paying a similar cheque in July, 2018.

RBI has now stepped up printing currencies. The central bank, which used to print up to Rs 2,500 crore worth of 500-rupee notes every day, will now be printing Rs 7,000-7,500 crore to meet the rising demand.

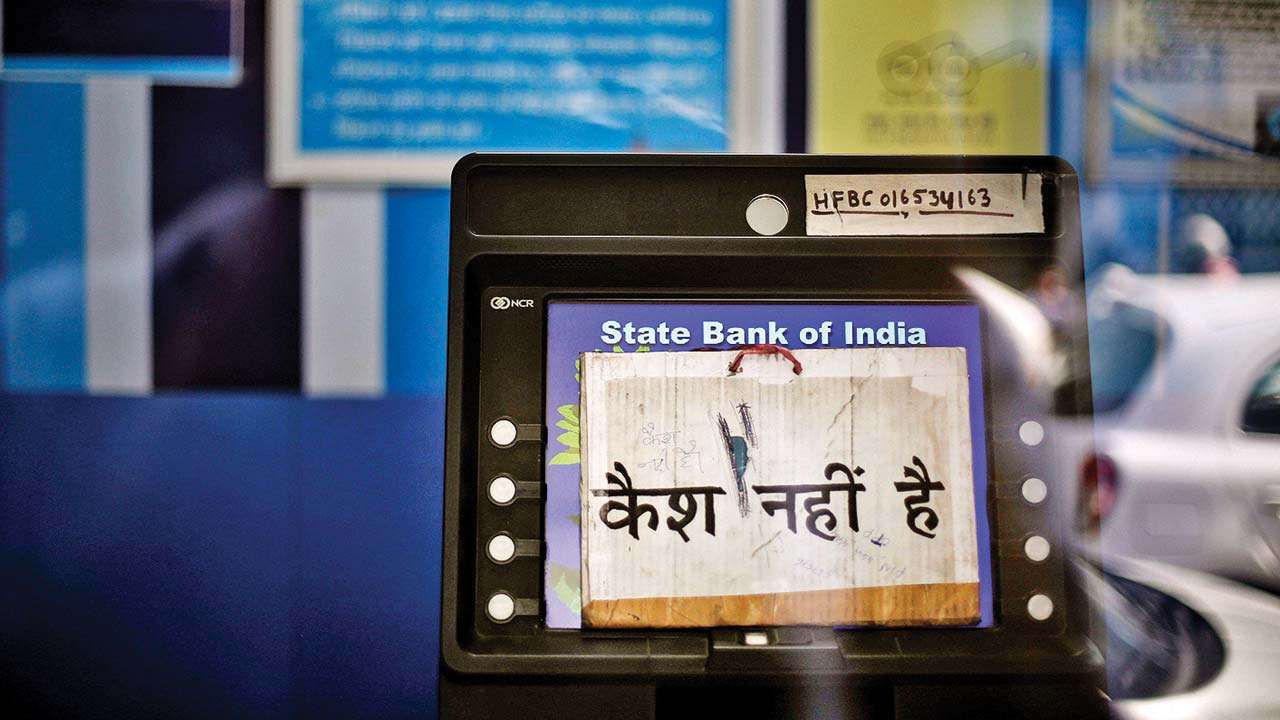

Bankers tell us in confidence that the currency crunch had never completely disappeared after DeMo.

Three factors have created the mess jointly: rumours about banks and ATMs running dry of cash, possible hoarding in the wake of state elections, and more importantly, an increasing demand for cash in a growing economy.

The latest figures by the central bank show that the currency in circulation touched Rs 18.42 lakh crore on April 6, higher than what it was just before the note ban at Rs 17.97 lakh crore.

It clearly shows the demand has risen far in excess of supply while digital transactions have failed to pick up the pace.

Economic affairs secretary Subhash Chandra Garg said the government suspects big hoarding of Rs 2,000 notes.

That means the hoarders, who had lost confidence in Indian rupee soon after the surgical strike on November 8, 2016, are back in the market.

Soon after note ban, hoarders had deftly moved to other assets such as gold, real estate and foreign currency, and no abandoned old notes were found floating in the Ganges as expected then.

But now, the corrupt nation is back to generating piles of black money.

The Rs 2,000 notes are missing in action as various states are gearing up for elections. In the absence of the smart chip-linked with GPS, investigating agencies are at a loss to locate these huge piles illegally stashed away by hoarders.

Demonetisation has given its verdict, finally. If the government still believes that it helped wipe off black money and illegal hoarding, it should seriously think of a second round.

Once Rs 500 and Rs 200 notes are printed adequately and supplied to banks, all the Rs 2,000 notes can be withdrawn to take the whole process to a logical conclusion. Will the government do it?

The fact is that India continues to be stuck in the lifeless chrysalis.

The writer is editor, DNA Money.

He tweets @AntoJoseph