Indian market participants, for once, chose to ignore global market cues and rejoice the sovereign ratings upgrade of India by one notch to Baa2 by Moody’s Ratings. The upgrade news provided relief to a battered bond and swap market while equities continued to enjoy the roller coaster ride that has already been in play for some time now.

In global financial markets, the week concluded with something of a whimper rather than a bang, with equity indices going flat at expiry and sentiment somewhat upbeat with hopes of US tax reform following the successful house vote.

Oil prices declined from recent highs after data showed US stockpiles unexpectedly rose and as Russia was seen to be wavering on the need to extend output cuts. US markets especially have been enjoying low volatility as data shows it's been 508 days since the last 5% sell-off and almost two-years since the last 10%.

The focus for most of us was the surprise ratings upgrade by Moody’s Ratings that took India two notches higher into the investment grade universe. Moody’s had last upgraded India in 2004. It would remain to be seen when the other two major rating houses, Fitch and the S&P, follow Moody’s action. The upgrade is buttressed by Moody's expectation that continued progress on economic and institutional reforms will, over time, enhance India's high growth and the rating agency also believes that the reforms put in place have reduced the risk of a sharp increase in debt, even in potential downside scenarios.

No doubt this is a positive development for a government and its perseverance to reform the country of archaic policies against a backdrop of sharp criticism on currency withdrawals last year and GST implementation this year, by a section of the populace and industry. This upgrade from Moody’s comes after 13 years and the last upgrade ever happened in 2007 by S&P. Given the high ratio of public debt to GDP (with the issue of bank-recap technically defying the Fiscal Debt to GDP ratio slippage), anaemic economic growth and risk of another bout of widening CAD and a mere 18 months for the next General Elections, it could be a case of ‘running to remain where we are”.

Inflation data (CPI and WPI) came in worse than expectations but does not threaten to overshoot the estimated trajectory and a large section of the economic press believes the final average for FY 2018 could be below targeted average of 4%. With a US rate hike in December becoming a high-probability event and other G5 nations also reporting stronger growth numbers, one veers to think that India should have reached the end of easing cycle. What is equally interesting is that our real growth is still sub-par and where we should have been a leading growth-economy, we appear to be languishing. The issue of a rate hike therefore should be out of reckoning for a much longer period and interest rate curves should flatten sooner than later. The Moody’s upgrade should help corporates fund their capex at better prices now, while the sovereign curve should see muted impact as we do not have a hard currency debt.

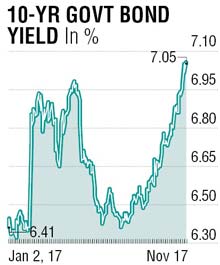

Bond yields that had retraced nearly 13 basis points at open on Friday, gave up all the gains despite a positive auction result. Absence of follow-through buying post the opening gap-down in yields and concerns over macro issues may have kept sentiments low. RBI cancelled a scheduled OMO Sale in a late evening announcement. This should augur well for bond market sentiment as the sustenance of higher yields may not be a welcome factor. This move should be seen as a precursor to more decisions that may likely come over the days ahead, helping to cap bond yields without compromising on RBI’s liquidity stance. A test of 6.75% is likely and upside in yields should be limited.

The writer is a market expert