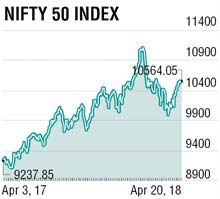

The broader index Nifty closed positive for the fourth straight week and gained 0.80% ending at 10564 backed by Indian Meteorological Department (IMD) forecast of normal monsoon at 97% for this season.

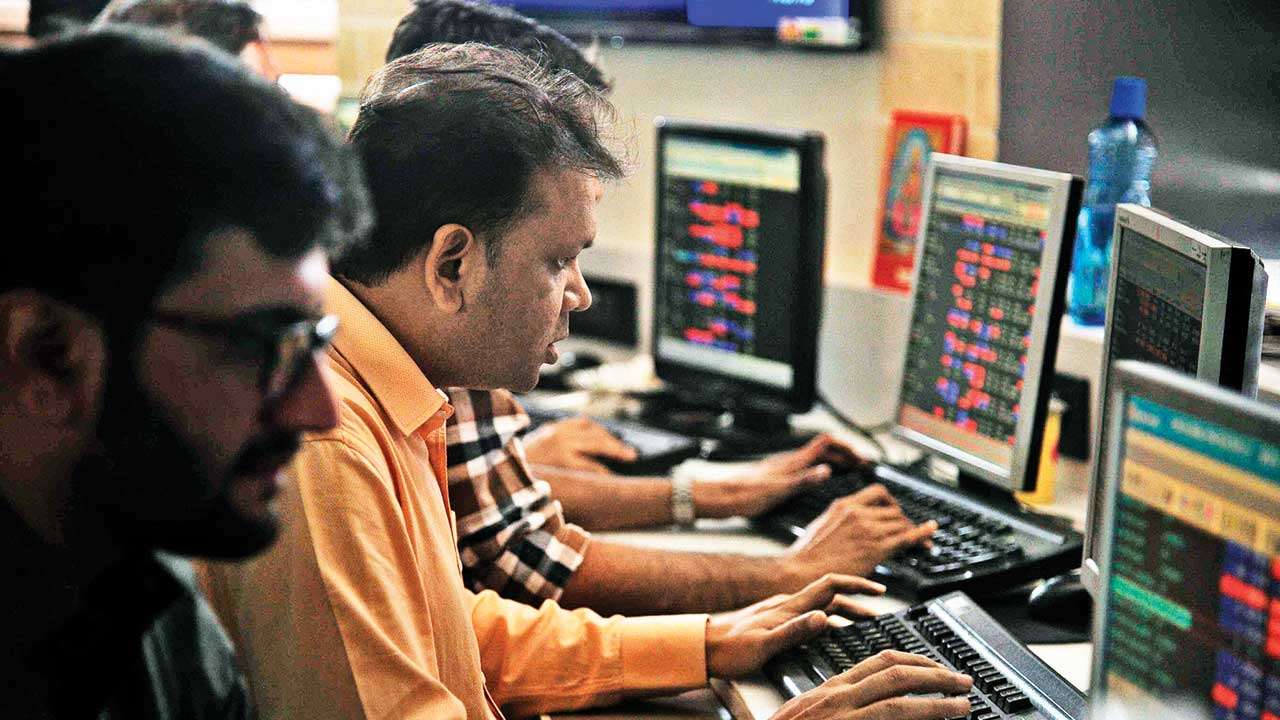

Though the mid and small cap indices surged 1.17% and 1.43% respectively, Nifty Bank underperformed losing 1% led by the PSU Banks which lost 4.83% whereas private banks lost 1%.

The Information Technology (IT), FMCG and Metal sectors outperformed gaining between 4-5% taking cues from the strong rally in base metal prices on LME. Tata Consultancy Services (TCS) results and guidance were above street expectation and it became India’s first company with market capitalisation of Rs 6.5 lakh crore.

Markets continued its rally in the last week ignoring the noises like the weakening of the rupee, rising bond yields and spurt in base metal prices. The rupee slipped to 66.10/$, the lowest level since March 2017, after the minutes of the last meeting of the Monetary Policy Committee (MPC) indicated that the central bank may shift to a hawkish monetary stance in its meeting in June which spiked Indian bond yields to 7.71%.

The International Monetary Fund (IMF) expects India’s economy to grow at 7.4% in FY18 and 7.8% in FY19 on strong private consumption. Structural reforms will gradually raise productivity and incentivise private investment.

For the week, Indian markets will face volatility ahead of the April month Future and Options (F&O) series expiry. Sentiments may remain positive on Donald Trump’s statement on the artificial rise in international crude price and initiate peace talks between the US and North Korea.

Technically, Nifty has strong resistance at 10630-10650 levels and rally may continue if Nifty closes above 10650. But if it fails to surpass then it may see the time correction, supports are at 10460-10330 respectively. The probable trading range for the week could be between 10650-10330.

Foreign institutional investors (FII) sold equities worth Rs 2,821 crore while domestic institutional investors (DII) bought shares worth Rs 2,124 crore during last week.

The April F&O expiry is on Thursday. In the ongoing earnings season companies like Bharat Financial, Cholamandalam Finance, Delta Corp, LIC Housing Fin, Bharti Airtel, M&M Fin, Ultratech, Wipro, Axis Bank, Biocon, Tata Elxsi, YES Bank, Bandhan Bank, Maruti, RBL Bank, Shriram Transport Fin, UPL, MCX etc. will announce their fourth-quarter results this week.

The key global events to watch this are the US and Euro services and manufacturing PMI data releasing today while the European Central Bank (ECB) meeting will be on Thursday. The Bank of Japan (BoJ) policy meeting is scheduled on Friday.

The writer is VP- Retail Research, Motilal Oswal Securities Ltd