How BJP controlled co-operative banks in Gujarat subverted demonetisation

If Prime Minister Narendra Modi's real aim for demonetisation was to fight black money and corruption, the affairs of co-operative banks in his home state Gujarat have proved the opposite.

In fact, the kind of inflow into co-operative banks in Gujarat after the note ban was announced is indicative of quantum of black money transactions that go on in the state.

BJP's banking sector

Of the 20-odd district cooperative banks in Gujarat, BJP leaders and their followers have seized control of as many as 16 during the last one decade or so.

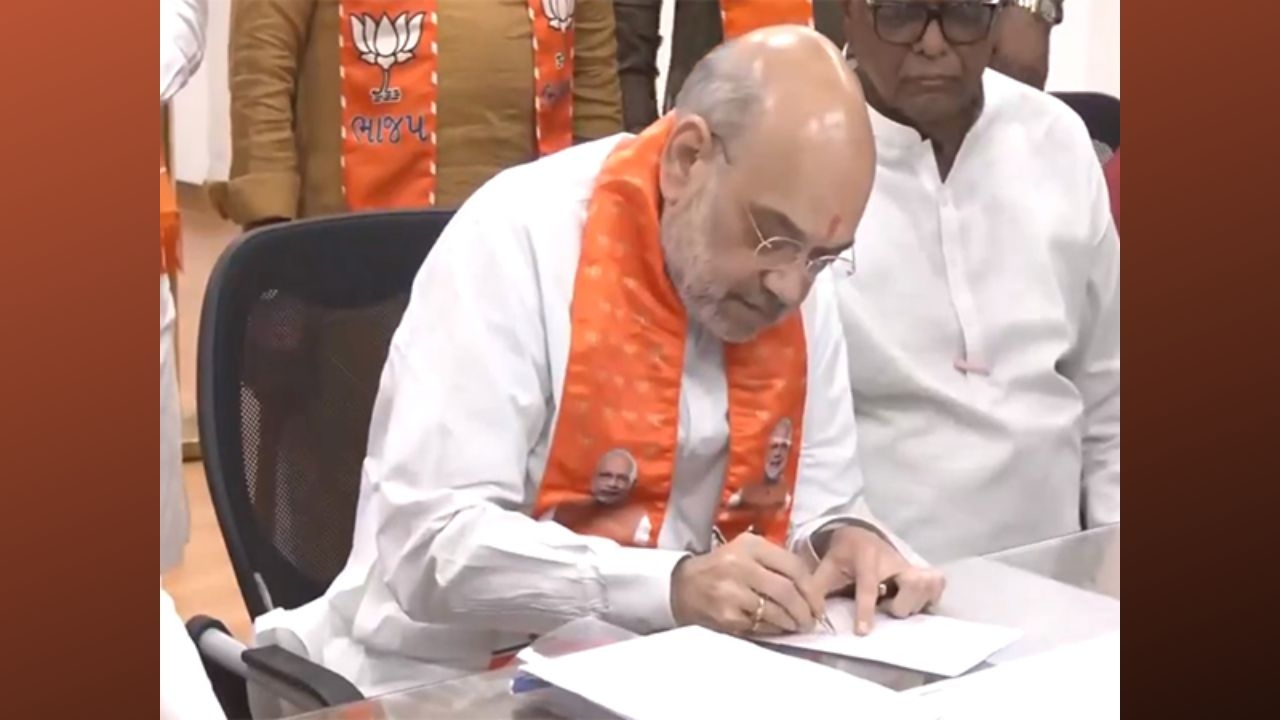

Which is why it isn't surprising that BJP national president Amit Shah is listed as a director of the Gujarat State Co-operative Bank Ltd - the apex body of these co-operative banks.

Also read - How BJP used the Gujarat co-operative bank sector to 're-monetise' its funds

Not only that, Gujarat's Minister of State for Health Shanker Chaudhary is the Vice Chairman of the bank. Legal sources in the state say that there is no illegality involved in these two BJP leaders holding the posts of office bearers in the co-operative bank as they do not constitute any Office of Profit (OoP) under the law.

But what of the illegality of several crores being deposited in the same bank after demonetisation was announced?

On the night of 8 November, after the Prime Minister's nation-wide telecast of his four-pronged intention to unearth black money, eradicate corruption, defeat terrorism and ease out fake currency, one branch of the Gujarat State Co-operative Bank Ltd received deposits of Rs 500 crore in demonetised notes.

Perhaps that is why the narrative was quickly changed to transforming India into a cashless, digital economy.

The monumental quantum of deposits on the night of the demonetisation announcement have baffled the Income Tax department, which has launched an investigation.

But it can be safely predicted that the I-T probe in this case would probably meet the same fate as the Mahesh Shah case, where he made a disclosure of Rs 13,860 crore of black money in December.

The small time real estate dealer had caused a sensation by declaring the huge amount of black money, which he wanted to turn into 'white' by paying 45% as taxes and penalty.

Enthusiastic I-T sleuths had picked up Mahesh Shah from the midst of a live interview at a local television studio, but soon developed cold feet when the real estate dealer said that the Rs 13,860 crore didn't belong solely to him, but to very big politicians, including a Rajkot-based leader now shifted to Karnataka.

He claimed he had made the disclosure to earn a commission from the money that would be left behind after paying the taxes and penalty. With the information, the I-T authorities did not act, fearing the consequences of investigating the origin of the Rs 13,860 crore.

Choosing a convenient option, the Income Tax Department termed Mahesh Shah's declaration as hoax and charged him with only minor offences like misleading the authorities.

Large deposits

Soon after 8 November, a dubious deposit of Rs 871 crore was discovered in a Rajkot-based co-operative bank. In fact, more than 4,500 new accounts were opened in the same bank in November and December, including 62 which had the same mobile phone number. The deposits were made using demonetised notes between 9 November and 30 December.

During the same period, Rs 108 crore was also withdrawn in a suspicious manner. The number of accounts opened, the amounts deposited and amounts withdrawn during these days are much higher than similar transactions during the same period in earlier years, the I-T sleuths say.

Many of the pay-in slips had no signatures or PAN numbers, as is mandatory under banking rules. For the payment of Rs 1 crore to the son of the bank's former director through cash deposits in 30 accounts, the same person filled every pay-in slip.

The mother of the vice-chairman of the bank received cash deposits of Rs 64 lakh, the I-T investigation revealed.

A long history of embezzlement

These transactions might look startling now but Gujarat has a history of embezzlement and siphoning off public money through co-operative banks. An infamous example is the 2001 scam in the Madhavpura Mercantile Co-operative Bank (MMCB), which was duped to the tune of more than Rs 800 crore by Mumbai-based stockbroker Ketan Parekh.

Among the depositors who lost their money in the MMCB scam were also the ruling BJP's foot soldiers in the party's stronghold areas of Ahmedabad. They had even held demonstrations against the BJP when it was learnt that the party's Rajya Sabha MP from Gujarat was arguing the bail application of Ketan Parikh in the Supreme Court.

A joke for the ages

Over the last 22 years of BJP's rule in Gujarat, at least two of its MPs had been arrested for scams in co-operative banks led by them. However, both were released on bail and were elected again.

These episodes prove a journalist's joking remarks made some 15 years ago. Sighting the host of the night's shoes in an open rack outside the main door, a visitor from Delhi had wondered about the chances of theft.

The Gujarat-based scribe replied. "No such small thefts, they would rather start a co-operative bank, pack the board of directors with family members and then swindle a few crores of depositors' money."

Looks like jokes do come true sometimes.

Edited by Aleesha Matharu

More in Catch - Did Amit Shah's bank in Gujarat receive Rs 500 crore soon after note ban?

Black cash is just 1% of black economy: Arun Kumar on 50 days of note ban

First published: 10 January 2017, 18:13 IST

![BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH] BJP's Kapil Mishra recreates Shankar Mahadevan’s ‘Breathless’ song to highlight Delhi pollution [WATCH]](http://images.catchnews.com/upload/2022/11/03/kapil-mishra_240884_300x172.png)

![Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE] Anupam Kher shares pictures of his toned body on 67th birthday [MUST SEE]](http://images.catchnews.com/upload/2022/03/07/Anupam_kher_231145_300x172.jpg)