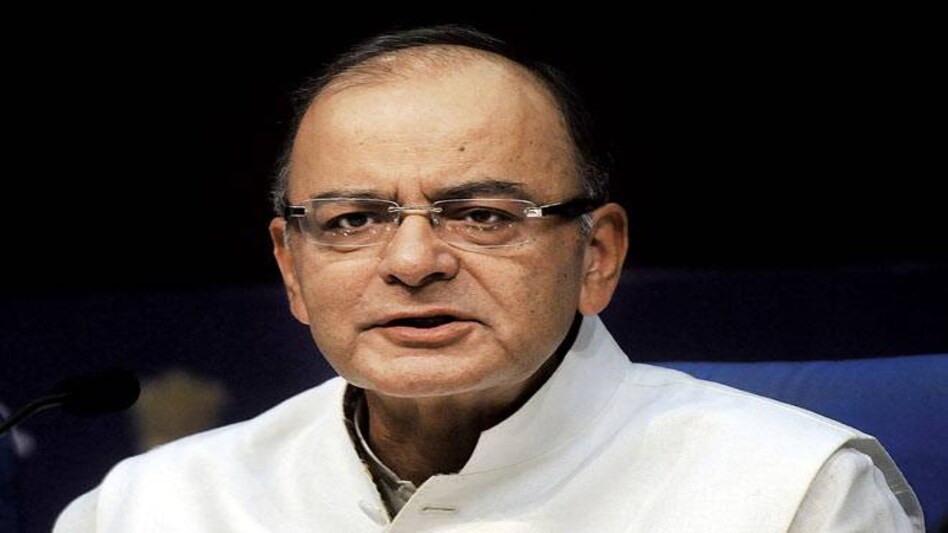

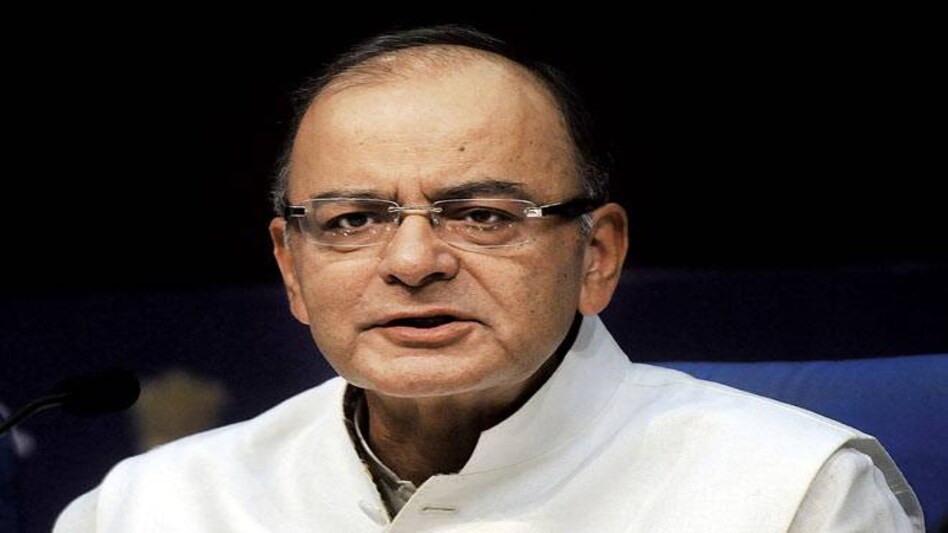

The government is drafting a central law to protect people investing in chit fund schemes and will bring the legislation very soon to Parliament, Finance Minister Arun Jaitley said today.

Replying to a debate on 'The Banking Regulation (Amendment) Bill, 2017' in the Lok Sabha, he said there is a need for a pan-India law to deal with chit fund schemes in addition to state laws which already exist.

During the debate, opposition members had raised the issue of chit funds due to which investors have been duped and sought to know from the government what steps it was planning to take to deal with this malaise.

"SEBI is looking into the existing chit fund cases. There are state laws to deal with them in Bengal and Odisha. But what to do with those who run operations throughout the country? We are drafting a central law and very soon we will bring it before you," Jaitley said.

He said the chit fund schemes attract investors by offering a meagre 1-1.5 per cent interest rate higher than what is given by banks.

Jaitley had in the 2017-18 Budget announced that the government will amend the 'Multi-state cooperative Act' as there was an urgent need to protect the poor from dubious chit fund schemes, operated by unscrupulous entities.

Replying to the debate, the finance minister said the government has come out with safer options for investments and the Life Insurance Corporation has launched a pension scheme for senior citizens which offer a fixed 8.3 per cent interest rate on deposits.

Jaitley said the government has taken steps to offer stable interest rates to investors so that they are not lured into chit fund schemes.

ALSO READ: Why every big car launch has a woman next to the vehicle

He said at a time when inflation was running high at 10 per cent, bank deposit rates were high at 9 per cent. But loans were extended by banks at 14-15 per cent interest rate and with such high interest rates, global industrial investments will not come in.

"Slowly interest rates will become reasonable... Pension funds are safe investments," Jaitley said.

Also watch:

Copyright©2024 Living Media India Limited. For reprint rights: Syndications Today