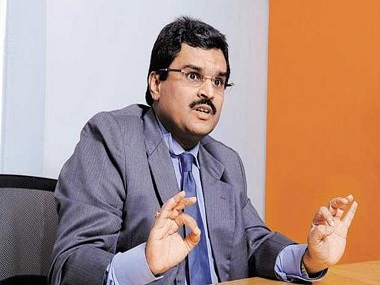

Editor’s note: In a new book, journalist Shantanu Guha Ray meticulously probes Jignesh Shah and the events that led up to the NSEL scam. Reproduced below is an excerpt from The Target.

On a hot May afternoon in Mumbai, India’s divided city, the incident happened exactly the way I took notes and wrote it in my reporter’s notebook.

Integral to this one was a prolonged conversation, not one, but a few in quick successions. The conversations are an example how devious minds have always worked in India, messed up growth and dreams, and always killed great passion and great market push. Such conversations are rarely made public, unless some intrepid reporter works overtime, and unless some sudden Right to Information (RTI) note – in some ways India’s answer to poor man’s investigative journalism – pushes out secret notes from rickety almirahs in government offices.

I was, somehow, lucky to know. It was an authenticated source from Delhi; I did not need RTI papers or sting tapes. It went like this. “Sir what do we do, we have nothing against him, nothing on him? He is cooperating well with the cops (read Economic Offences Wing (EOW) of the Mumbai Police). They called him seven times, he visited them 21 times. He is even helping them with his IT team to open up the case so that the money trail can be traced. The cops are happy with his cooperation. They are not keen to pull him in, arrest him,” said a top official of the Ministry of Finance.

By then, the Arvind Mayaram Committee had, in fact, put in every investigating agency against Shah in less than a month, “but truth being on his side, he is facing bravely (sic)”. “A new government is coming, if he continues to remain a free man, he will open a Pandora’s Box and seal our fate. We could be in trouble,” the official sounded worried. “So what do we do?” he asked in the same breath. There was a deathly silence, probably the person on the other end was plotting. And then the person answered. “Get the cops to arrest him somehow and put him in custody. The lock-up will break his spine. Once he is destroyed mentally, a defamed man like him will have no takers ever again. If the cops don’t relent, I will get the CBI to go after them,” the person declared.

Who was this person? A top minister, a seasoned bureaucrat? The subject of this devious conversation, a fairly clear hint of what transpired between the two, was offered in a cloaked manner the following day in the country’s largest business broadsheet, The Economic Times, was none other than Shah, then the nonexecutive director of National Spot Exchange Limited (NSEL) that was in the thick of a Rs 5000 crore plus payment crisis. It was 7 May 2014, India had just wound up the first phase of the general elections in Andhra Pradesh, Bihar, Himachal Pradesh, Jammu and Kashmir, Uttar Pradesh, Uttarakhand and West Bengal. But in Mumbai, a man-made storm was being shaped to create the stock market’s biggest tornado, its biggest destruction.

The evening of 7 May 2014 was going to be devastating for Shah. Shreekant Javalgekar, former CEO of MCX and a nonexecutive director of NSEL was initially summoned by the EOW at 3 pm for questioning. He told Shah that he was not keeping well. So, Shah told him that he will accompany him to the EOW office, and together they would meet Rajvardhan Sinha. As Sinha was not there, both of them left the EOW office at 4 pm. But this case – unwarranted observers had already got involved – was like a cooker with multiple pressure points. Unexpectedly, Shah and Javalgekar were called again. “Why," both asked? “Just come, it’s an order, something urgent has come up”, replied the cops.

The sun had not set on the Arabian Sea across the Marine Drive when the two walked into the EOW office at the Police Headquarters in Mumbai’s ever-busy Crawford Market area at 6 pm calmly, without any fear. Surprisingly, they were told that they have been arrested. “And what is the charge?” asked Shah. “Total non-cooperation during the interrogation,” a junior officer replied. “We were here three hours ago, what went wrong that you are taking us in?” Shah asked again. Shah was interrogated by the EOW several times between September 2013 and 7 May 2013, and no incriminating evidence was ever found against him.

Actually Shah was summoned 7 times, and he went on his own to the EOW Office 21 times, a fact corroborated by the cops. Even records of how many times the two had come for interrogation were shared with the cops. The list of interrogation calls and list of interrogation appearances against such calls were all kept inside a file placed on the table. Yet the cops looked the other way. Shah simply could not believe that he was being pushed into a lock-up. A police officer walked in to offer water. The glasses remained untouched on the table. Both Shah and Javalgekar sat motionless on rickety chairs inside the EOW office. They were told that EOW head Rajvardhan Sinha would be meeting them in sometime. Sinha walked in after an hour, very curtly informing the them about the decision and how it was important for the EOW to seek custody of the two so that their presence would not hamper the probe into the payment crisis. “We have orders to arrest both of you; this order has come right from the top.” “What is top, and who is the person sitting at the top?” Javalgekar asked Shah. No answers were forthcoming.

As expected, a junior officer had informed the news channels about the decision to arrest the two, breaking news filled the air. Pesky reporters and their whirring cameras jammed the corridors of EOW. The alleged creator of the payment crisis, so claimed the EOW, was finally nailed. That it was a blatant lie was proved much later, but for the moment of the night, one of India’s biggest creators of wealth and honour, was heading for custody in a waiting Black Maria. For television channels, this was great visuals. Pain and shame often make great copy.

The two had been in and out of the EOW precincts for almost three months; in fact, precisely two months and a half, helping the cops in every possible way, answering whatever was asked in their efforts to track down a whopping Rs 5600 crore that went missing in the NSEL payment crisis. What’s significant is that even after 90 days in custody, cops did not find anything substantial against Shah. In the eyes of the burly cops, however, Javalgekar and Shah were the main men behind the Rs 5600 crore payment problem that had rattled NSEL. In the eyes of the NSEL, MCX and FTIL employees, and all those who cared to ponder and listen, the two had no charges of financial irregularities against them. Worse, they were not even directly involved in the day to day running of NSEL.

During the police custody, the grilling continued day in, day out. Shah appeared calm; his face did not reflect the tumult of his mind. “But we have been cooperating with them every day; we have set up a special office with computers to track the trading patterns of the brokers who caused the crisis. They have – on paper – appreciated our efforts. The EOW has even said this was for the first time some genuine effort was being made to track and trace money lost in dubious deals. So where is the non-cooperation?” Both said to each other.

Shah was grappling with a host of issues in his mind. He was getting around to the point that someone really wanted him to be out of the business, destroy his empire. “Someone wants to silence us, at any cost, wants to taint us so that we lose both face and faith,” Shah told Javalgekar.

To waiting reporters outside the EOW offices, cops lined up mics on a table to address a press conference. For them, it was a big day, Shah and Javalgekar had been arrested. Channels played breaking news claiming the duo, who were questioned for several hours before being arrested, were evasive during questioning and not cooperating with the cops. I was told that the EOW team was acting directly on orders from someone powerful in the Indian capital.

My worries were confirmed when The Economic Times of 9 May 2014 wrote something very serious, very devastating: “While Jignesh was waiting in the EOW office (on his being summoned second time on 7 May 2014), a senior officer of the Mumbai police was having a meeting in a suburb with a Finance Ministry official who had landed up. When the EOW officer returned a little after 5 pm, Jignesh was told that he was being taken in.” ET further said: “Jignesh had ruffled many a feathers and made powerful enemies, including a senior bureaucrat. In the past six months, these men worked overtime to make sure Jignesh faced arrest.” The daily added, “Sinha’s damaging statement (Anjani Sinha’s revised statement dated 21 October 2013 retracting the earlier confession statement made by him in September 2013), followup investigations by the EOW, the appointment of Rakesh Maria as commissioner of the Mumbai police in February, some of the invisible forces and a few powerful enemies in New Delhi – who pushed for action before a new government took over in a few weeks – went against Jignesh.” The same newspaper further stated: “The factors that precipitated the arrest were the changing political equations in Maharashtra (where a large number of investors are based) and the urgency to prove a point before the state Assembly elections later this year.”

EOW officials did not open up but after much coaxing relented to tell me that the VIP who had air-dashed to Mumbai that evening to meet EOW boss Rajvardhan Sinha was one of the lieutenants of KPK, a top official in the Department of Economic Affairs (DEA) in the Ministry of Finance. Why was he in Mumbai, and why did he meet (Rajvardhan) Sinha? Was he carrying any message from someone powerful in the UPA-2 Cabinet? No answers were forthcoming. But the Rubik’s cube was – finally – into place. It was clear why Shah and Javalgekar were called at 6 pm and placed under arrest.

For me, things were still revolving in a host of probability theories; I was inclined to believe The ET news report that hinted at a hidden agenda that transpired between 3 pm and 5 pm in the Mumbai EOW. Why was Shah then suddenly summoned on 7 May 2014, when all opinion polls had predicted a clear majority in the 2014 Lok Sabha elections for the Bharatiya Janata Party (BJP) and its allies? Probably the idea was to taint Shah and his senior colleague beyond doubt, break their morale for once, forever. Else, the EOW had no other reason to explain its tearing hurry after 11 months.

Once the arrest announcement was made, life, in one shot, had changed for two of the finest players of the Indian commodities markets in India, Jignesh Shah and Shreekant Javalgekar. At the end of the press meet, as if to balance charges levelled against Shah and Javalgekar, Sinha also said EOW was probing the 27 alleged complicity of several brokers indulging in malpractices. “Certain brokerage houses had been charging 0.2 per cent in warehouse charges, whereas no warehouse receipts were given to the investigators. We also found that the accounts of several investors were used without their information and consent for purchases of the trading amounts. These transactions were then truncated," Sinha wrapped up the day.

But his closing remarks were largely ignored by the media, which had already got its breaking headlines for the day. The channels went into a tizzy. What Rajvardhan Sinha did not tell the media was that he himself had written in the police records about “the exemplary cooperation” shown by the duo, and how Shah even had set up a server/terminal at the EOW office to explain the NSEL operations and trading practices to the police and the investigating agencies, as they were not aware of the modus operandi. Rajvardhan Sinha had to flow with the tide, the currents of which were –presumably – directed by someone from somewhere.

Inside the EOW building, Shah and Javalgekar stood motionless; their lawyers had already told their individual drivers the dreadful lines: that today, saab will not return home. The drivers, dutifully, went back to their respective homes to narrate the tales of arrest. “We have to help the cops recover the lost amount, and then clean ourselves of the charges levelled. This is a double body blow,” Shah told Javalgekar, comparing the incident to the unfair attack by Bheem, the second of the Pandava brothers, on Duryodhana in the epic Mahabharata. Shah, who loved watching mythological films, had found Mahabharata a very intriguing epic as compared to the Ramayana. During meetings with his colleagues in FTIL, he would routinely lace his statements with incidents from the epic and argue how those – put in the current context – were still extremely relevant. It seemed sure to both that “someone was plotting a big, dirty game”. But they had no time to think who that person was.

By then, the sun had set on the Arabian Sea, sprinkling the swirling waters with its deep sepia cover. Shah and Javalgekar knew their nightmare had just begun. For them, the entry into a lock-up was a devastating blow for successful businessmen who navigated the ranks of high society with pride and honour, creating positions of wealth for the nation. But both Shah and Javalgekar – many thoughts criss-crossing their minds – knew they were victims of machinations that were totally beyond their control. Shah thought of his life, his association with billionaires and top business and political leaders across the world, and hundreds of families, which benefited from his companies. He wondered whether it was all over. He was unable to reconcile to the fact that the government had found him and directors of NSEL “not fit and proper” to run any bourse. He knew he was the best, having created companies which were the finest examples of Make in India. He had put Indian companies on the world map, etched new routes for Indians to charter a new life of business. His companies were revered all over the world. “Who wants to kill us?” Shah asked Javalgekar, who calmed down Shah by holding his hand. Javalgekar, obviously, did not have an answer.

They both hugged and got ready for their night, and the nightmare. Shah remembered how some cops repeatedly pushed top staff members of NSEL to give a statement against him and how they had resisted such unreasonable demands. Some had even told Shah that they were aware that the cops were working under pressure to get Shah at any cost. He had told his seniors very clearly: “If you feel you cannot take the undue pressure, give that statement against me; do not worry about me. Ultimately, truth will prevail.” His colleagues understood what Shah was saying; they admired him even more thereafter.

A little over a week later, came more disturbing news. A Sessions Court remanded Shah and Javalgekar to judicial custody. Meanwhile, Shah heard the news that hired killers of the dreaded Ravi Pujari gang were in Arthur Road prison to eliminate him. Shah had heard it before, also, and had therefore requested the judge –through his lawyer –not to be sent to the Arthur Road jail where Pujari’s gang was very strong and routinely harassed inmates. The judge agreed, and instructed the police to send them to a jail near Kalyan in Thane district. The two – present in the court – heard the pronouncement and waited for their biggest tensions in life. At the EOW office, the van for the jail was made ready for the prison. For two of India’s finest experts of the commodities markets, this was a face palm moment.

Shah and Javalgekar knew they were headed for judicial custody. Once in custody in Adharwadi near Kalyan, the two were made to complete formalities and then sent to their cell. Both Shah and Javalgekar were wide awake till 2 am, probably 3 am. There were no fans, no loud talking by the cops. But there was one problem. There were no visitors from home, no relatives, no colleagues from office, and no dailies to read to know what was happening in the world outside the jail’s towering walls. Shah was disturbed on the first day. He asked Javalgekar: “What have we done to deserve this?” Javalgekar had no answer. Freedom was just a seven letter word.

Shah and Javalgekar got their privacy, but their routine was horrible. Shah absorbed the situation, routinely talking to inmates who shared their tales. Thanks to the intervention of Shah, who submitted written letters to the authorities concerned, a whole group of neglected inmates were given improved care and treatment, and some juveniles freed, with the help of Tata NGO Prayas. He was also helping on Sundays the Navi Mumbai Church preachers by translating their English speeches into Hindi for the jail inmates. But despite these interventions and help, the two were constantly reminded that “you are in jail at the total control of others”. As a result, the two never crossed what was described by the jailor as the proverbial Lakshman Rekha.

Eventually, after two months in jail, Javalgekar was released on bail. After 108 days, Shah was also granted bail by the Hon Bombay High Court on 22 August 2014, ordering him to appear before the EOW of Mumbai Police twice a week, on every Monday and Thursday, for interrogation. Interestingly, the total days spent in custody were 108, the number revered highly by pious Hindus who believe 108 signifies coming off a full cycle, at times the beginning of a new life cycle. The order came late. By then Shah had retired for the night to his cell. The jailor was in no hurry. He followed rules, and the following day, Shah walked out of the prison.

Shah insisted on visiting the FTIL office to boost the morale of the staff of the company, before heading home. He walked up the stairs and was welcomed by many at the gate; some had tears in their eyes. Javalgekar stood next in silence. In a brief interaction with the staff of FTIL not lasting more than five minutes, Shah made two crucial points about his work, and what seemed like an uncertain future: “Have faith, we will rise from these ashes.” And then, Shah left.

While Shah was in jail, the salary of the FTIL staff for any month was not delayed by a single day, nor was the sweet dish in lunch and the regular football match screening given a miss. At home, Javalgekar – still a disturbed person – consumed some fruit juice, only to vomit instantly. He crashed on his bed, refused food for the night. Time and again, his family members wanted to push him into a brief conversation. Actually they wanted to know how long the ordeal would continue. Shah, however, became strong-willed, and started working immediately from the next day after his release from the jail. In September 2015, a visitor found him at his prayer room in the top floor of the grey glass-panelled FTIL building. It seemed to the visitor Shah was talking to himself. He walked close; saw Shah sitting cross-legged before a large statue of Lord Ganesha, the elephant God —widely worshipped across Maharashtra—that guaranteed both wealth and wisdom. “Life in prison, for all I did?” Shah asked. And then, seconds later, he walked out of the temple office where he officiated as Chairman Emeritus with the visitor. He did not want to tell him what he had told the God. Shah did not know that the visitor had already overhead his whisper.

After his jail term – the visitor was told – Shah had learnt not to give up hope, even if he stood alone against all odds. Shah called it total transformation, life’s biggest Agni Pariksha. “It helps you to emerge unscathed, only if you are in the clean,” he told the visitor. Shah knew he was in the right. In one of the meetings with his colleagues and friends, he showed them the judgment of Justice Thipsay who, while releasing Shah on bail, stated that no money trail was found out of the alleged NSEL crisis to FTIL or Shah. “The cops knew I was in the clean, so why did they act against me?” Shah asked. So, was the move to arrest Shah a quick ploy to taint a visionary forever in life? Probably yes, Shah had to be dethroned, overthrown to help rivals grow in business. That, in some ways, sums up the NSEL payment crisis and the subsequent decisions of the UPA-2 government in Delhi. For India’s commodities market, this was perhaps the saddest growth-to-death story, the most troublesome chapter.

The Target by Shantanu Guha Ray; pages: 240; price: Rs 495 A reader, Chirag Shah, sends his critique

An alternative title of the book could be – “Friends turn Foe” and let me explain why. The book reads like a lament, “How could an establishment which first let the chief protagonist, Jignesh Prakash Shah, become a Badshah of Electronic Exchanges, playing fast and loose with the regulatory system, suddenly insinuate that he is the “Bad”Shah. All that Shah did was let people steal right under his watch, from his custody. The investing public may be under some illusion that an exchange is a Public Financial Institution; to Shah it was an unregulated fiefdom, where words such as governance, prudential norms were merely words (Chairman Shankarlal Guru’s son-in-law Nilesh Patel was the first and the largest borrower/defaulter, owes Rs.950 crores). What kind of a state are we, that does not allow a first generation Crony Capitalist make it out like a bandit and become a Robber Barron. Didn’t we let Vijay Mallya flee? Why do we have to single out Jignesh Prakash Shah?

In this back drop it is important to understand what an exchange is and its place in the country’s economic landscape. Much like a bank, the permission to start an exchange is a coveted one. The exchange being a Central Counter Party, a guarantor of all trades that take place on its trading system, its reputation and credentials need to be absolutely impeccable. It is important to note that an exchange going bust is an absolute black swan event. The mammoth financial market meltdown in 2008, or the Lehman crisis as it is popularly known, did not bankrupt any exchange anywhere in the world. The reason is the robust regulatory and risk architecture.

Whether the exchange has allowed participants to assume undue risk is constantly under the regulatory scanner, and this ensures that the exchange is always solvent and liquid. In this context it must be said that while NSEL was indeed an exchange, but there was no regulator appointed to oversee or monitor their activities. Let us assume for argument’s sake that the regulator was a few steps behind, Shah being an alleged Czar of Exchanges in the making, should have known that paying out vast sums of money to dodgy borrowing members and not even instituting any internal controls ensuring water tight custody is an unpardonable sin. This defies even common sense.

The foreword invokes Ayn Rand, Mr. Seth seems to be under a belief that quoting Rand and comparing Shah to John Galt would add some shine. Truth be told, Shah actually resembles Floyd Ferris, who attempts to build on Prof Stadler’s work and absolutely ruins it. Mr. Seth’s foreword reads as if it’s written by Wesley Mouch, Tinky Holloway and Bertram Scudder all rolled into one.

The author seems to suggest that the protagonist is being victimized for taking on the “establishment” in the MCX-SX saga, but fails to dwell upon misdeeds of National Spot Exchange Ltd. (NSEL), its parent Financial Technologies India Ltd. (FTIL) and Shah’s vice like grip and absolute executive control of the operations of all his companies. There are enough and more Court orders, Judgments, Regulatory orders which unambiguously state these facts, but the author has chosen to gloss over by citing selectively what is essentially a “Bail Order”.

Had the author consulted any criminal lawyer before selectively quoting from the bail order, he would have understood what the legal position of a bail order is. It merely dwells upon questions involving the personal liberty of an accused, and also says categorically at the end that a bail order cannot be used for the purpose of a trial. The author seems to have made a cardinal error in arriving at any conclusion of the guilt of the accused or the absence of it, by speed reading a bail order. The author must peruse the judgment of the Honorable Divisional Bench of the Bombay High Court in NSEL v. State of Maharashtra of October 1, 2015, which categorically states the following.

“…The record further indicates that there are many accommodation entries which resulted into financial mishap due to collusion between the Petitioner and its selling trading members.”

For those who have either not read about or understood what the NSEL scam is about, here’s the gist.

NSEL was a Spot Exchange for trading commodities, which had the recognition from the Government of India, but strangely, no regulator overseeing its affairs. This clearly points to a very friendly “establishment” which grants recognition but fails to regulate the affairs. The exchange accepted money from investors/depositors by issuing an “Electronic Warehouse Receipt” transferring to them title to the goods upon receipt of money, and simultaneously buying the commodity back from the investor/depositor by way of a Repo (Repurchase) transaction, promising the investor/depositor that his/her money will be returned on the said date and the goods will be transferred back to the original owner.

Fast forward to July 31, 2013, NSEL announces that they do not have the money to pay investors/depositors, but they will liquidate the commodities held in warehouses under their control, and repay investors. Shah addresses a press conference on August 5, 2013, invokes his personal credibility and assures the world at large that he will liquidate all the commodities and pay back investors/depositors within 30 weeks, failing which he will pay the balance sums with interest. The press conference videos are widely available on YouTube for those interested, but obviously the author seems oblivious to these facts. The facts as they stand today, only 6.5% of the investors/depositors money was returned until September 2014, and thereafter no money has been paid at all.

The author seems to gloss over the fact that barring a few of FTIL ventures, namely, MCX, NBHC, IEX and NSEL, all the others were bleeding cash and were propped up by constant capital infusion by FTIL. The situation was so desperate that they had to find a cash cow and that too soon, if they had to continue the charade of being a serial disruptor/innovator/creator. NSEL was chosen as one such unregulated business which could be milked while the regulators were not looking at it, or the friends in the then “establishment” kept NSEL away from the prying eyes of the regulator.

The Financial Stability and Development Council (FSDC) sub-committee, headed by the then Deputy Governor of Reserve Bank of India raised the issue of a regulatory gap in May 2011 and the fact that since none of the market regulators namely SEBI or FMC regulated NSEL, the spot exchanges cannot be offered the Clearing Services of Banks. It also highlighted that NSEL did not have the Payment and Settlements System license and that they will be constrained to ask Banks to stop providing clearing services to NSEL. The FSDC sub-committee wrote to the Department of Economic Affairs (DEA), Ministry of Finance and highlighted these gaps.

The DEA Secretary in turn wrote to the Department of Consumer Affairs (DCA) in the Ministry of Consumer Affairs, and highlighted these gaps and concerns of the FSDC sub-committee. The Secretary DCA then hurriedly writes back around October 2011, stating that they have noted the concerns and are appointing FMC as a Designated Agency for Spot Exchanges and FMC will be substantially regulating these exchanges. If one is familiar with the regulatory architecture in the country, such play of words would have baffled them. It appears this was done for a reason.

As soon as FMC was appointed the Designated Agency, and NSEL was mandated to submit reports to them, FMC highlighted to the DCA that there were rampant violations by NSEL and something is surely amiss. The DCA issues a Show Cause Notice to NSEL in April 2012. This begs a question, how can a regulator substantially regulate an exchange when it can’t even issue a Show Cause Notice on its own and why has DCA taken the onus of issuing such Show Cause Notice? Subsequent correspondence, obtained by us through RTI, lays bare the fact that DCA was keen on giving a long rope to NSEL and FMC was not allowed to initiate any action.

By then, the stonewalling by NSEL would have made it abundantly clear to FMC that either the stocks do not exist or they are substantially short of the stated/declared quantities. Their stand was vindicated when close to nothing was found in the so called NSEL warehouses once the investigative agencies got into the act post July 2013. It is interesting to note what the Honorable Judge of Bombay High Court said in a recent court proceeding, whether there was a tsunami due to which all the stocks disappeared or whether the front door of the warehouse was locked but the back door was deliberately left open.

On July 10, 2013 Shah and his bunch of lackeys went to the FMC office in Mumbai to allay their fears about news reports suggesting non-existence of stocks in their warehouses and to urge the FMC to not apply stringent regulatory standards on NSEL, much like those applicable to another of its group company MCX. The perverted logic being offered was that NSEL and more particularly spot exchanges being at a nascent development stage need not be fettered with stringent regulations, which would not let them grow and fulfil a national objective.

Interestingly, the DCA Secretary was also in attendance and after the bravado of Shah and his lackeys, they came to a conclusion that NSEL should not be allowed to launch new contracts and that they should wind down all outstanding contracts on their respective due dates. It is interesting to note that the friends in the “establishment” took the final decision to take stern action on NSEL a good 15 months after first having issued a Show Cause Notice in April 2012. The flurry of letters, interestingly marked “private & confidential”, make for a very interesting reading, for those who are still in doubt whether Shah was being shielded or was he indeed a “target” as the author would like us to believe.

An interesting trait of the FTIL Group with Shah at its helm was “interpret the law, do not obey the law” and as is their want, they continued business as usual by merely tweaking the contract maturity, until they ran out of funds to pay investors/depositors on July 31, 2013. The Financial Intelligence Unit of the Government of India in their report has highlighted this particular trait.

It would interest the readers to know that like all Public Financial Institutions, even NSEL was supposed to maintain a reserve in the form of a “Settlement Guarantee Fund” (SGF), much like banks maintain a CRR & SLR. But guess what, on July 31, 2013, it was discovered that they have blown the entire SGF of Rs. 800+ crores, without letting anyone know, despite being legally bound to do so. This is much like a Bank knowing fully well that they are going to run out of funds soon and they pay back some select set of people on a “first come first served” basis, before being busted.

It is noteworthy that neither MCX nor National Bulk Handling Corporation ( NBHC), which dealt with third party commodity stocks in their capacity as a custodian, were ever accused of such grave violations.

I guess the regulators did a splendid job by “targeting” the misdeeds of NSEL and thereby exposing the parent FTIL, while both MCX and NBHC are well managed businesses under their new ownership and managements, having being rid of Shah and his lackeys.

(Chirag M. Shah is an employee of a brokerage firm, which is a member on these commodity exchanges. He has invested and lost his personal savings in NSEL contracts.)

The author responds

I have read Chirag Shah’s letter with all seriousness and would like to argue it on facts.

Jignesh Shah was not a stranger to the markets, having built 10 world class exchanges which functioned under different regulatory regimes, both in India and abroad, those were not fly-by-night affairs, painstakingly built with scientific precision over a decade under the watchful eyes of global regulators.

I find merit in Suhel’s comparison of Jignesh with John Galt, the protagonist innovator of Ayn Rand’s classic Atlas Shrugged.

An exchange is first seen by its users as it is in their business, which is why some exchanges work and some fail. For the records, out of the 10 FTIL exchanges, only one - NSEL - met with an accident of a payment default primarily due to artificially induced risk of closure and also because of induced regulatory risk and various trading malpractices by defaulters and brokers and connivance of some staff of NSEL that messed up the traders contracts. At NSEL, two of the three segments, namely, e-series and farmers’ contracts, functioned perfectly alright with much larger number of clients and some brokers.

The payment crisis did not happen while the exchange was functioning; it happened in July 2013 after the government ordered its abrupt closure!

I have investigated to to bring forth hitherto unknown facts about the NSEL crisis and some kind of pre-meditated approach of powerful and influential people for their own vested interests. For instance, contrary to what was propagated, NSEL was always a regulated exchange as brought out by government’s various notifications and the regulatory concerns were being addressed by the highest financial sector body looking after risk, namely, the FSDC.

On the alleged violations of exemptions by NSEL, as I mentioned on Page 88 of my book, the Gazette Notification dated June 5, 2007 itself granted general exemptions to all spot exchanges under Section 27 of the FCR Act.

Regarding the propaganda that NSEL was never a regulated agency, on Page 95 of my book, I have reproduced a letter dated August 8, 2011 written by Rajiv Agarwal, the then Secretary of the Department of Consumer Affairs, reiterating that FMC was the designated regulator for NSEL.

Chirag Shag had raised some concerns expressed by FSDC regarding NSEL. I wonder how the FMC and the DCA allowed the payment crisis to take place when the FSDC had deliberated NSEL way back in 2011? In fact, the DCA had designated FMC as the regulator for spot exchanges in August 2011 and NSEL had been promptly reporting to FMC on all its operations.

All this talk about a regulatory vacuum started only after the DCA ordered its abrupt closure presumably at the behest of the FMC resulting in the payment crisis in July, 2013. Even post-default, the FMC, instead of acting against the defaulters, acted against Shah and his FTIL though there was no evidence against either of them.

Though the FIU had raised the issue of non-compliances by brokers in NSEL, the FMC did not act against them when they indulged in rampant malpractices such as client-code modification and changing their clients KYC to trade without their permission.

Only now, the SEBI is correcting the wrongdoings committed by FMC since it has also issued show cause notices to top brokerage firms on why they should not be declared ‘not fit and proper’ following their conduct on NSEL.

An exchange does not “lend to borrowers” or “accept deposits from investors”. It only provides a platform for two willing parties to trade –to buy and sell – through their respective intermediaries.

The book brings into the public domain larger issues of policy, regulation, business rivalry and the implication of closure of the market which I saw in handling of NSEL crisis and the annihilation of a first-generation globally accomplished professional Shah, and his FTIL Group.

)

)

)

)

)

)

)

)

)