Japan's government bond (JGB) yields have climbed and may be headed even higher, but the yen wasn't likely to follow suit, analysts said.

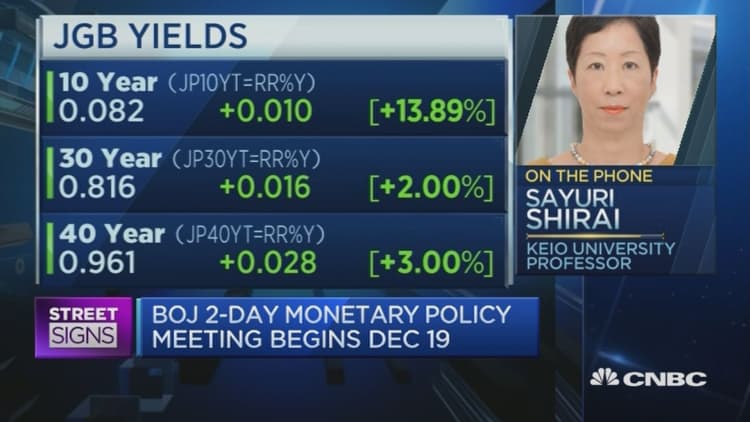

The benchmark 10-year JGB yield has climbed to around 0.08 percent, after crossing into positive territory in mid-November. Bond yields move inversely to prices.

That's a slight departure from the Bank of Japan's policy, introduced at its late-September meeting, of using yield-curve control as a monetary policy tool, setting its target yield for the benchmark bond at zero.

That target may be headed higher, Sayuri Shirai, a professor at Keio University and a former member of the BOJ, told CNBC's "Street Signs" on Tuesday.

"The BOJ at this moment hasn't done any intervention in the JGB market," she noted. "I think in the first half of next year probably the BOJ should raise their 10-year target from around zero percent to around 1 percent or into a range between zero to 1 percent."

Previously, the BOJ had been willing to intervene to keep the benchmark bond in line with its zero percent target. In mid-November, the central bank offered a special bond buying operation, helping to boost bond prices and bring the benchmark's yield closer to its target.

A rise in U.S. Treasury yields, with the U.S. Federal Reserve widely expected to hike interest rates at its meeting this week, has also pushed up bond yields globally, including Japan's.

Shirai also expected the BOJ would begin tapering its asset purchases under its quantitative easing program, which would also likely push up JGB yields.

The policy shift theoretically means that the BOJ can buy fewer bonds as it would only need to time its purchases for when the yield curve moves away from its target. That would help ease concerns that the central bank, which already owns more than a third of all JGBs, would run out of bonds to buy as it continued with its planned 80 trillion yen (around $693.92 billion) annual pace of expansion of its monetary base.

When it comes to tapering, Shirai said, "I think they already started to do it implicitly, because if you look at the current level of JGB purchases, I think they reduced by a few trillion yen already."

She added that the shift to a yield-rate targeting program would also reduce the need to purchase as many JGBs.

But at the same time, Shirai expected the higher JGB yields wouldn't support the yen, pointing to the Fed's meeting this week. Higher bond yields would usually make a currency more attractive, spurring inflows.

"If the Fed starts to raise their expected number of rate hikes from next year from current two times to three times and if they also revise their inflation [and] real GDP growth upward for 2017, this may lead to further yen depreciation," she said.

That's on top of the Japanese currency's recent sharp drop, with climbing over 116 yen on Monday, compared with levels around 103 yen at the beginning of November. On Wednesday at around 9:05 a.m. HK/SIN, the dollar was fetching 115.15 yen

Others also expect the yen to head lower.

Capital Economics said in a note on Monday that it expected the dollar would fetch as much as 120 yen by the end of 2017.

That's despite expecting the BOJ will stand pat on policy amid signs that spare capacity in the economy was narrowing and growth in part-time wages had picked up, suggesting price pressures would strengthen ahead.

"We now expect the Bank to leave policy settings unchanged for the foreseeable future. But we also expect the Federal Reserve to tighten policy by more than the markets are currently expecting, so the depreciation of the yen has further to run," Capital Economics said.

But others expected that the yen may have hit a trough in the near term.

"We believe the dollar/yen rally is ripe for a short-term correction toward 110," Shusuke Yamada, a foreign-exchange strategist at Bank of America Merrill Lynch, said in a note dated Monday, citing expectations for profit-taking.

He said the recent sharp move in the yen appeared to be "increasingly speculative," with fast money into yen short positions likely getting crowded as gross short positions hit their highest level in around a year.

Yamada said that a further rally in the dollar/yen could spur diplomatic concerns amid President-elect Donald Trump's rhetoric on trade, a possibility that may spur uncertainty over the government's currency policy.

But while he forecast a near-term correction, longer term, Yamada expected that the bull market in the dollar/yen would push the pair toward 120 next year.

—By CNBC.Com's Leslie Shaffer; Follow her on Twitter @LeslieShaffer1