The significant borrowing by the SME sector was surprising as these enterprises had been seen retiring debt in the quarter in previous years.

“Average SME financing growth in the third quarter contracted by 5.4% during CY11-15,” the State Bank of Pakistan (SBP) said in its quarterly performance review of the banking sector.

The central bank has cut interest rate by 4.25 percentage points since November 2014 to 5.75% as inflation remains benign and private sector needs credit to expand and set up new businesses.

The SBP said SME financing picked up 9.2% (Rs27.4 billion) during the July-September quarter. The rise has been broad-based potentially for working capital, fixed investment and trade finance needs.

There may be two major reasons behind this break from the past, the SBP said.

First, with a view to broadening the coverage of SMEs, the regulations were revised to enhance parameters for the identification of SMEs. Banks had been allowed to segregate/re-balance their advances portfolio by the end of September 2016.

Secondly, in January 2016, the SBP set SME financing targets for banks where the assigned target was related to the size, branch network and existing SME portfolio of the banks.

Auto financing

The low interest rate regime also revived auto financing in the quarter, as it accounted for about 73% (Rs7.1 billion) of the total consumer financing of Rs9.7 billion.

“Auto financing has been on the rise for the last few years and its share in consumer financing has been increasing as well. This higher growth is backed by consistently higher auto production, which went up by 12.7% (year-on-year) … and could rise further if the planned investment takes place,” the SBP said.

The central bank said consumer financing had continued on the steady growth path with 2.9% rise in Q3CY16 (year-on-year 9.7%) on account of auto financing (6.4%), mortgage loans (5%) and credit cards (5.7%).

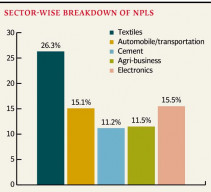

In the corporate sector, automobile and transportation, energy and financial sectors were also seen increasing their borrowing under the favourable interest rate regime.

However, majority of the other sectors including textile, agribusiness, chemical and pharmaceuticals, cement and sugar were retiring their loans in the quarter.

With this, assets of the banking sector declined by 1.6% during Q3CY16 compared to 2.1% rise during Q3CY15.

“The dip in assets has been driven by seasonal decline in advances by the private sector and commodity operation financing along with reduction in banks’ investments in government securities. On the funding side, borrowings from financial institutions - mostly from the SBP - have declined 12.7% while deposits have observed a nominal growth of 0.6%,” the SBP said.

Branch network

Despite the seasonal slowdown in bank financing to the private sector in the quarter ended September 30, the banking sector has continued to invest in infrastructure, which is reflected in the expansion of branch network, absorption of fresh employees and rise in ATMs and credit cards, according to the SBP.

The central bank said in its quarterly performance review that total bank branches in Pakistan surged to 13,119 in the quarter under review from 13,033 in the previous quarter ended June 30, 2016.

Similarly, the number of online branches increased to 12,527 in the last quarter from 12,442 in the prior quarter.

The number of ATMs rose by 3.4% to 11,100 from 10,736; Point of Sales increased 4.9% to 52,201 from 50,072; ATM cards rose by 0.7% to 4.79 million from 4.76 million; credit cards increased by 2.8% to 1.43 million from 1.39 million; debit cards rose by 3.5% to 27.42 million from 26.48 million and the number of full-time employees at banks rose 1.3% to 186,406 in the July-September quarter from 184,022 in the previous quarter.

Published in The Express Tribune, December 9th, 2016.

Like Business on Facebook, follow @TribuneBiz on Twitter to stay informed and join in the conversation.

COMMENTS

Comments are moderated and generally will be posted if they are on-topic and not abusive.

For more information, please see our Comments FAQ