IN creating long-term wealth, the power of compounding works like an income-generating machine. Simply multiplying your investment by re-investing the earnings and making it grow can take care of many long-term financial needs such as children’s education and retirement.

The magic of compounding means earnings on the past earnings plus the principal amount. To make compounding work in your favour, invest in those financial assets which give higher returns. For instance, if R1 crore is left in your savings account for three decades, it will fetch R3 crore at 4% per annum. Safer assets like fixed deposits at 7% interest per annum can get you around R7 crore. If the same principal is invested in equities, which is, of course, risky, the amount at the end of 30 years can potentially grow to R60 crore at 15% growth per annum.

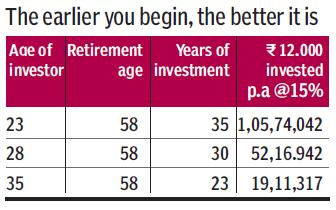

So, while investing one must keep in mind that the portfolio should maximise earnings potential; after that time and reinvesting will bring into play the magic of compounding. One just has to start early and stay invested for a longer time.

Wealth creation

Before investing in a financial product and to make the power of compounding work in the long run, the investor must work out the inflation risk, interest rate risk, market volatility and tax efficiency. If an investor invests in fixed deposits at the rate of 7% per year, then the post tax returns will be close to only 5%. In the long run, such instruments are incapable of meeting inflation, let alone beating it. However, for some investors comfort is in assured returns and capital protection.

MF: the SIP way

In mutual funds, the power of compounding works through systematic investment plans (SIPs). When the value of a unit goes up, investors make capital gains and the money that the investor earns as capital gains also generates returns.

SIPs allow the investor to buy units on a given date each month. One can start with a minimum amount of only R500. One of the biggest advantages of an SIP is that the investor does not have to time the market. When an investor times the market, he usually misses out on the rally or enters the market at the wrong time—either the valuations have peaked or the markets are on the verge of declining. Investing every month ensures that one is invested during the highs and the lows.

Long-term investors gain the most if the returns are reinvested.

For instance, if one invests R1,000 per month every month in SIP, the amount will become R1,64,000 in 10 years at a very conservative 8% annual rate of return. If the investor invests for another 10 years, then the money will grow to R4,47,000. So, this is the gain for an investor due to the power of compounding.

The other advantage, analysts say, is that SIPs make the volatility in the market work in favour of an investor and help average out the cost. This is called rupee cost averaging. For instance, with R1,000, one can buy 50 units at R20 per unit or 100 units at R10 per unit, depending on whether the market is up or down. More units are purchased when a scheme’s net asset value (NAV) is low and fewer units are bought when the NAV is high.

An investor must see wealth management as setting long-term financial goals and balancing the various risks and protection. Such an approach will make the power of compounding work the most.