Trending

This story is from December 3, 2016

Post demonetisation, LIC earns Rs 1400 crore in one day

As a result of SBI slashing its bulk deposit rates by 1.9% on November 23 in the aftermath of demonetisation, LIC of India garnered over Rs 1400 crore (Rs 1479,13,01,547) in just one of its policies, Jeevan Akshay VI Plan, which promises 7.6% interest rate.

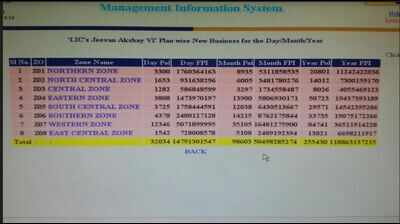

LIC Jeevan Akshay VI Plan growth for November month post demonetisation

AGRA: As a result of SBI slashing its bulk deposit rates by 1.9% on November 23 in the aftermath of demonetisation, LIC of India garnered over Rs 1400 crore (Rs 1479,13,01,547) in just one of its policies, Jeevan Akshay VI Plan, which promises 7.6% interest rate.

According to LIC data assessed by TOI, the insurance corporation had a total of 32,034 people buying the scheme in one day while the total windfall for LIC from this scheme in November has been Rs 5047,82,85,274 crore.A total of 98,603 person took this policy in the entire month.

The cut in deposit rates of SBI is because of a fall in the cost of funds, as the banking system is flush with funds ever since the government scrapped Rs 500 and Rs 1,000 notes.

Speaking to TOI, LIC’s senior divisional manager of Agra zone, S K Pandey said, “The windfall gain is a result of sudden slash in bulk deposit rates by various public and private banks. Banks, like SBI who have recorded high liquidity after the demonitisation, were forced to reduce down the interest rates, which prompted customers to opt for Jeevan Akshay VI plan, which offers 7.6 % interest and that too for entire life.”

From December 1, 2016, the interest of Jeevan Akshay VI plan has been averagely reduced to 0.5%.

On anonymity, a senior LIC agent said, “Right from Dadar to Lucknow, people have paid premium for the pension policy in crore. One customer from Lucknow’s Aminabad paid Rs 4 crore cheque, while on customer paid Rs 50 crore in Dadar.”

As a product, Jeevan Akshay had been languishing for years as returns were not considered attractive when compared to small savings schemes. However, post-demonetisation, banks have started cutting deposit rates and with indications that the Reserve Bank of India might cut rates in December, there were fears that deposit rates might fall further. Jeevan Akshay is an annuity plans which provides fixed returns like a bond throughout the life of the policyholder.

According to LIC data assessed by TOI, the insurance corporation had a total of 32,034 people buying the scheme in one day while the total windfall for LIC from this scheme in November has been Rs 5047,82,85,274 crore.A total of 98,603 person took this policy in the entire month.

The cut in deposit rates of SBI is because of a fall in the cost of funds, as the banking system is flush with funds ever since the government scrapped Rs 500 and Rs 1,000 notes.

Speaking to TOI, LIC’s senior divisional manager of Agra zone, S K Pandey said, “The windfall gain is a result of sudden slash in bulk deposit rates by various public and private banks. Banks, like SBI who have recorded high liquidity after the demonitisation, were forced to reduce down the interest rates, which prompted customers to opt for Jeevan Akshay VI plan, which offers 7.6 % interest and that too for entire life.”

He said, “Those person who took the scheme prior to November 30 will enjoy pension every month till his death bed. It’s a win-win deal both for customer and LIC.”

From December 1, 2016, the interest of Jeevan Akshay VI plan has been averagely reduced to 0.5%.

On anonymity, a senior LIC agent said, “Right from Dadar to Lucknow, people have paid premium for the pension policy in crore. One customer from Lucknow’s Aminabad paid Rs 4 crore cheque, while on customer paid Rs 50 crore in Dadar.”

As a product, Jeevan Akshay had been languishing for years as returns were not considered attractive when compared to small savings schemes. However, post-demonetisation, banks have started cutting deposit rates and with indications that the Reserve Bank of India might cut rates in December, there were fears that deposit rates might fall further. Jeevan Akshay is an annuity plans which provides fixed returns like a bond throughout the life of the policyholder.

End of Article

FOLLOW US ON SOCIAL MEDIA