Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds and investors’ positions as of the end of the third quarter. You can find write-ups about an individual hedge fund’s trades on several financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of YPF SA (ADR) (NYSE:YPF) based on that data.

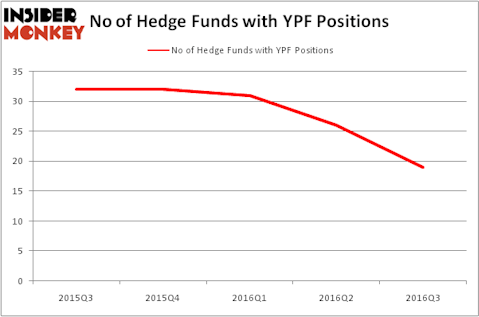

Is YPF SA (ADR) (NYSE:YPF) a buy, sell, or hold? Investors who are in the know are actually turning less bullish. The number of long hedge fund positions decreased by 7 lately. YPF was in 19 hedge funds’ portfolios at the end of September. There were 26 hedge funds in our database with YPF holdings at the end of the previous quarter. At the end of this article we will also compare YPF to other stocks including Lear Corporation (NYSE:LEA), Teck Resources Ltd (USA) (NYSE:TCK), and Torchmark Corporation (NYSE:TMK) to get a better sense of its popularity.

Follow Y P F Sociedad Anonima (NYSE:YPF)

Follow Y P F Sociedad Anonima (NYSE:YPF)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Zorandim/Shutterstock.com

How are hedge funds trading YPF SA (ADR) (NYSE:YPF)?

Heading into the fourth quarter of 2016, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 27% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in YPF over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Discovery Capital Management, led by Rob Citrone, holds the most valuable position in YPF SA (ADR) (NYSE:YPF). Discovery Capital Management has a $107 million position in the stock, comprising 2.3% of its 13F portfolio. Sitting at the No. 2 spot is FinePoint Capital, led by Herb Wagner, which holds a $59.7 million position; the fund has 26.4% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that are bullish consist of Tom Wagner and Ara Cohen’s Knighthead Capital, Zach Schreiber’s Point State Capital and Jonathan Kolatch’s Redwood Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.