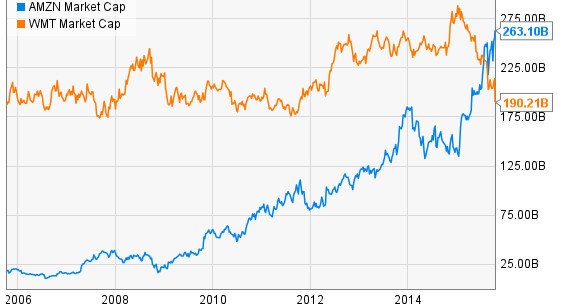

Amazon's bold investment that beat Walmart, Google, Macy's and Wall Street

How to make innovation disappear completely

Who would have predicted that Amazon, launched as a bookstore, would ever surpass Walmart’s market capitalization? No one in 1997, and likely very few in 2005 when Amazon generated a shade more than $500,000 in sales. But today, Amazon is the world’s fifth biggest company, beating Walmart and almost everyone else in market cap. Two core factors drive the brand’s incredible rise: First is Jeff Bezos’ perspective that marketing and customer satisfaction are an inseparable investment to generate revenue and highly individualized product development. Second is Amazon's habit of, as CMO Neil Lindsay puts it, mining "customer feedback and immediately improve products so the new experience disappears into customers' every day."

Amazon’s electric growth is incongruous with our Impression of the company. Their most material touchpoint is a cardboard box, and the logo is stuck in the ‘90s. “We are not great advertisers,” Bezos once told Charlie Rose. I'd argue that's because Amazon is so responsive, so quick to make innovation disappear that we don't give them enough credit.

Beating Google: Inventing the Shopping Web

More than any other company, Amazon redefined the online shopping experience. Amazon created and trademarked 1-Click Ordering. They beat Apple to the tablet punch with the connected Kindle. They so thoroughly outperform Google in online shopping that almost half of Web shoppers go directly to Amazon for product searches. Amazon also pioneered personalized product recommendations, popularized free shipping and returns and accelerated the validation of customer reviews.

In terms of a shopping experience, the cardboard box is actually quite brilliant. It means that Amazon, once again, has delivered. Likely in just a few hours, with no online confusion or in-person support. Bezos likes to say that the best customer service is when the process “just works,” and his roughly 300 million active users must agree. Amazon’s $189 revenue per unique user is more than eBay, Google, Facebook, Tencent, Yahoo, Baidu and Mail.ru—combined and doubled.

Beating Walmart: Faster, Bolder, Smarter

CMO Neil Lindsay says Amazon’s approach is to mine customer feedback and immediately improve products so that the new experience “disappears into our customers’ every day.” Since the brand doesn’t celebrate itself with much fanfare, we take a lot of their work for granted. Walmart hasn’t, however—they just acquired Jet.com for $3b in a strategy to try and catch up with Amazon. But, now that Amazon is our personalized portal to the commercial Web, they are looking to outpace Jet and other competitors and may soon disappear everywhere in fashion, fine art, fresh food, smart homes, newspapers, movies, TV shows, podcasts and, of course, drones. Can Amazon do it?

We will see. Original content and haute couture require more than smooth delivery, and Amazon's upmarket mobility is challenged by low Impression scores. For example, the three-year-old Amazon Art brand is listless, remaining obscure even internally. Amazon thought that easy shopping, massive inventory, and guaranteed returns could sway dealers and shoppers. As we saw from the Gagosian-Hirst split, having a cheerleader is priority No 1 for art sales. Amazon Fire also tanked, Amazon Studios is battling sturdy competition and AmazonFresh reviews aren’t sparkling. In the smart home space, Amazon will be up against more refined brands like Apple and Google.

Beating Macy's: Changing Course after Failure

But Amazon’s stomach for risky experimentation is, at this point, a signature. Amazon has the heart of a startup with the scale of a giant, a unique combination that lets them roll out in India at the same time they experiment with the Washington Post. All the experimentation sparks conversation, feedback, user testing, complaints and compliments. Exactly the kind of fuel that’s driven Bezos’ company since launch.

Amazon Fashion seems to be the blueprint for what to expect from Amazon moving forward. The eCommerce brand learned from Amazon Art that personality, voice, originality and credibility deeply matter. Instead of focusing on free returns and one-click purchasing, which consumers already know, Amazon doubled down on original lifestyle content. They tapped their heritage of compelling storytelling (book reviews, back in the day) to take over a new market.

The brand created East Dane, a curated fashion site run by a former GQ editor. They’re building private labels and sponsoring New York Fashion Week to engage the industry in conversation from a position of power. At the same time, Amazon is attracting less brand- conscious consumers through pricing algorithms that undercut competition. Suddenly, Amazon is dominating retail—almost half of US shoppers buy clothing from Amazon, up 15% from last year. And, by 2017, unstylish Amazon is expected to be America’s biggest apparel dealer. We expect Amazon to continue to rise in XP rankings, market cap and in consumers’ hearts and minds.

A version of this story was originally published on GroupXP. Go there to understand how companies building Experience Capital beat the market and their competitors.

Founder @ 5pm.co.uk / Kooble / simpleERB.com

7yIf they keep growing surely an anti-trust action is inevitable?

Co-Founder at Johnster Inc

7yThanks to customer driven leadership; so easy to understand and frequently challenging to keep as a daily top business priority.

Managing Director presso coccobello sg

7yAmazon is probably and will be the greatest company of our time. Though right now the price of the stock is all over the place and it's really expensive. I'd invest in Walmart any day at the current prices.

A.I. Writer, researcher and curator - full-time Newsletter publication manager.

7yThe real magic happens when in 2017 Echo gets smarter and Amazon gets a better physical foot print with grocery stores and pop-up mall retail shops for its electronics. To expect other companies to "catch up" is a bit unrealistic when you consider the speed and scale of innovation here. Enjoyed the read, good intro, never get tired of this topic.

In need of restructuring your accounts ? Getting some analysis and reporting done on your business ?

7yThis is really a nicely written article. One important thing is missing in my opinion and that is the 3rd party seller problem. If Amazon keeps on getting caught out because of none bona fide or plain fraudulent third party products and sellers, the brand will quickly start suffering. As a matter of fact, it already is. And I can see that in my personal shopping behaviour having started buying through Amazon in around 2000. If I were to draw this in a graph, I am coming down the right side of the distribution slope at the moment.