RED ALERT: Is INDIA's War On Cash Part of A GLOBAL Central Banking Experiment?

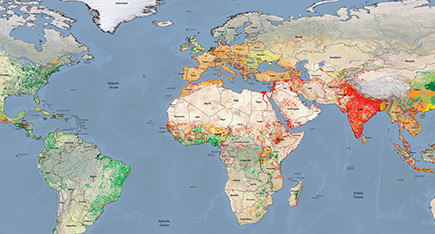

1. A nation of 1.3 billion people has been blind sided and immobilised by the most shocking financial experiment in modern history announced on 8th November 2016, the same date as the United States presidential elections, which was probably not a coincidence because the entire world was watching events in the US.

2. India is a country, with the 7th largest global economy according to the International Monetary Fund (IMF), the central bankers' bank.

3. In her economic size, India lies just behind the United Kingdom and France and ahead of Italy and Brazil, where 90% of the transactions are still carried out in cash. She has had 86% of all notes in circulation in denominations of Rs 500 (USD 7.5) and Rs 1000 (USD 15) phased out with immediate effect. In other words, that paper money has been nullified.

4. Prime Minister Narendra Modi has not consulted parliament before proceeding with this most radical measure presented as a mechanism to curb terrorism and the black economy, which refers to untaxed cash, transactions and financial assets. Whilst the Indian PM may not have informed his parliament, he appears to have certainly been influenced by the leading central bankers of the world to adopt this very extreme and rapid change towards a cashless and digital economy in which every person's every movement becomes totally transparent.

5. Out of all cash transactions, 90% of those are legitimate and form part of the white economy, ie, the taxed economy. Why? Only 6% of black money resides in cash in India and the rest is in properties, gold bullion, stocks, bonds and foreign bank accounts in exotic locations such as Switzerland, Singapore and other offshore tax havens. Many top economists from the West argue that this will grind the vast Indian economy to a halt without necessarily tackling the malaise of black money and untaxed assets as well as giving a heart-attack to the entirety of the Indian sub-continent's industrial supply chain and just-in-time delivery systems.

6. The new money consisting of brand new Rs 500 (USD 7.5) and Rs 2000 (USD 30) notes -- announced by the Indian government -- is not readily available, trillions of which still need to be printed and the present ATM machines are not able to dispense them without recalibration. If something is not done soon, there won't be any ATM machines left to recalibrate if tempers rage.

7. This period of pain that Indians are now going through, most notably by standing in long bank queues to convert old currency into new, is supposed to be good and patriotic according to the Indian government officials. The Indian citizens are told that they are to imagine that they are like soldiers defending the borders of India from enemy attack. More than 55 Indians have already died in those bank queues and the severing of food supply chains may yet cause many multiples more of Indian lives to be lost.

8. What if India is part of a global central banking experiment to understand what happens when other major economies like the United States, the European Union, China and Japan are subjected to a totally cashless world as soon as the next global financial crisis when all transactions are totally digitised and money does not exist outside the virtual realm? At this point, the banks and governments will then have total control over their citizens and all their privacy and sovereignty will be lost forever.

9. Notice, how sovereign bond yields across the world are rising, save in India, after Trump's election. This means that the over indebted economies of the world, primarily Western, are going to become unhinged very soon as the voluminous corporate junk bond market collapses followed by major falls in equity markets to compensate for the higher interest rates, which will stifle growth, make the dollar stronger in the short term, and usher in global recession with possible double digit inflation.

10. As the next financial crisis arrives, in late 2016 or early 2017, much bigger than 1998 which involved Long Term Capital Management (LTCM) and 2008 with Lehman Brothers, it is entirely plausible that as the world liquidity crisis arrives, the trillions of currency units that will need to be printed to bail out all the indebted nation states, derivatives markets and other financial credit instruments, will be printed as Sovereign Drawing Rights (SDRs) of the IMF because faith in the fiat currencies and their connection with sovereign bonds may have totally broken by then.

11. When that happens all currencies, including the US dollar, will become localised to the domestic market and will be internationally convertible only via IMF SDR's reference unit which may be christened "Global Currency Unit" or "GCU". Given that China's currency as of 1st October 2016 is part of the SDR, this means China will be an integral part of the bailout of the hugely indebted nation states. This will be an unprecedented development that will concern every country in the world.

12. The cash in the bank, and assets at stock markets, and everything could be frozen in this cashless new world as everything is redenominated in SDRs, thereby heralding the demise of the individual top currencies including the US Dollar, Euro, Japanese Yen, Pound Sterling and Chinese Yuan. Perhaps the Indian Rupee will at that point also be just denominated in SDRs.

13. It's an assumption, as yet unconfirmed that the single global currency -- the IMF's Special Drawing Rights (SDRs) -- may lead the way to our Brave New Cashless Digital World. In the meantime, the countries will continue with their beloved fiat currencies, but all new versions would be devalued and tied to the SDR.

Key Question: Is The World Ready for an all digital "Global Currency Unit" accessed only via the virtual world?

[ENDS]

What are your thoughts, observations and views?

Watch Video

What's wrong with #India's #DeMonetisation?

ex-PM Dr Manmohan Singh tells Parliament https://youtu.be/pGoGMfib1G0

Data Analytics Consultant

7yVelocity of money is taken to be the number of times a piece of currency changes hands in a given time. The problem is that even the amount of money that is available with the public is not changing hands due to hoarding mentality. To combat this, as a good citizen, I am paying all (or almost all) my payables in cash including salaries to put the cash back in the system as I get access to it. This is of course hugely popular among my vendors and employees. Velocity of money is more important than even the volume of money in circulation. A foreign economist compared demonetising a booming economy to shooting a racing car in the tyres. I agree.

Indian Cement Sector Equity Research

7yEverything will get cut in NET... Soon.. But it was a good article to read the cons..

CEO - Managing Director - Founder - Investor - Startup Enthusiast & Speaker Gov of India Recognized Startup: Recognized Speaker Member of Delhi Government Entrepreneur Program

7yUse OTC Payments Merchant app to accept payment and OTC Payments app to make payment for any amount. Available on android only.

business | finance | engineering

7yRFID implants to be rolled out soon... #CashlessSociety #NWO