- India

- International

Four years into job, Tata Sons chairman Cyrus Mistry out, Ratan Tata to hold fort until new successor

The Mistry family — headed by Cyrus’s father construction baron Pallonji Mistry — which holds around 18 per cent stake in Tata Sons is the largest individual shareholder — and non-Tata shareholder — in the Tata holding company.

The Tata Sons board constituted a Selection Committee to choose a new Chairman for Tata Sons which holds significant stakes in Tata companies. (PTI photo)

The Tata Sons board constituted a Selection Committee to choose a new Chairman for Tata Sons which holds significant stakes in Tata companies. (PTI photo)

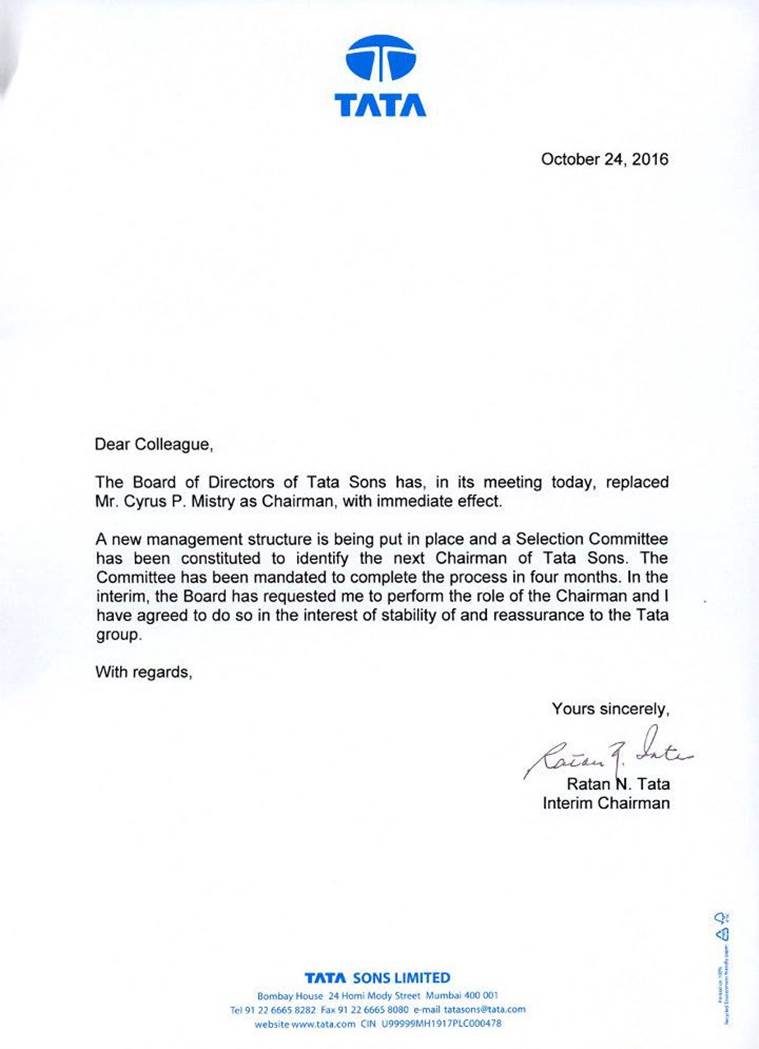

IN a dramatic announcement, nearly four years after taking over as head of the $103-billion automobiles-to-salt conglomerate, Cyrus Pallonji Mistry was “replaced” by the board of Tata Sons, the group’s holding company without any reasons being assigned. Mistry, chosen as Chairman of Tata Sons in November 2011, has been replaced by his predecessor Ratan Tata as interim Chairman. Tata who had retired in 2011 when he turned 75 will now be back at Bombay House, the headquarters of Tata group in Mumbai in the near term until a new chairman is appointed.

WATCH VIDEO: Cyrus Mistry’s Career Timeline

“Tata Sons today announced its board has replaced Mr Cyrus P Mistry as Chairman of Tata Sons. The decision was taken at a board meeting held here today,” a Tata Sons statement said.

READ | Cyrus Mistry: Everything you need to know about the outgoing Tata Sons chairman

Sources said board-room and management issues could be among the reasons. Former Solicitor General Mohan Parasaran confirmed to The Indian Express that the group had sought legal opinion a month ago on “issues relating to management”. “He was replaced due to management issues,” Parasaran said.

The Tata Sons board constituted a Selection Committee to choose a new Chairman for Tata Sons which holds significant stakes in Tata companies. The committee has Ratan Tata, industrialist Venu Srinivasan, investment banker Amit Chandra, ex-diplomat Ronen Sen and economist Lord Kumar Bhattacharyya.

READ | Cyrus Mistry: Here are key business decisions he took for Tata group

“The committee has been mandated to complete the selection process in four months,” the Tata Sons board said in a release after a meeting on Monday.

WATCH VIDEO: Cyrus Mistry Removed As Chairman of Tata Sons: Here’s What Happened

Ratan Tata still controls and chairs the Tata Trusts which hold a major stake in Tata Sons. About 66 per cent of the equity capital of Tata Sons is held by philanthropic trusts endowed by members of the Tata family. The largest of these trusts are the Sir Dorabji Tata Trust and the Sir Ratan Tata Trust, which were created by the families of the sons of Jamsetji Tata, the founder.

READ | ‘Cyrus Mistry replaced in long-term interest of Tata Sons’

The Mistry family — headed by Cyrus’s father construction baron Pallonji Mistry — which holds around 18 per cent stake in Tata Sons is the largest individual shareholder — and non-Tata shareholder — in the Tata holding company. In 2011, Cyrus Mistry was part of the Selection Committee to identify the successor but surprisingly he was picked up as the successor by Ratan Tata. Naval Tata, Ratan Tata’s half brother, was also a contender.

READ | Cyrus Mistry’s Tata journey: Suprise entry, abrupt exit

Several of the group’s big businesses are visibly struggling. Tata Power guzzles capital but has little to show in terms of profit. Tata Teleservices has been caught in a costly row with NTT DoCoMo, a Japanese joint-venture partner. Tata is disputing a $1.2-billion arbitration award against it. Indian Hotels, which operates the Taj group of hotels has also been reporting a lacklustre performance. Tata Motors would have gone down had Jaguar Land Rover, acquired during Ratan Tata’s time, not bailed out the company.

READ | Tatas m-cap: Double under Cyrus Mistry; 57-times under Ratan Tata

There are dozens of other smaller businesses, but they hardly affect the Tata conglomerate’s bottom line.

Tata Steel has been splashed in red ink for several quarters now and it reported multi-fold increase in consolidated net loss in the June quarter at Rs 3,183 crore. Mistry has been unable to find a solution to bring the ailing European business back on track. The UK business, earlier known as Corus, has been an albatross around Mistry’s neck.

READ | Cyrus Mistry was attempting to shake up the $100 billion Tata company

“Seven of the nine-largest listed Tata entities in terms of capital employed have negative economic value added, meaning that their earnings before interest and tax translate into a return below their overall cost of capital. Roughly six in ten rupees deployed by Tata are in businesses yielding returns below its cost of funding, up from three in ten rupees eight years ago,” The Economist had said in an article critical of the Tata empire ‘Mistry’s elephant’ in September this year.

“After retirement, Tata publicly called for his successor to target $500 billion in revenues by 2021, a figure that group executives say is still on the cards. Mistry has shown some signs that he knows what needs to be done. For the moment, however, he appears dangerously content just to sit atop what has grown into an impressive but lumbering pachyderm,” the magazine said.

Every year, a major part of his time — around 700 hours — is spend chairing meetings with the boards of the major operating companies. “He’s very analytical, a numbers guy, but if he has a grand vision he hasn’t shared it,” The Economist had said quoting an employee. While Mistry has not given an interview to the media since taking over, in a statement on September 13 this year he did speak of Tata companies needing “to earn the right to grow”.

According to The Economist, Tata is eyeing still further expansion: defence, infrastructure and financial services are the latest targets. There is a growing sense that it lacks the “refocus” gene altogether. “Nearly four years into Mistry’s tenure, the listless performance that could once have been blamed on things like slowing Chinese demand seems to be entrenched. One former adviser to several Tata CEOs says that ‘the risk is that Tata uses its long-term emphasis and ethical way of doing business as an excuse to tolerate underperformance’,” it said.

Apr 27: Latest News

- 01

- 02

- 03

- 04

- 05