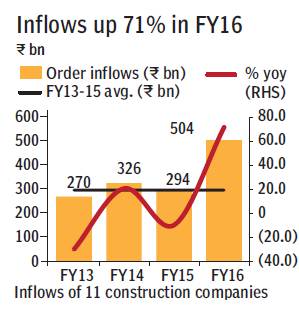

While construction has been a long-term underperformer, we highlight that macro tailwinds for a cyclical uptick are building up. Investment in infrastructure is growing (10% CAGR, up 40% between FY15 and 18E) after stagnating between FY12 and FY15, driving order inflows (up 70% y-o-y in FY16) for the sector. Deleveraging, Infrastructure Investment Trusts (INVITS) and supportive government policies can help further.

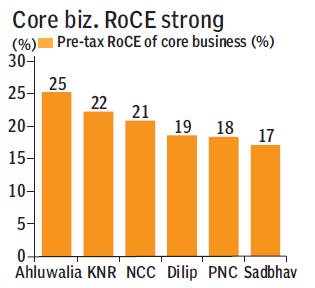

Core EPC returns very strong

Based on the aggregate of 12 listed construction companies, we present key sector trends: (i) order inflow in FY16 is almost 2x from FY13 levels, (ii) in spite of strong inflows, revenues so far up only 11% in FY16, (iii) core EPC returns are strong (20%) and most of the return dilution result from investments in infrastructure assets, real estate, etc. (iv) working capital has remained high and can trend down.

Lower interest rates to buoy further

Our strategy team highlights that inflation and interest rates can be significantly lower versus current expectations. 200 bp. Lower interest rate with 25% higher EBIT can drive 67% growth in PAT for a company that is having 50% of its EBIT being consumed in interest cost. Lower interest cost can drive working cap lower, and execution higher as client financials and end demand improve.

Reiterate outperform on L&T and Sadbhav

We reiterate outperform on L&T (TP increased to R1,925 from R1,825) on likely execution pick up, strong cash flows with reasonable valuations and strong earnings growth. We maintain our OUTPERFORM rating on Sadbhav Engg. (TP increased to R375 from R340) based on stronger traffic growth, benefit of refinancing, lower interest rates, strong medium-term opportunity basket, healthy balance sheet, and no residual construction risk in the BOT projects.

Environment conducive

We highlight that the construction sector is recovering with investment in infrastructure on the rise. This would drive strong revenue recovery as well from now on. Deleveraging on the back of sell down, access to incremental pool of capital through INVITS and supportive government policies (e.g., easier clearances, EPC and hybrid contracts, time bound arbitration and payments post that) can help further. Incremental investment recovery would present more tailwinds for the sector.