- News

- Business News

- India Business News

- Centre-states compromise raises hope of Apr GST rollout

Trending

This story is from September 24, 2016

Centre-states compromise raises hope of Apr GST rollout

New Delhi: The prospects of an April rollout of the goods and services tax brightened on Friday with the Centre and the states agreeing to a compromise formula on two of the three contentious issues and also deciding to subsume all cesses into the levy.

All cesses which are being levied now such as Swacch Bharat, Krishi Kalyan and others will be included under GST to avoid any multiplicity of taxes once the indirect tax reform measure rolls out

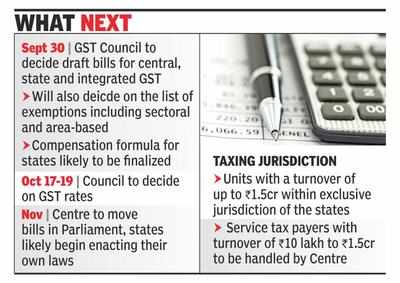

On the other issues, the GST Council decided to fix a turnover threshold of Rs 10 lakh for an entity to be part of the GST net in hilly and north-eastern states.For other states, the floor has been fixed at Rs 20 lakh, finance minister Arun Jaitley announced after the end of the two-day meeting of the GST Council. By the end of the month, the Council hopes to tackle the issue of exemptions and the draft rules with a discussion on GST rates scheduled for October 17-19. All eyes are now on the rates as the impact on sectors would be known once the rates are finalized.

“All decisions today by the GST Council were taken on the basis of consensus,” Jaitley told reporters.

Similarly, the finance ministers opted to keep units with a turnover of up to Rs 1.5 crore within exclusive jurisdiction of the states, addressing concerns of those such as West Bengal. But to tackle the Centre’s concerns, the GST Council agreed that service tax payers with turnover of Rs 10 lakh to Rs 1.5 crore would be handled by the Centre. The finance ministry had argued for dual control over units on the grounds that 93% of the assessees in the lower turnover segment were service tax payers and states had virtually no experience in this segment.

On the third issue of working out a compensation formula, the state finance ministers agreed to discuss the issue further. While the base year will be 2015-16, finance minister Arun Jaitley told reporters that three options are being explored. One option is to assume a fixed rate of revenue growth. the second is to use the average for the three best years out of the past five, while a third option is to exclude the two best years during the last five and then calculate the average growth. This will then be used as the benchmark to calculate compensation based on the actual collection data for the financial year.

“Entities will have to handle the fact that there will be different threshold in different states. It may not be ideal but you have it under VAT,” said Harishanker Subramaniam, Indirect Tax Leader at consulting firm at EY.

While maintaining that the decision to subsume all cesses provided clarity to the industry, Pratik P Jain, leader, indirect tax at PwC India said, “Enhancing the annual turnover for exemption to Rs 20 lakh (except north-east) from Rs 10 lakh contemplated earlier would be administratively easier for the government as several small businesses would be out of GST ambit. Industry would also welcome the move to have a single assessing authority, instead of having a dual system of assessment and scrutiny, which was a major concern for businesses.”

The move to set the Rs 20 lakh as threshold will benefit states such as West Bengal and come as a relief for small enterprises.

“23,000 small business in West Bengal will go out of the tax net and the revenue loss will be only 0.37%. It is big relief for the small businesses in the state. This was a point which our chief minister wanted to be included and that is why we are supporting GST,” West Bengal finance minister Amit Mitra told TOI. He said the decisions finalized by the Council was a “big victory for states and the Centre.”

Experts said the next meeting of the Council would be keenly watched.

“Eyes would be set on Council’s meeting proposed mid-October when discussion on GST rates and slabs is on agenda. Decision on rates is a big missing link in India Inc’s ability to quantify the potential impact of GST on their businesses and accordingly revisit their pricing structure and distribution costs,” Rajeev Dimri , leader inidrect tax at tax consultancy BMR and Associates LLP.

All cesses which are being levied now such as Swacch Bharat, Krishi Kalyan and others will be included under GST to avoid any multiplicity of taxes once the indirect tax reform measure rolls out

On the other issues, the GST Council decided to fix a turnover threshold of Rs 10 lakh for an entity to be part of the GST net in hilly and north-eastern states.For other states, the floor has been fixed at Rs 20 lakh, finance minister Arun Jaitley announced after the end of the two-day meeting of the GST Council. By the end of the month, the Council hopes to tackle the issue of exemptions and the draft rules with a discussion on GST rates scheduled for October 17-19. All eyes are now on the rates as the impact on sectors would be known once the rates are finalized.

“All decisions today by the GST Council were taken on the basis of consensus,” Jaitley told reporters.

The move to have two cut-offs may be cumbersome for entities operating in multiple states but helps those states that come on board such as Uttar Pradesh, Tamil Nadu and the hilly and north eastern states. They were of the view that the proposed Rs 25 lakh threshold would result in the exclusion of several units, causing revenue loss.

Similarly, the finance ministers opted to keep units with a turnover of up to Rs 1.5 crore within exclusive jurisdiction of the states, addressing concerns of those such as West Bengal. But to tackle the Centre’s concerns, the GST Council agreed that service tax payers with turnover of Rs 10 lakh to Rs 1.5 crore would be handled by the Centre. The finance ministry had argued for dual control over units on the grounds that 93% of the assessees in the lower turnover segment were service tax payers and states had virtually no experience in this segment.

On the third issue of working out a compensation formula, the state finance ministers agreed to discuss the issue further. While the base year will be 2015-16, finance minister Arun Jaitley told reporters that three options are being explored. One option is to assume a fixed rate of revenue growth. the second is to use the average for the three best years out of the past five, while a third option is to exclude the two best years during the last five and then calculate the average growth. This will then be used as the benchmark to calculate compensation based on the actual collection data for the financial year.

“Entities will have to handle the fact that there will be different threshold in different states. It may not be ideal but you have it under VAT,” said Harishanker Subramaniam, Indirect Tax Leader at consulting firm at EY.

While maintaining that the decision to subsume all cesses provided clarity to the industry, Pratik P Jain, leader, indirect tax at PwC India said, “Enhancing the annual turnover for exemption to Rs 20 lakh (except north-east) from Rs 10 lakh contemplated earlier would be administratively easier for the government as several small businesses would be out of GST ambit. Industry would also welcome the move to have a single assessing authority, instead of having a dual system of assessment and scrutiny, which was a major concern for businesses.”

The move to set the Rs 20 lakh as threshold will benefit states such as West Bengal and come as a relief for small enterprises.

“23,000 small business in West Bengal will go out of the tax net and the revenue loss will be only 0.37%. It is big relief for the small businesses in the state. This was a point which our chief minister wanted to be included and that is why we are supporting GST,” West Bengal finance minister Amit Mitra told TOI. He said the decisions finalized by the Council was a “big victory for states and the Centre.”

Experts said the next meeting of the Council would be keenly watched.

“Eyes would be set on Council’s meeting proposed mid-October when discussion on GST rates and slabs is on agenda. Decision on rates is a big missing link in India Inc’s ability to quantify the potential impact of GST on their businesses and accordingly revisit their pricing structure and distribution costs,” Rajeev Dimri , leader inidrect tax at tax consultancy BMR and Associates LLP.

End of Article

FOLLOW US ON SOCIAL MEDIA