In a massive infusion of liquidity that has driven down yields sharply, the Reserve Bank of India has, since April, bought government bonds worth over R1 lakh crore through open market operations (OMOs).

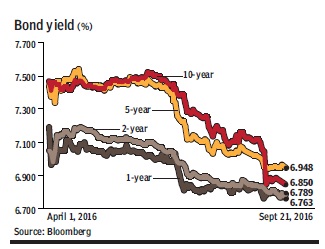

Yields on government bonds have fallen anywhere between 25-60 basis points over this period. For instance, the 10-year benchmark yield has fallen by around 60 basis points with the new 10-year gilt now trading at 6.85%. The yields on the 5-year, 2-year and 1-year paper have seen falls of 48 bps, 26 bps, and 43 bps respectively; the yield on the 2-year paper hit over a 6-year low at 6.77% earlier this month.

In his final monetary policy review as the governor of the RBI, Raghuram Rajan had observed that liquidity conditions had eased significantly during June and July on the back of increased spending by the government but had also pointed out that the regulator’s OMOs had also helped in easing liquidity conditions.

“The injection of durable liquidity through purchases under open market operations (OMOs), amounting to R80,500 crore billion so far, also helped in easing liquidity conditions, bringing the system-level ex ante liquidity deficit to close to neutrality.” Rajan had said.

The central bank has been trying to aid transmission of lower policy rates into lending rates by ensuring there is adequate liquidity in the system. However, there has been far less transmission in the banking system than there has been in the money markets where rates have fallen significantly.

As a result of RBI purchasing bonds, banks across the system had surplus cash in hand which led to increased inflow into non-SLR securities like commercial paper and corporate bonds. In the period under review, yields on AAA-rated 10-year corporate bonds fell by over 60 bps and are currently hovering around the 7.75% level. Yields on A1-rated 3-month commercial paper fell even more, around 95 bps, to 6.92% as measures by the RBI to improve liquidity in the money market resulted in increased investment in these instruments by banks and mutual funds.

“In our view, the sharp decline in yields in India reflects the easier liquidity conditions in India due to large OMO by the RBI rather than large FPI inflows in the debt market,” Kotak Institutional Equities said in a report on Wednesday. “The RBI seems comfortable with the inflation trajectory and external conditions, despite forthcoming FCNR(B) redemption, to keep liquidity conditions sufficiently loose.”

The brokerage added that a 25-50 bps cut in interest rates by the RBI has already been factored in the recent decline in yields across tenures.

Speaking about the fall in yields across asset classes, Kartik Srinivasan, senior vice-president at ICRA, reiterated that the RBI’s OMOs have resulted in banks holding surplus cash in their hands. “Credit offtake has been extremely low so banks have turned to instruments like corporate bonds and CPs, which has improved the liquidity in those markets and resulted in a decline in yields. Also, inflow into mutual funds and insurance segments has also been quite robust and a combination of all this has resulted in liquidity being quite comfortable at the moment,” he said.

Srnivasan added that the picture on our liquidity position will become clearer once the FCNR(B) redemptions start at the end of September. “The RBI looks to be quite confident that the FCNR(B) redemption won’t impact liquidity in a major way this time around, but we can only be sure of that once it happens. So I think the October-November period would be very crucial to determine what our liquidity psoition really is,” he said.