Ron Baron Boosts Position in Inovalon

- By Sydnee Gatewood

Ron Baron (Trades, Portfolio) of Baron Funds further increased his position in Inovalon Holdings Inc. (INOV) by 12.35% on Aug. 31.

Warning! GuruFocus has detected 1 Warning Sign with INOV. Click here to check it out.

The intrinsic value of INOV

Baron founded Baron Capital Management in 1982 and serves as CEO, CIO and trustee. He is a co-portfolio manager of Baron Asset Funds and the portfolio manager of the Growth and Partners Funds. He likes to invest in companies with open-ended growth and defensible niches. He applies bottom-up company research, invests for the long term and purchases companies at what he believes are attractive prices. On average, Baron holds investments longer than five years.

Baron purchased 1,604,039 shares for $15.7 per share. The transaction had an impact of 0.13% on the portfolio. He has had a position in Inovalon since the first quarter of 2015 and now holds 14,590,962 shares.

Inovalon is a health care data and analytics company. The company was founded in 1998 and is headquartered in Bowie, Maryland.

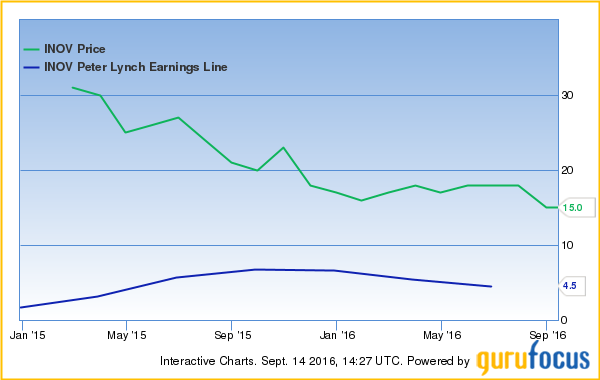

The company has a market cap of $2.4 billion with an enterprise value of $1.9 billion. It has a price-earnings (P/E) ratio of 52.2, a price-book (P/B) ratio of 3.1 and a price-sales (P/S) ratio of 5.2.

GuruFocus ranked Inovalon's financial strength 7 of 10. The Altman Z-Score of 5.8 places the company in the safe zone, meaning it is not at risk of bankruptcy. Its cash-debt ratio is 2.7, far below the industry median of 11.3.

GuruFocus ranked the company's profitability and growth 4 of 10. Its operating margin is 16.6% and its net margin is 9.9%. It has a return on equity (ROE) of 6.12% and a return on assets (ROA) of 4.1%, which rank above 51% and 57% of other companies in the industry.

The DCF Calculator gives the stock a fair value of $3.21; it was trading at $15.72 on Wednesday.

Among the gurus, Paul Tudor Jones (Trades, Portfolio) and Vanguard Health Care Fund (Trades, Portfolio) also hold positions in Inovalon.

Disclosure: I do not own stock in any companies mentioned in the article.

Start a free 7-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 1 Warning Sign with INOV. Click here to check it out.

The intrinsic value of INOV