Alan Fournier Sold 6 Holdings in 2nd Quarter

- By David Goodloe

Alan Fournier (Trades, Portfolio), founder and manager of Pennant Capital, sold six holdings in the second quarter, including two with connections to the airline industry.

Warning! GuruFocus has detected 3 Warning Sign with MIDD. Click here to check it out.

The intrinsic value of MIDD

The guru's largest divestiture of the quarter was the sale 1,133,832 shares in The Middleby Corp. (MIDD), an Illinois-based commercial cooking equipment company, for an average price of $114.64. The deal had a -3.46% impact on the portfolio.

Middleby's leading shareholder among the gurus is Ron Baron (Trades, Portfolio) with a stake of 2,605,017 shares. The stake is 4.53% of Middleby's outstanding shares and 1.6% of the guru's total assets.

Middleby has a price-earnings (P/E) ratio of 30.89, a forward P/E of 22.27, a price-book (P/B) ratio of 5.54 and a price-sales (P/S) ratio of 3.37. GuruFocus gives Middleby a Financial Strength rating of 6/10 and a Profitability and Growth rating of 8/10 with return on equity (ROE) of 19.18% that is higher than 87% of the companies in the Global Diversified Industrials industry and return on assets (ROA) of 8.49% that is higher than 83% of the companies in that industry.

Middleby sold for $122.93 per share at market close Friday. The DCF Calculator gives Middleby a fair value of $98.61.

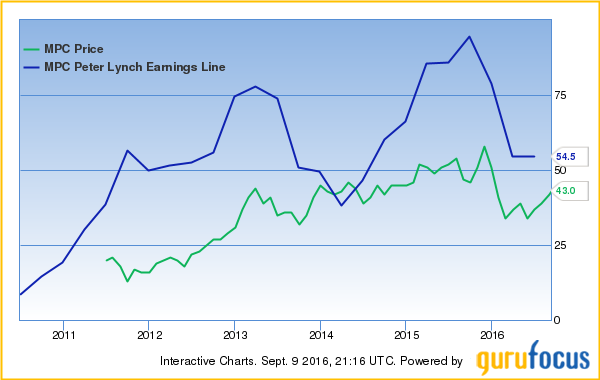

The guru sold a 2,550,166-share stake in Marathon Petroleum Corp. (MPC), an Ohio-based oil and gas company, for an average price of $36.74 per share. The deal had a -2.71% impact on the portfolio.

Marathon's leading shareholder among the gurus is Barrow, Hanley, Mewhinney & Strauss with a stake of 24,511,104 shares. The stake is 4.64% of Marathon's outstanding shares and 1.42% of the guru's total assets.

Marathon has a P/E ratio of 11.60, a forward P/E of 12.38, a P/B ratio of 1.68 and a P/S ratio of 0.35. GuruFocus gives Marathon a Financial Strength rating of 5/10 and a Profitability and Growth rating of 7/10 with ROE of 15.23% that is higher than 65% of the companies in the Global Oil & Gas Refining & Marketing industry and ROA of 5.10% that is higher than 57% of the companies in that industry.

Marathon sold for $42.24 per share Friday. The DCF Calculator gives Marathon a fair value of $38.88.

The guru sold a 1,488,100-share stake in United Continental Holdings (UAL), a Chicago-based airline holding company, for an average price of $47.51 per share. The divestiture had a -2.54% impact on the portfolio.

United Continental's leading shareholder among the gurus is PRIMECAP Management (Trades, Portfolio) with a stake of 19,587,105 shares. The stake is 6.08% of United Continental's outstanding shares and 0.86% of the guru's total assets.

United Continental has a P/E ratio of 2.93, a forward P/E of 8.36, a P/B ratio of 2.26 and a P/S ratio of 0.54. GuruFocus gives United Continental a Financial Strength rating of 5/10 and a Profitability and Growth rating of 7/10 with ROE of 87.75% that is higher than 97% of the companies in the Global Airlines industry and ROA of 16.11% that is higher than 91% of the companies in that industry.

United Continental sold for $52.45 per share Friday. The DCF Calculator gives United Continental a fair value of $190.49 with a 72% margin of safety.

The guru sold a 1,664,150-share stake in Delta Air Lines (DAL), an Atlanta-based airline, for an average price of $42.61 per share. The transaction had a -2.31% impact on the portfolio.

Delta's leading shareholder among the gurus is PRIMECAP Management (Trades, Portfolio) with a stake of 19,473,230 shares. The stake is 2.6% of Delta's outstanding shares and 0.76% of PRIMECAP's total assets.

Delta has a P/E ratio of 6.12, a forward P/E of 6.95, a P/B ratio of 2.48 and a P/S ratio of 0.77. GuruFocus gives Delta a Financial Strength rating of 6/10 and a Profitability and Growth rating of 7/10 with ROE of 44.47% that is higher than 84% of the companies in the Global Airlines industry and ROA of 9.05% that is higher than 72% of the companies in that industry.

Delta sold for $37.75 per share Friday. The DCF Calculator gives Delta a fair value of $65.82 with a 43% margin of safety.

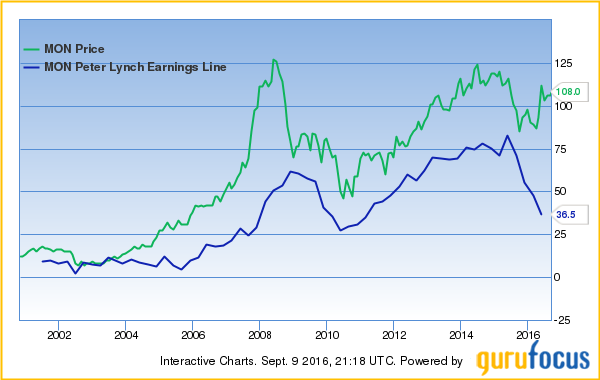

The guru sold 700,440 shares in Monsanto (MON), a Missouri-based biotechnology company, for an average price of $98.88 per share. The deal had a -1.75% impact on the portfolio.

Monsanto's leading shareholder among the gurus is PRIMECAP Management (Trades, Portfolio) with a stake of 11,370,263 shares. The stake is 2.6% of Monsanto's outstanding shares and 1.25% of PRIMECAP's total assets.

Monsanto has a P/E ratio of 43.23, a forward P/E of 22.47, a P/B ratio of 9.13 and a P/S ratio of 3.58. GuruFocus gives Monsanto a Financial Strength rating of 5/10 and a Profitability and Growth rating of 8/10 with ROE of 18.33% that is higher than 80% of the companies in the Global Agricultural Inputs industry and ROA of 4.90% that is higher than 60% of the companies in that industry.

Monsanto sold for $106.78 per share Friday. The DCF Calculator gives Monsanto a fair value of $69.18.

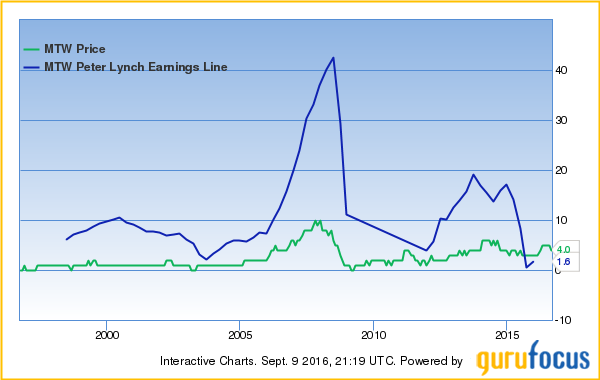

The guru sold 708,200 shares in Manitowoc (MTW), a Wisconsin-based manufacturer of heavy equipment, for an average price of $5.42 per share. The divestiture had a -0.09% impact on the portfolio

Carl Icahn (Trades, Portfolio) is Manitowoc's leading shareholder among the gurus with a stake of 10,582,660 shares. The stake is 7.69% of Manitowoc's outstanding shares and 0.28% of the guru's total assets.

Manitowoc has a forward P/E of 54.05, a P/B ratio of 0.83 and a P/S ratio of 0.25. GuruFocus gives Manitowoc a Financial Strength rating of 5/10 and a Profitability and Growth rating of 6/10 with ROE of -20.41% that is lower than 89% of the companies in the Global Farm & Construction Equipment industry and ROA of -5.46% that is lower than 83% of the companies in that industry.

Manitowoc sold for $4.6 per share Friday. The DCF Calculator gives Manitowoc a fair value of $-12.31.

Disclosure: I do not own any stocks mentioned in this article.

Start a free seven-day trial of Premium Membership to GuruFocus.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 3 Warning Sign with MIDD. Click here to check it out.

The intrinsic value of MIDD