Can Global LED Market Growth Light Up IQ Group Holdings’ Prospects?

Remember the first time you walked into a room that automatically lights up? While rare in the past, many buildings are now equipped with smart lighting systems, which uses sensors to detect and control lighting to achieve energy efficiency.

Today, sensors are also commonly used in numerous applications including car park space monitoring, central heating and air-conditioning systems (using thermostats) and speed cameras. As the world move towards the vision of the Internet of Things (IoT), sensors which can collect and transmit data back to cloud servers play an important role.

With potential seen in the market for sensor-based products, we zoom in on IQ Group Holdings (IQ Group), a motion sensor lighting producer listed in Malaysia.

Business – Most Revenue from Europe, Japan, and the US

IQ Group, founded in Penang, Malaysia in 1989, is principally engaged in the design and manufacturing of sensor products which includes passive infrared detectors, motion sensor light controllers, wireless video communication devices, door bells and home security system products.

Subsequently, the group formed a joint venture with Taiwan-based SemiLEDs Optoelectronics Co to diversify into the development, design and manufacture of light-emitting diode (LED) luminaires, hoping to ride on the growing LED market.

The company operates under both the original equipment manufacturer (OEM) and original design manufacturer (ODM) business models, with manufacturing facilities located in Penang and Dongguan, China. The group derives most of its revenue from customers in Europe, Japan and the US, and main customers of the firm are said to include big names like OSRAM, OPTEX Co and Hager.

The core technologies of the firm focus on passive infrared (PIR) sensors which operate by monitoring the background ‘temperature’), and wire-free door chimes and video intercom systems.

IQ Group’s core technologies, Source: Company

Turnaround Story – Recovered from GFC; Revenue and Net Profit Growing

Looking at IQ Group’s past operating performance, things were not all smooth for the firm. The company fell into losses for three consecutive financial years from FY09 to FY11 before making a turnaround in FY12.

The group’s performance in those periods was dragged down by poor economic conditions during the global financial crisis, coupled with a rise in manufacturing costs, particularly in China. IQ Group then underwent a successful restructuring exercise (completed in FY11) and streamlined its processes to improve efficiency and reduce costs, which helped return it to profitability.

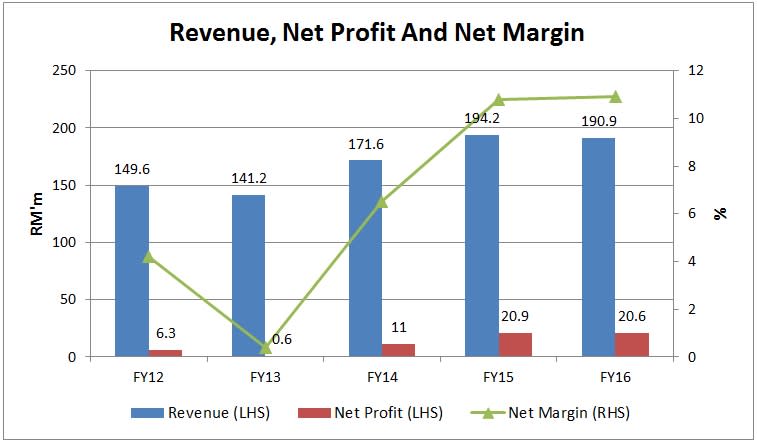

In the past five financial years from FY12 to FY16, the firm’s top and bottom lines have been on a general uptrend. Revenue and net profit grew at compounded annual growth rate of 6.3 percent and 35 percent over the period to reach RM190.9 million and RM20.9 million respectively.

While there was a dip in earnings in FY13, we note that it was due to foreign exchange loss of RM1.6 million and the absence of disposal gains amounting to RM4.2 million recorded in FY12. Net margin has also been improving and held steady at 10.8 percent and 10.9 percent for FY15 and FY16 respectively.

Source: Company

Strong Balance Sheet And Cash Flows – 30% of Market Cap

In terms of financial strength, IQ Group boasts a cash-rich balance sheet that is free of debts. As of 30 June 2016, the firm’s net cash stood at approximately RM56.8 million (including short-term deposits), which translates to roughly 30.8 percent of its market capitalisation of RM184.4 million as of 5 September.

On the cash flows front, the group has posted positive operating cash flows in all of the past years except for FY11. We like that the company’s free cash flows have also been positive in the latest four financial years from FY13 to FY16. The strong cash generating capabilities have, in turn, allowed IQ Group to build up its cash reserves.

As business recovered and cash pile grew, the firm rewarded shareholders with the resumption of dividend payout in FY15. Based on the share price of RM2.09 as at 5 September’s close, IQ Group’s FY16 dividend per share of RM0.10 translated to a decent yield of 4.8 percent.

Management: In-house Brand LED Lighting Expected To Drive Growth

In the past few years, IQ Group has developed its own intelligent lighting solutions, which was launched in early 2015 under the Lumiqs brand. Lumiqs LED products are equipped with wireless transceivers and can be programmed to grow dimmer or brighter according to movement of people in an area, allowing up to 90 percent energy saving.

Currently, the Lumiqs range of products are mainly targeted at the industrial and commercial markets but the firm is developing and designing a new sensor lighting offering (projected to be released by 2018) to be used in small commercial premises and residential households. According to the firm, orders for the Lumiqs lighting solutions have already started coming in from South-East Asian countries, Japan, Australia, and Switzerland.

The group expects its in-house brand name LED products to be its driver of growth in the next five years. Riding on a forecast that the global LED market will hit US$42.7 billion by 2020, the company targets for the Lumiqs brand to generate 10 percent of its total revenue by 2018, and 30 percent by 2020.

Conclusion

Based on a share price of RM2.09, the company’s shares are trading at a trailing twelve months price to earnings ratio (P/E) of 8.7 times, which seems reasonable given the company’s performance and growth prospect. In contrast, Taiwan-listed peer Everspring Industry Co (Everspring) trades at a P/E of 25.3 times. While Everspring’s market capitalisation is about three times that of IQ Group, we note that the former’s latest full year net profit is only about 10 percent higher.

Overall, we foresee the demand for the IQ group’s products to rise as people become more conscious about the environment and saving energy. Additionally, with the increasing popularity of the IoT, the company is in a good position to capitalise on the trend using its innovation and expertise.

This article is brought to you by Bursa Malaysia Berhad. The research in this article was conducted independently by Pioneers & Leaders (Publishers) Pte Ltd (“Pioneers & Leaders”) and the views and opinions expressed in this article are Pioneers & Leaders’ own and do not represent the views and opinions of Bursa Malaysia. Bursa Malaysia does not warrant or represent, expressly or impliedly as to the accuracy, completeness and currency of the information in this article. In no event shall Bursa Malaysia be liable to the reader or any other third party for any claim howsoever arising out of or in relation to this article.

Yahoo Finance

Yahoo Finance