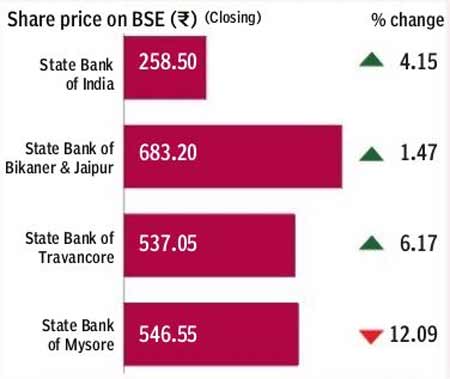

Shares of State Bank of India (SBI) closed at Rs 258.50, up 4.15%, driving the BSE Bankex up to a 52-week high of 22,352.07 on Friday after the country’s largest lender announced its board had cleared the merger of its five associate banks with the parent. On the NSE, the stock closed 4.06% higher at Rs 258.50.

The Bankex closed the session at 22,296.27, up 100.55 points or 0.45%. The Sensex closed at 28,077, down 0.17% or 46.44 points. Shares of Bank of Baroda (BoB) rallied the most on the index as the stock closed up 4.56% at Rs 161.65.

Shares of other banks such as Federal Bank, Punjab National Bank, YES Bank and ICICI Bank were up between 1% and 3%. Among the banks that ended the trading session in red were HDFC Bank, Axis Bank, IndusInd Bank and Kotak Mahindra Bank, whose shares lost between 0.50% and 0.76%.

Shares of two of the SBI’s associate banks – State Bank of Bikaner & Jaipur (SBBJ) and State Bank of Travancore (SBT) – were up 1.47% and 6.17%, respectively, to close at Rs 683.20 and Rs 537.05.

At the other end of the spectrum, shares of State Bank of Mysore were down around 12% to close at Rs 546.55.

According to the merger proposal, shareholders of SBBJ will get 28 shares of SBI (Rs 1 each) for every 10 shares (Rs 10 each).

In a similar arrangement, shareholders of SBM and SBT will receive 22 shares of SBI for every 10 shares. In the case of Bharatiya Mahila Bank (BMBL), 4,42,31,510 shares of SBI will be swapped for every 100 shares of Rs 10 each.

Shares of SBI have gained 15.19% so far this calendar year, while stocks of SBBJ, SBM and SBT have gained 30.37%, 29.2% and 28.33%, respectively. The BSE Bankex index has gained 15.35%, outperforming the benchmark Sensex, which grew 7.50% during the same period.

In 2008, SBI had merged State Bank of Saurashtra with itself. Two years later, State Bank of Indore was merged. Last month, the Cabinet had cleared the merger of all the five associate banks of SBI with the parent and acquisition of BMBL.

The merger would now require the approval from the government and various regulators including the Reserve Bank of India.

Post merger, SBI will become big enough to compete with the major ones across the globe with an asset base of Rs 37 lakh crore crore with 22,500 branches and 58,000 ATMs.

The combined entity will have more than 50 crore customers.